It will likely be a brief week for the US financial calendar, with the normal finance (TradFi) market closed on Monday for the Labor Day vacation.

Nonetheless, a number of US financial information factors will likely be current thereafter and will affect Bitcoin (BTC) and crypto markets. In the meantime, the Bitcoin worth continues to point out weak point, with Ethereum (ETH) following swimsuit after shedding assist at $4,400.

US Financial Indicators for Crypto Merchants to Watch This Week

Merchants trying to shield their crypto portfolios this week can accomplish that by frontrunning the next occasions.

JOLTS

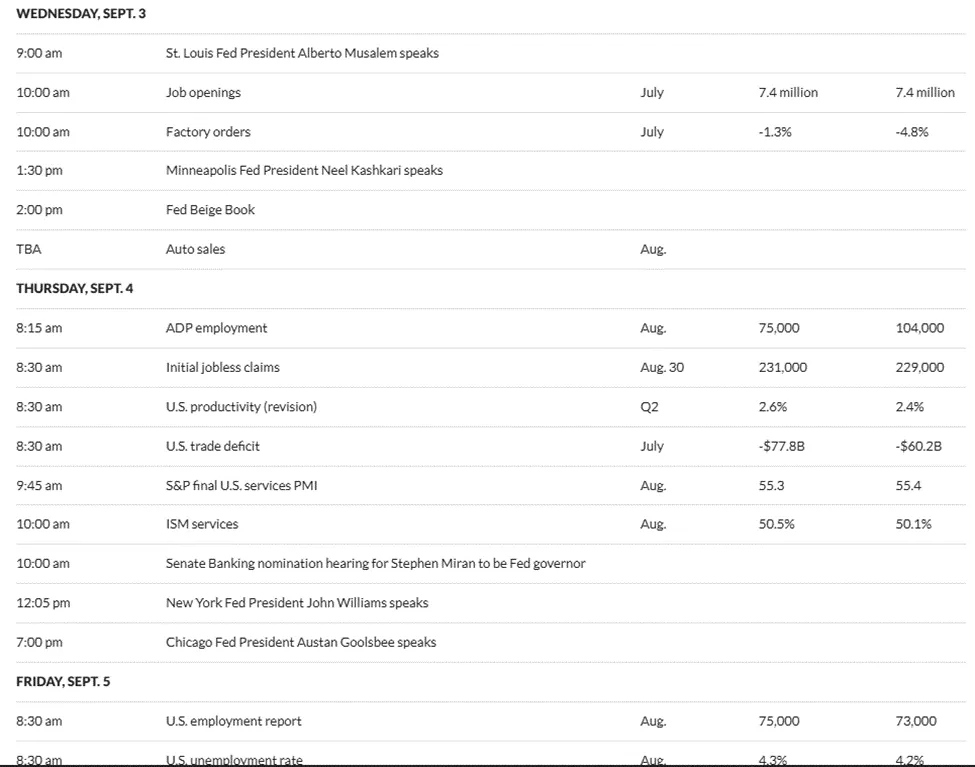

First in line for the highest US financial information factors to affect Bitcoin sentiment this week is the job openings report, launched by the Bureau of Labor Statistics. This macroeconomic occasion is due on Wednesday, September 3, after the earlier JOLTS report indicated 7.4 million job openings in June and seven.8 million in Could.

In response to economists surveyed by MarketWatch, July information on US job openings, hires, and separations might are available in at 7.4 million, identical to in June.

If it does, it might sign a gradual labor market, retaining Federal Reserve (Fed) coverage “increased for longer.” This could assist the greenback and cap liquidity expectations and sure go away Bitcoin barely pressured, absent different macro catalysts.

ADP Employment

One other US financial occasion this week is the ADP employment report, which is extra complete and broadly considered the official measure. It’s a non-public sector survey primarily based on payroll information from its shoppers.

This US financial information, due on Thursday, got here in at 104,000 in July, considerably increased than economists’ expectations of 82,000. Nevertheless, economists anticipate a continued droop, projecting a studying of 75,000 in August.

This factors to a continued outlook of a slowdown in hiring, signaling cooling labor demand. Softer labor markets weaken the greenback and ease yields, boosting liquidity-sensitive property like Bitcoin and crypto.

Merchants usually interpret weaker ADP prints as bullish for digital property, anticipating risk-on flows and stronger demand for alternate options to conventional markets.

Nevertheless, if the slowdown sparks recession fears, short-term volatility could hit crypto earlier than liquidity expectations drive longer-term upside.

Preliminary Jobless Claims

Additionally, the preliminary jobless claims due each Thursday are on the watchlist for US financial information this week. They measure the variety of US residents who filed for unemployment insurance coverage for the primary time final week.

Within the week ending August 23, there have been 229,000 preliminary jobless claims, with economists now anticipating extra filings to 231,000 final week.

An uptick in jobless claims could sign financial weak point. This could enhance the chance of the Fed adopting a extra accommodative financial stance.

Such a shift might result in a weaker greenback, enhancing Bitcoin’s attractiveness as a substitute asset. Nevertheless, if the rise in claims is seen as a short lived fluctuation, the influence on Bitcoin could also be restricted.

In the meantime, analysts say a resilient labor market, coupled with sticky inflation, might enable rates of interest to stay elevated. Nevertheless, indicators of a cooling job sector might mood the Fed’s path.

Employment Report

Lastly, with labor market information progressively rising as a key macro for Bitcoin, the US employment and unemployment experiences on Friday might additionally transfer the crypto market this week. Each information factors are crucial indicators of the economic system’s well being.

The employment report is forecasted to point out 75,000 new jobs, up from 73,000 within the earlier month, whereas the unemployment price is anticipated to rise from 4.2% in July to 4.3% in August.

Such an final result within the employment information would recommend hiring is enhancing barely, displaying resilience within the labor market. In the meantime, the modest surge in unemployment would level to extra folks on the lookout for work than jobs created, pointing to underlying slack.

Markets usually see this as neutral-to-dovish, the place progress exists, however rising unemployment hints at softening situations.

For Bitcoin and crypto, it might assist rate-cut expectations (liquidity-friendly), providing a mildly bullish tilt regardless of the headline job good points.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.