Bitcoin could also be hailed as “digital gold” on Wall Avenue, however when an actual disaster hits, many will deal with the cryptocurrency like fantasy play cash, says Tezos co-founder Arthur Breitman.

However why on earth would a crypto builder of virtually a decade say such a factor?

What about all of the institutional cash pouring in, the billions flowing into spot Bitcoin ETFs and its narrative as a safe-haven asset?

Breitman says irrespective of how sturdy the narrative, there’ll at all times be a cohort of Bitcoin holders who will drop it when occasions get powerful.

“If individuals are very unsure about their financial future, the very first thing they do is promote their humorous web cash and their humorous shares,” the 40-year-old Frenchman, now primarily based in London, tells Journal.

“Folks would possibly say it could possibly be way more than humorous web cash. Possibly so. However lots of people personal it on the idea that it’s humorous web cash; that’s how they see it.”

Bitcoin will at all times threat being a “momentum asset”

That doesn’t imply Breitman thinks Bitcoin’s a joke by any means; he’s simply saying what many individuals received’t admit aloud… Not everybody may be really received over by Bitcoin.

“What the market is possibly missing is actually long-term basic patrons of Bitcoin who will principally clean out these momentum cycles,” Breitman says.

He factors to the COVID-19 market crash in 2020, when Bitcoin’s worth tanked in simply days as buyers fled amid world financial uncertainty.

“The dangers are at all times there as a result of it’s a momentum asset,” he says, explaining that extra folks are inclined to pile into Bitcoin when the value is rising.

Political uncertainty can have an analogous impact. Fears round US President Donald Trump’s govt order imposing tariffs on items from China, Canada and Mexico in early February noticed Bitcoin tumble under $100,000 for the primary time in six days.

In April, Cointelegraph reported that numbers counsel Bitcoin continues to be perceived extra as a speculative tech proxy and is but to enter a brand new part of market habits.

Hype slowing down may also tip FOMO buyers to panic. Breitman says:

“In some unspecified time in the future, you run out of patrons, after which it stops going up, and folks say, ‘Oh, my goodness. I assumed I used to be shopping for an asset that goes up, and I used to be fallacious. It’s an asset that doesn’t go up; I shall promote it.’”

“Then everybody does, and it goes down,” he says.

Breitman’s unapologetic calls possible come from his time in quantitative evaluation at Goldman Sachs and Morgan Stanley, the place you sink when you don’t converse up.

However don’t mistake Breitman for a stereotypical crypto bro with Lamborghinis and personal jets.

“I can drive, however I don’t. Initially, I reside in London,” says Breitman. “There’s not a lot sense for me to drive,” he laughs. As an alternative, Breitman leans into quieter passions.

“I get pleasure from classical singing, piano, opera and programming in my spare time,” Brietman says.

Bitcoin treasuries have threat for each the draw back and upside

Breitman says one of many largest dangers for Bitcoin is the rising variety of corporations including it to their steadiness sheets.

