Be part of Our Telegram channel to remain updated on breaking information protection

The stablecoin provide on the Ethereum blockchain has reached a brand new all-time excessive (ATH) after Tether and Circle went on a minting spree.

In line with an X publish by Token Terminal, the availability of stablecoins on Ethereum has surpassed $160 billion.

“The availability has greater than doubled from January ‘24 ranges,” Token Terminal stated in its publish.

Ethereum’s surging stablecoin provide cements its dominance over the stablecoin market. With the lately handed GENIUS Act legitimizing the sector, the surge of newly minted tokens, which is gasoline for buying and selling, lending, and DeFi exercise, may assist elevated demand for ETH and potential outperformance towards the broader crypto market.

Tether And Circle Mint Billion Of {Dollars}

The stablecoin provide peak on Ethereum comes as Tether and Circle, the issuers of main stablecoins USDT and USDC, minted billions of {dollars} value of their tokens within the final couple of days.

On-chain analytics platform Lookonchain stated in an X publish earlier immediately that Tether minted 1 billion USDT.

Tether(@Tether_to) simply minted one other 1B $USDT!

Previously 3 days alone, #Tether and #Circle have minted a mixed $4B in stablecoins.https://t.co/Ptsy2BsPoEhttps://t.co/6dITkpO0hm pic.twitter.com/nad7EQ7baI

— Lookonchain (@lookonchain) August 30, 2025

In simply the previous three days Tether and Circle have minted a mixed $4 billion of their stablecoins, Lookonchain added.

USDT and USDC are at present the most important stablecoins available in the market by capitalization. Tether’s USDT has a market cap of over $167.6 billion, whereas the capitalization for Circle’s USDC stands at about $71.56 billion.

Analysts Predict ETH Value Will Soar Off Stablecoin Adoption After GENIUS Act Signing

Launched in 2019, Ethereum was the primary blockchain that enabled builders to discover use instances for decentralized functions.

One such use case is stablecoins, which make it simpler for buyers and merchants to maneuver cash throughout borders without having to place up with the volatility related to crypto.

Knowledge from DefiLlama reveals that Ethereum at present has greater than half of the stablecoin market share at 53.12%. The second-largest share of the market goes to the Tron blockchain.

The massive quantities of {dollars} being minted by issuers like Tether and Circle comes after the GENIUS Act, a key legislature that establishes pointers for stablecoin issuers within the US, was signed into legislation by President Donald Trump earlier this 12 months.

Following that signing and Ethereum’s dominance within the stablecoin market, a number of analysts predict that ETH’s worth is poised to soar as stablecoin adoption picks up.

Earlier this month, Normal Chartered raised its year-end goal for ETH from $4,000 to $7,500, and in addition predicted that the stablecoin provide will surge by 8X by the top of 2028.

Wall Road banking large JPMorgan made a equally bullish prediction for ETH this month, and stated that Ethereum’s dominance within the stablecoin market positions the altcoin chief to outperform the remainder of the crypto market.

Fundstrat’s CIO, Tom Lee, who can also be the Chairman of the main ETH treasury agency Bitmine Immersion Applied sciences, predicted throughout an interview with CNBC that the altcoin may soar to $16K.

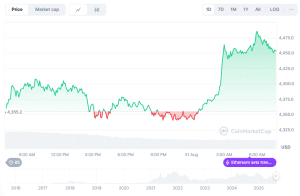

ETH trades at $4,454.24 as of 1:46 a.m. EST following a 1% acquire within the final 24 hours. That is after the most important altcoin by market cap noticed its worth tumble over 6% within the final week amid a broader crypto market sell-off.

ETH worth chart (Supply: CoinMarketCap)

Regardless of the weekly drop, ETH remains to be up 21% on the month-to-month time-frame.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection