- XRP is defending $2.74, however each spot and futures CVD present sturdy promote dominance.

- Open Curiosity has been sliding, reflecting bearish sentiment amongst speculators.

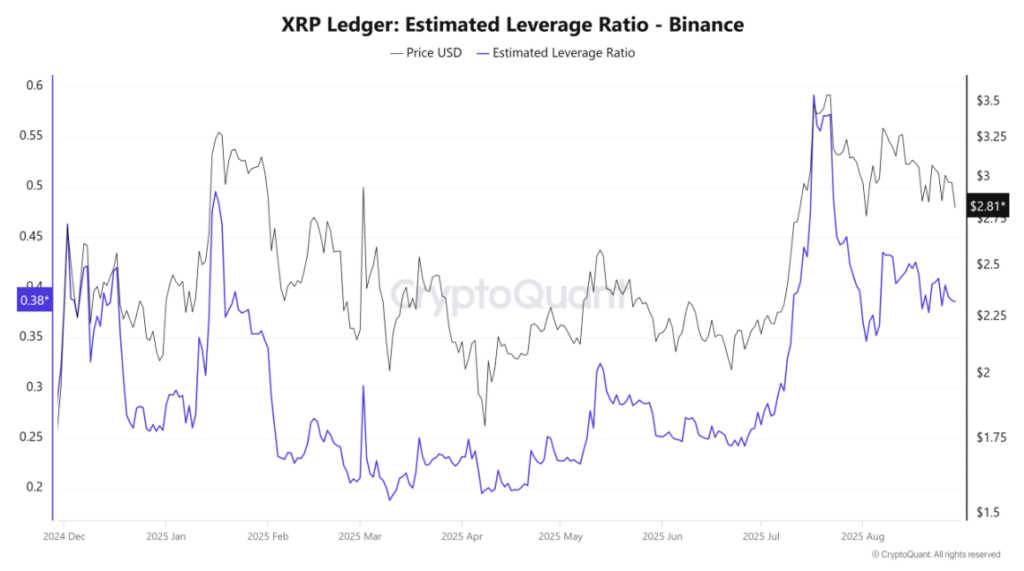

- Solely the drop in leverage presents reduction—no main liquidation danger but, however draw back nonetheless looms.

Ripple’s XRP is hanging on to the $2.74 help stage for now, however the temper throughout the broader market is shaky, and that would simply drag it right into a deeper bearish section.

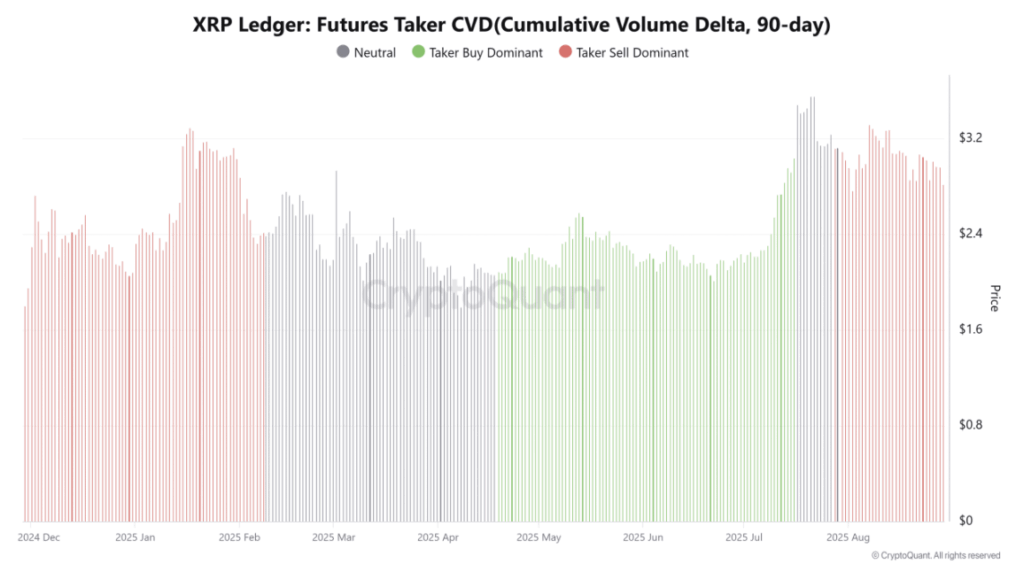

For weeks, spot and futures taker CVD information have been flashing pink, signaling sellers are firmly in management. What makes issues extra sophisticated is the truth that CME Open Curiosity lately hit a recent report—usually a bullish signal—however to date, that optimism hasn’t proven up on the charts.

Analysts additionally pointed to the price foundation heatmap, which positioned $2.8 as a significant stage to observe. If bulls can’t defend this zone, the street may open towards $2.4 subsequent.

A Fragile Construction

On the 12-hour chart, the August low at $2.74 is the road within the sand. Lose it, and XRP dangers sliding additional down. The Cash Movement Index (MFI) has been declining, underlining weakening demand, whereas construction on that timeframe leans bearish. Most indicators are just about agreeing with that outlook proper now.

Including to the strain, Bitcoin’s current dip beneath $110K has weighed on sentiment. If BTC stumbles additional, it’s onerous to see XRP holding sturdy in isolation.

Spot and Futures Level to Promote Strain

Trying on the spot market, the taker CVD (90-day delta) has been adverse since late July. Throughout that very same time, XRP saved failing to crack $3.4—a resistance stage sitting just below July’s all-time excessive at $3.65.

That persistent adverse CVD plus falling quantity tells us it is a sell-dominant atmosphere. Till that modifications, patrons are unlikely to flip the development again of their favor.

The futures market isn’t portray a prettier image both. Taker CVD there has additionally been adverse for weeks, and Open Curiosity has trended downward for the reason that finish of July. During the last two weeks particularly, OI has thinned out, suggesting merchants are closing positions quite than betting on new upside.

One Slight Optimistic

The Estimated Leverage Ratio (ELR) has been dropping, which at the very least means the market isn’t dangerously overleveraged. In plain phrases: even when issues flip south, the percentages of an enormous liquidation cascade look low.

Nonetheless, the general image stays tilted bearish. So long as XRP stays above $2.74 and the backup help at $2.60, bulls can argue the construction isn’t utterly damaged. But when these ranges give approach, the sell-dominant section may get uglier in a rush.

The put up XRP Battles to Maintain $2.74 as Bearish Strain Mounts first appeared on BlockNews.