- Practically 70% of Solana’s provide is staked, pushing its staking market cap to $67–70B, forward of Ethereum’s $65–68B.

- Solana provides larger yields (8.3–11.5% APY) in comparison with Ethereum’s ~3%, boosted by inflationary rewards and MEV suggestions.

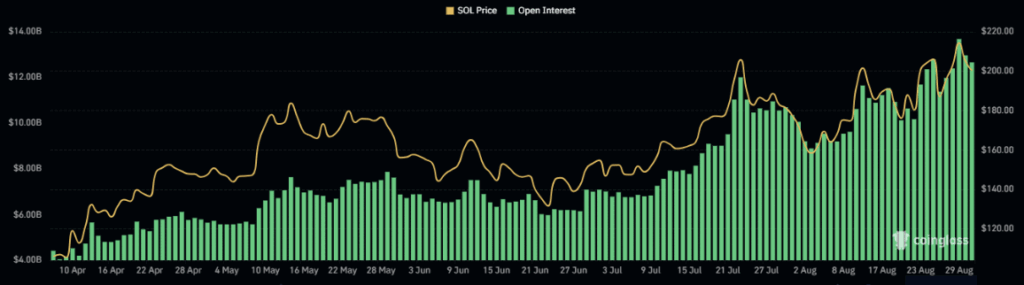

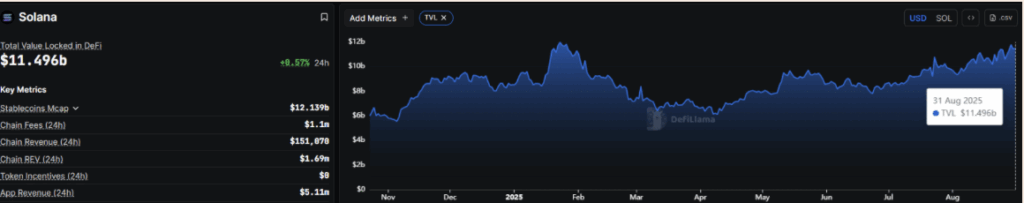

- Institutional curiosity and ecosystem progress are rising, with Solana’s open curiosity above $12B and TVL reaching $11.49B.

Solana simply pulled forward of Ethereum in a giant method, now topped the most important blockchain by staking market cap. It’s a milestone that doesn’t simply communicate to numbers however to how buyers are weighing yield, threat, and general confidence in these two ecosystems.

Two-Thirds of SOL Locked Up

Proper now, practically 67–70% of all circulating SOL — that’s round 410 to 420 million tokens — is being staked. These tokens are unfold throughout greater than 1,300 validators and 1.2 million delegators. At as we speak’s market ranges, that interprets to roughly $67–70 billion price of worth tied up in staking, edging out Ethereum for the primary time.

The extent of participation is fairly wild. Two-thirds of the provision isn’t casually sitting on exchanges; it’s locked and dealing, displaying sturdy perception in Solana’s design and reward mechanics.

Ethereum Nonetheless Robust, However Enjoying Catch-Up

In fact, Ethereum isn’t precisely fading into the background. With 34–35 million ETH staked (about 28–30% of provide) and over one million validators, it nonetheless carries severe weight. Its staking market cap hovered shut, round $65–68 billion.

However right here’s the catch — Ethereum’s validator setup requires 32 ETH, making it more durable for on a regular basis customers to leap in instantly. That’s why liquid staking suppliers like Lido dominate, controlling virtually 88% of the market. And yields? They’re sitting at a modest 2.9–3% APY, although the periodic burns from EIP-1559 do add a provide tightening impact when exercise spikes.

Why Solana Pulled Forward

Solana’s edge is, in a single phrase, yield. Stakers are pocketing anyplace from 8.3% to 11.5% APY. That comes from inflationary rewards plus MEV suggestions from Jito, which now handles greater than 90% of validator stakes. Certain, inflation is scheduled to say no over time, however proper now these double-digit returns are powerful to disregard.

This benefit isn’t simply theoretical both. Derivatives exercise has been buzzing — CoinGlass reported Solana’s open curiosity crossing $12 billion previously week. That’s a sign of rising institutional curiosity, one thing that tends to bolster bullish worth motion.

DeFiLlama backed this up too, displaying Solana’s Whole Worth Locked pushing to $11.49 billion, reflecting developer confidence and deeper liquidity throughout the ecosystem.

Wanting Forward

At this level, Solana has claimed the highest spot in staking economics. The query is whether or not it could actually keep there. Ethereum’s roadmap is full of upgrades, and Solana nonetheless has to show it could actually preserve these excessive yields sustainable with out fueling long-term inflation worries.

For now, although, Solana has stolen the lead — and with two-thirds of its provide already locked, the message from its group is obvious: they’re in it for the lengthy haul.

The submit Solana Surpasses Ethereum in Staking Market Cap first appeared on BlockNews.