Bitcoin’s newest value energy could also be masking cracks in its underlying momentum.

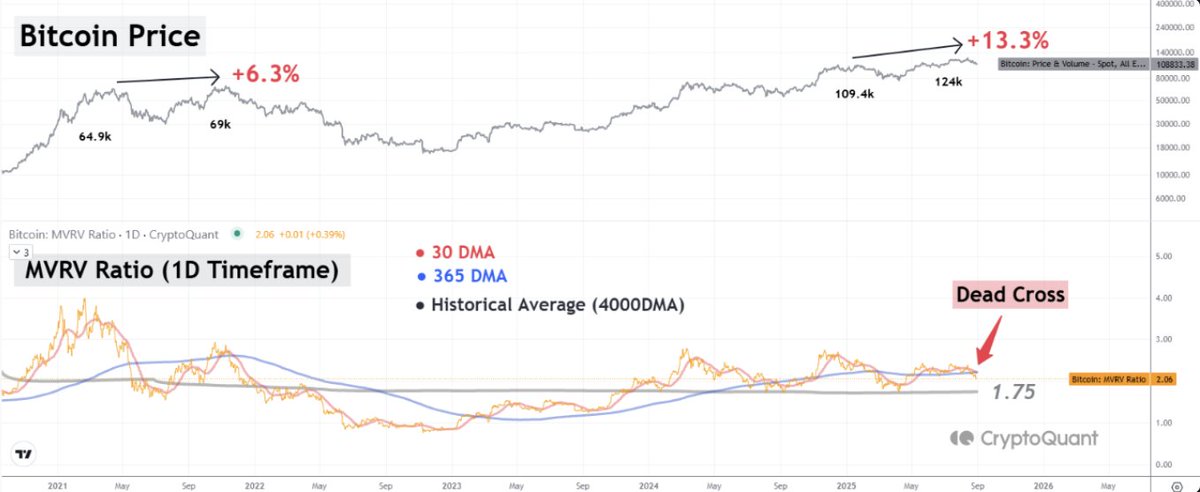

On-chain analytics agency CryptoQuant confirmed that the MVRV ratio (Market Worth to Realized Worth) has simply printed a lifeless cross, a bearish technical sign that usually precedes cooling phases in crypto markets.

What the Lifeless Cross Means

The MVRV indicator compares Bitcoin’s present market value to the common acquisition price of all cash. When it tendencies above 1, holders are sitting on earnings, whereas values under 1 counsel losses. CryptoQuant notes that the short-term transferring common of MVRV has now crossed beneath the long-term average-creating a lifeless cross. Traditionally, such occasions have coincided with waning bullish momentum, even in the course of uptrends.

Value vs. Fundamentals

Bitcoin continues to be displaying resilience, just lately climbing over $124,000, up 13.3% from its prior vary. But the MVRV’s weak spot implies fewer holders are aggressively including at present ranges. CryptoQuant’s analyst cautioned that whereas the chart stays in an uptrend, the divergence between value appreciation and declining momentum may foreshadow a consolidation interval.

Broader Implications

If the lifeless cross holds, merchants might even see profit-taking intensify. Nevertheless, earlier cycles reveal that such alerts don’t at all times set off speedy corrections – typically they mark cooling-off intervals earlier than one other leg greater. With institutional inflows nonetheless robust by way of ETFs, traders are watching carefully to see if Bitcoin can defy the bearish sign.