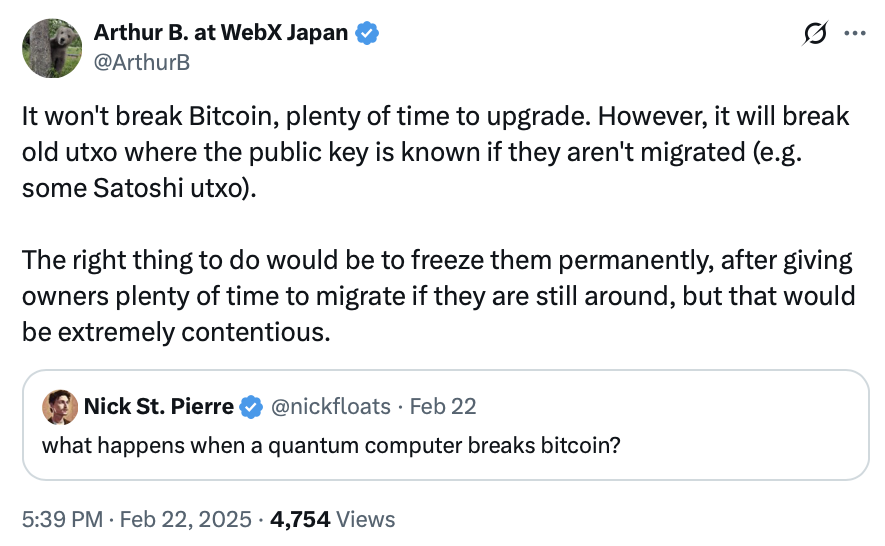

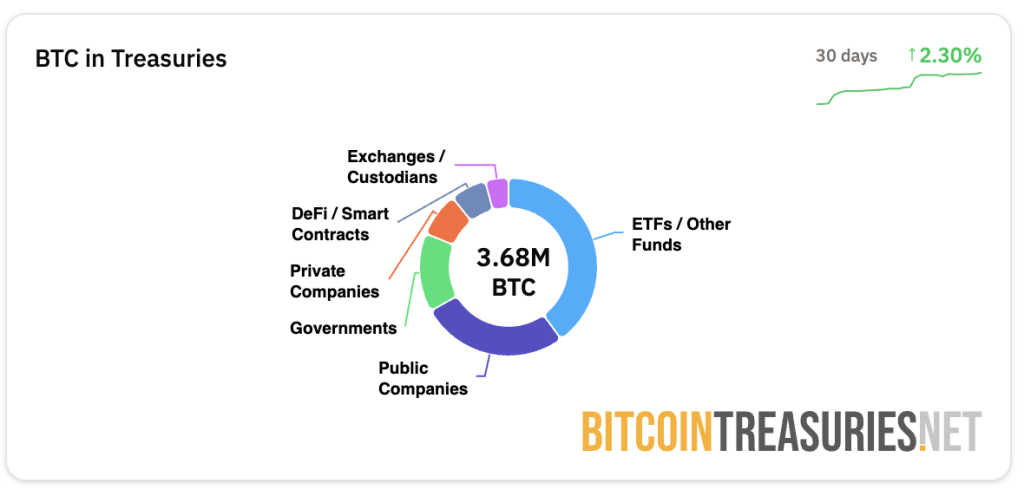

“They’ve threat on the draw back and threat on the upside,” Breitman says. Publicly traded Bitcoin treasuries maintain roughly 984,971 BTC, price roughly $110.97 billion on the time of publication, in keeping with BitcoinTreasuries.NET.

“The chance on the draw back is that in case you have a market pullback, I believe lots of people can even pull again from possession of those shares; as they achieve this, their premium will collapse,” he says.

Breitman argues that the premiums propping up these Bitcoin treasury corporations received’t final without end. He says corporations shall be compelled into a tricky choice if the inventory trades under guide worth. As soon as they collapse, panic promoting will observe.

“The pure factor to do can be to promote their property and purchase again their inventory,” he says.

Learn additionally

Options

The way to bake your personal DAO at residence — With simply 5 substances!

Options

Meet lawyer Max Burwick — ‘The ambulance chaser of crypto’

“I believe there shall be super shareholder stress to do this, which additional creates a gross sales spiral. So, that’s a spiral you may have on the draw back. I believe the premiums that these corporations have will not be sustainable,” he says.

Enterprise capital agency Breed just lately echoed Breitman’s warning, predicting that just a few Bitcoin treasury corporations will stand the check of time and keep away from the vicious “dying spiral” that may impression BTC holding corporations that commerce near the NAV.

It was solely in July when crypto analyst James Examine stated that his intuition is “the Bitcoin treasury technique has a far shorter lifespan than most anticipate.”

Breitman says there may be additionally threat on the upside, “paradoxically, as a result of a whole lot of these corporations have been financing themselves with convertible debt.”

Learn additionally

Options

‘Slaughterbot’ drones in Ukraine, MechaHitler turns into horny waifu: AI Eye

Asia Categorical

Hong Kong crypto frenzy, DeFi token surges 550%, NBA China NFTs — Asia Categorical

“Should you take a look at it — convertible debt — it’s somewhat bit like promoting lined name choices, in a way of, like, in the event that they do too nicely, then the debt converts into the property after which the upside will get clipped,” Brietman says.

Breitman says it’s a “rattling disgrace” about Tezos’ rating

Regardless of his controversial opinions about Bitcoin, Breitman is simply as blunt about Tezos (XTZ), the native token of the open-source, self-upgradable blockchain platform he co-founded together with his spouse.

As soon as a top-10 cryptocurrency, Tezos has slid far down the rankings primarily based on market capitalization, a actuality that clearly frustrates him.

“Quantity 88 of the 100 is fucking rattling disgrace,” Brietman says.

It’s not exhausting to see why. Tezos was as soon as among the many business’s most promising tasks, however now he watches as memecoins like Pepe, Dogecoin, Shiba Inu and FLOKI surpass it on the charts.

In 2021, Tezos reached an all-time excessive market cap of $7.2 billion. By the point of publication, it had shrunk to simply $883 million, in keeping with CoinMarketCap.

Fortunately, Tezos nonetheless manages to take a seat three spots above Fartcoin.

“On the finish of the day, this stuff commerce on sentiments,” Breitman says.

“Even after they have so-called protocol revenues, that is largely delicate and hype-driven,” Breitman says.

Nonetheless, Breitman says Tezos again within the high 20 can be a “good place to be now” as altcoins lastly begin to look promising once more.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Ciaran Lyons

Ciaran Lyons is an Australian crypto journalist. He is additionally a standup comic and has been a radio and TV presenter on Triple J, SBS and The Undertaking.