A decade after the primary block was generated on July 30, 2015, Ethereum’s roadmap has a renewed sense of route and function.

Certain, the latest value enhance helps lots, however after years of mucking round with scaling by way of L2s, the Ethereum L1 lastly has a reputable path to maximal scaling whereas preserving maximal decentralization.

The TL;DR is that the fuel restrict and transactions per second (TPS) will enhance a number of instances a 12 months from right here on out. Validators will swap from reexecuting transactions to easily verifying zero-knowledge (ZK) proofs, enabling the bottom layer to hit 10,000 transactions per second.

The L2s will scale up in live performance to course of tons of of 1000’s, if not thousands and thousands of TPS, and a brand new sort of L2 known as “native rollups” will act like programmable shards of a unified blockchain providing the identical safety as the bottom layer.

Whereas these proposals are but to be signed off on by the governance processes, they construct on concepts Ethereum creator Vitalik Buterin started exploring in 2017 and are being championed by high-profile Ethereum Basis researcher Justin Drake. At EthCC earlier this month, Drake mentioned:

“We’re at this inflection level for Ethereum scaling. And particularly, I’ve conviction that we’ll enter a gigagas period for the L1…. that’s roughly 10,000 TPS. And the important thing unlock for the gigagas period is zkEVMs and actual time proving.”

Drake needs the ecosystem to hit 10 million TPS inside 10 years, and no single blockchain can obtain that stage of throughput. That signifies that horizontal scaling, utilizing a “community of networks” — every L2 with completely different use instances, tradeoffs and advantages — is the one method to scale the ecosystem to the wants of your complete world.

(Leap straight to the zkEVM roadmap to 10K TPS explainer in case you are already acquainted with the background and rationale.)

Why has Ethereum L1 been unable to scale?

Whereas different blockchains use better {hardware} and computing energy to scale up throughput, Ethereum has at all times had an ideological, some would say utopian, fixation on decentralization.

From the viewpoint of ETH maxis, “information middle chains” like Solana have multimillion-dollar centralized factors of failure {that a} authorities might goal to censor transactions. Even chains with decrease {hardware} specs, like Sui, have prohibitive prices and bandwidth necessities that affect decentralization.

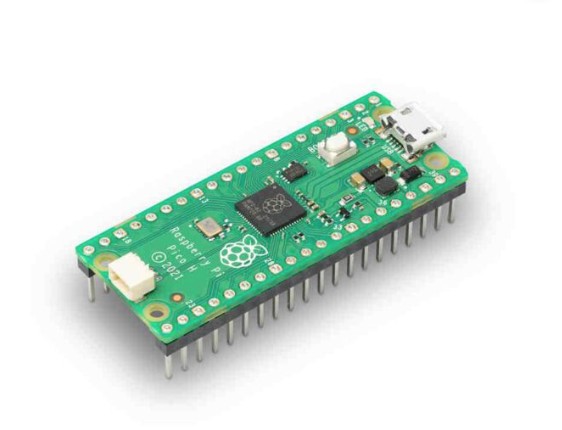

Ethereum can run on a bunch of Raspberry Pis. These low specs allow “house stakers” to take part in a community of 15,000-16,000 public nodes and 1 million validators. Consequently, it’s nearly unattainable to censor transactions and the community is resilient in opposition to assaults. Even after 50%-70% of the community complied with US authorities sanctions on Twister Money, the little guys saved confirming these transactions.

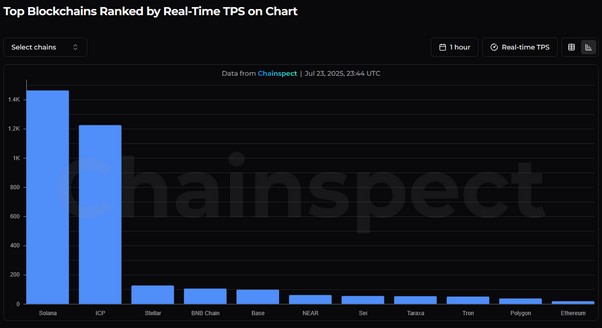

The trade-off is the community could be very sluggish and at the moment processes round 18-20 transactions per second in comparison with Solana’s 1,500 TPS.

Blockchains are horribly inefficient by design — a bit like a Google spreadsheet that makes each laptop with a replica recalculate the figures earlier than updating a cell.

“They principally need anybody to have the ability to sustain with the chain and reexecute the transactions,” explains Uma Roy, co-founder of ZK-proofs specialist Succinct Labs. “Meaning that you could’t simply have an arbitrarily excessive quantity of transactions as a result of there’s overhead from this reexecution.”

The shortcoming to scale the L1 sufficient whereas preserving decentralization compelled Ethereum to undertake the a lot criticized L2 roadmap in 2020.

Zero-knowledge proofs clear up blockchain trilemma

Buterin coined the phrase the “blockchain trilemma” to explain how troublesome it’s to attain safety, scalability and decentralization abruptly in a blockchain community. Each scaling proposal labored on any two of the three properties, however got here at the price of the third.

Till now.

Zero-knowledge proofs, which Drake aptly describes as “moon math,” are in a position to show mathematically {that a} bunch of sophisticated transactions have been carried out accurately with out revealing what these transactions are.

Whereas producing a proof is troublesome, verifying it’s right is quick and simple.

