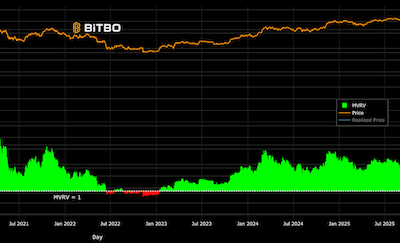

Bitcoin’s Market Worth to Realized Worth (MVRV) metric has not too long ago produced a ‘dying cross,’ sparking issues of waning momentum and a possible macro high for the asset.

This indicator, which compares bitcoin’s market worth to its realized worth, is intently watched for indicators of overvaluation and cycle reversals.

MVRV indicator indicators exhaustion

In keeping with CryptoQuant analyst Yonsei_dent, the MVRV momentum indicator has proven a transparent dying cross between the 30-day and 365-day transferring averages. Yonsei_dent defined:

Historical past doesn’t repeat, it rhymes — and the indicators from MVRV deserve consideration.

The earlier incidence of this bearish crossover coincided with the 2021 cycle peak, which was adopted by a 77% value decline from $69,000 to $15,500 throughout the 2022 bear market.

Regardless of bitcoin’s 13% rise to a brand new all-time excessive of $124,500 between January and August, MVRV continued to say no, suggesting weakening capital inflows.

See the present MVRV chart.

Analysts debate bear market threat

Ali Martinez, one other market analyst, famous that the MVRV dying cross signifies a macro momentum reversal.

If historical past repeats, short-term targets may fall to round $105,000, with some analysts warning of a attainable additional drop to $60,000 if a bear market takes maintain.

Different indicators present room to run

Nevertheless, not all indicators are bearish.

The MVRV Z-score stays effectively under ranges traditionally related to market tops, presently “sitting at round 2,” in response to analyst Stockmoney Lizards. They famous:

We’re not even near the hazard zone but. Folks aren’t massively overextended on earnings like they had been at earlier tops. This tells me we’ve acquired room to run.

Moreover, not one of the 30 CoinGlass bull market peak indicators point out overheating, and historic MVRV Z-score peaks have ranged between 7 and 9.