Regardless of being in step with the market expectations, July’s Private Consumption Expenditure report confirmed elevated inflation ranges within the US economic system.

The headline PCE rose by 2.6% year-over-year and 0.2% month-over-month. Core PCE, which strips out meals and vitality, elevated 2.9% yearly and 0.3% month-to-month.

Notably, the core PCE inflation is now at its highest stage since February 2025.

Crypto costs are crashing as soon as once more because of the macroeconomic headwinds, with the Bitcoin worth falling to $107,500 within the early Asian buying and selling hours on Monday.

Altcoins are faring worse, with Solana ecosystem and meme cash like Pyth Community, Fartcoin and Pudgy Penguins among the many greatest losers.

The Rektember situation is enjoying out. Nevertheless, the crypto crash can be the one ultimate alternative for sidelined buyers to build up high-upside cash earlier than the bull run within the 4th quarter.

July PCE Print Exhibits Sticky Inflation

The July Private Consumption Expenditure report got here in step with the market expectations. Nevertheless, the core PCE, which is the Federal Reserve’s most well-liked measure of inflation, continues to carry between 2.6% and three.0% over the previous 18 months.

The newest 2.9% studying signifies that the Fed is way from conducting its goal of two% inflation stage within the US economic system.

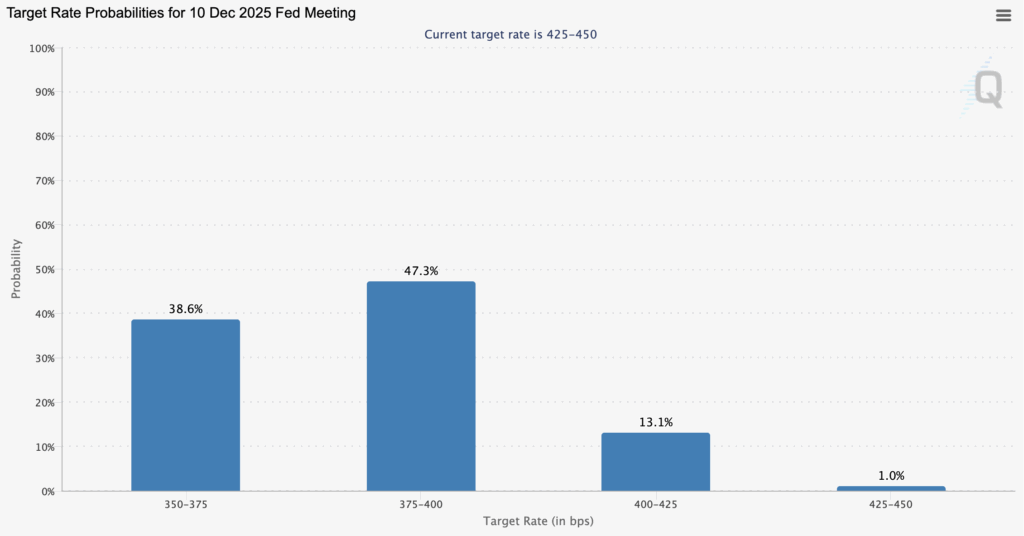

Nevertheless, the Fed will doubtless proceed with a 25 bps fee reduce in September. The CME FedWatch exhibits almost 90% odds of a September fee reduce, with one other reduce doubtless earlier than the year-end.

All eyes at the moment are on this week’s macroeconomic information, with the July JOLTS information and August nonfarm payroll taking the centre stage. Any signal of weak spot within the labour market will power the Fed right into a dovish pivot, a bullish situation for crypto costs in the long run.

Crypto Costs Crash, Is It Time To Promote?

Crypto costs are falling to start out the month of September. Nevertheless, buyers don’t must panic-sell their cash.

Take, as an illustration, Ethereum (ETH). The biggest altcoin is down by greater than 10% since its latest all-time excessive. Nevertheless, with its on-balance quantity (OBV) construction intact, outstanding analyst Revenue Sharks isn’t offloading his ETH holdings.

Regardless of the weak spot within the broader crypto market, the worldwide M2 cash provide continues to rise, which is a decidedly bullish situation for threat belongings.

Greatest Cash To Purchase Now

Sidelined buyers shouldn’t miss out on this chance to build up Ethereum and Solana on a budget.

The truth is, outstanding analyst Altcoin Sherpa has trimmed his portfolio down to simply ETH and SOL.

Solana meme cash are additionally going through important promoting stress, however have now grow to be undervalued. As an example, the Fartcoin worth is buying and selling at $0.70, whereas the legendary dealer Bluntz believes that it’s headed to $2.1 this 12 months.

Low-cap crypto tokens are additionally in excessive demand. As an example, the brand new BTC layer-2 coin, Bitcoin Hyper (HYPER), has raised over $13 million in its viral presale.

Unsurprisingly, whales have been the quickest to acknowledge its upside potential and are amongst its early consumers, with some deep-pocketed buyers making six-figure investments in a single transaction.

Notably, utility cash are beginning to present important bullish power. Even through the broader market bearishness, the ETH layer-2 coin Polygon (POL) is up by almost 7% over the previous 24 hours.

It’s, due to this fact, no shock that specialists imagine the newest BTC layer-2 coin has excessive upside potential. Even Bitcoin’s Stacks has a peak valuation of over $5 billion.

Contemplating its low-cap nature, early consumers are viewing Bitcoin Hyper as among the best cryptos to purchase with as much as 100x potential.

Go to Bitcoin Hyper Presale

This text has been offered by one among our business companions and doesn’t mirror Cryptonomist’s opinion. Please remember our business companions could use affiliate packages to generate revenues via the hyperlinks on this text.