So, as a substitute of getting a bunch of underpowered Raspberry Pis to laboriously reexecute each single transaction, the plan is to get these validators to only test the mathematics in a tiny ZK-proof.

“As an alternative of getting folks reexecute stuff, you simply give them a proof that one thing occurred,” explains Roy. “And now anybody can confirm the proof, and so they don’t should redo the computation.”

Neglect Raspberry Pis — Drake claims that even a $7 Raspberry Pi Pico, which has lower than one-Tenth of the computing energy of its elder sibling, might validate ZK-proofs.

Ethereum’s zkEVM roadmap to 10,000 TPS, defined

The Ethereum Basis’s Sophia Gold induced numerous pleasure together with her latest weblog saying {that a} ZK-powered Ethereum Digital Machine (zkEVM) might be added to the L1 inside the house of a 12 months.

Curiously, the L2s have been pioneering numerous the sensible work on ZK know-how, Linea, which spun out of Ethereum co-founder Joe Lubin’s Consensys.

Linea is a ZK EVM that’s 100% appropriate with the present EVM, so something that works on Ethereum works precisely the identical on Linea. It sees itself as an extension of Ethereum and has simply introduced it would burn 20% of its ETH transaction charges to help L1 worth accrual.

Learn additionally

Options

‘Slaughterbot’ drones in Ukraine, MechaHitler turns into attractive waifu: AI Eye

Options

Powers On… Why aren’t extra regulation faculties educating blockchain, DeFi and NFTs?

Declan Fox, head of Linea, explains that ZK tech solves the blockchain trilemma.

“It permits us to extend the fuel restrict on the L1 by orders of magnitude, because the magic of ZK is that the computation can scale with out growing the complexity of verification,” he says. “As ZK proving latency and value continues to enhance, we will course of extra throughput while protecting verification out there to easy {hardware}, even akin to a smartwatch.”

Don’t get too excited as a result of the plan to combine a ZK EVM within the house of a 12 months is just not going to allow 10,000 TPS on day one.

Slowly, slowly after which abruptly

Ethereum has 5 main software program shoppers that can be utilized to run the community, which means that if one fails, the community doesn’t shut down, as has occurred on Solana.

The transition plan will see two or three tailored shoppers launched permitting validators to change to checking ZK-proofs moderately than reexecuting transactions. Just a few validators will achieve this initially till the bugs are ironed out.

“Transitioning to a snarkified EVM goes to be a gradual course of,” explains Ladislaus from the Ethereum Basis’s Protocol Coordination workforce . (“Snarkified” refers to SNARKs, that are the kind of ZK-proof used.)

“Customers will primarily and progressively discover a distinction within the type of larger fuel limits permitting for larger financial exercise on L1.”

Whereas the transition to ZK-proofs will take time, the L1 fuel restrict appears set to scale massively within the meantime. Final week, the fuel restrict jumped 22% to 45 million, and researcher Dankrad Feist has proposed an EIP that may see shoppers routinely elevate the fuel restrict thrice a 12 months. After 4 years, the community could be working at 2,000 TPS. Drake has proposed extending this one other two years to get to 1 gigagas and 10,000 TPS in whole by 2031.

What’s real-time proving, and why is it vital to Ethereum?

A necessary a part of the plan is attaining “real-time proving.”

That’s “the concept that you could show Ethereum mainnet blocks in lower than 12 seconds,” explains Roy.

“After getting the power to show blocks in real-time, Ethereum can begin utilizing this of their protocol after which they’ll scale the fuel restrict principally arbitrarily with out sacrificing verifiability.”

Whereas 12 seconds is the size of a block, even real-time proving requires some change to the protocol. Ladislaus explains that subsequent 12 months’s Glamsterdam replace is prone to embody upgrades that “decouple block validation from speedy execution” in an effort to give provers “nearly a full slot price of time to craft a zkEVM proof.”

Succinct is on the verge of attaining the milestone. Again in Might, it unveiled the SP1 Hypercube zkVM, which was in a position to show 93% of 10,000 mainnet blocks in actual time, utilizing a 200-GPU cluster.

Roy says the undertaking is on monitor to show 99% of blocks inside 12 seconds by the top of the 12 months. Whereas “prover killers” will in all probability imply the occasional proof received’t be generated in time, she says there are workarounds the protocol might construct in, akin to “skipping that block and shifting to the subsequent one.”

Complicating issues, one other EIP that might be included in Glamsterdam would lower block instances to 6 seconds. This could imply faster confirmations and a greater expertise for L1 customers, however makes the duty twice as troublesome for provers. However Roy isn’t too frightened.

“Even when they halve the block time, it’ll be okay as a result of principally yearly, ZK has gotten 10x extra efficiency,” she says.

In June, Linea introduced it was now in a position to show 100% of exercise on the community with ZK-proofs. Linea has two-second block instances, runs at two TPS at current (as a consequence of demand moderately than capability) and sends its proofs via to customized verifier sensible contacts on the L1. So, whereas it’s not a precise match, it’s foreshadowing how snarkification of the L1 might work in observe.

{Hardware} necessities for Ethereum provers outlined

The inspiration is focusing on tech specs for provers that embody {hardware} prices beneath $100,000 and using lower than 10 kilowatts of electrical energy — just like the facility draw of a Tesla wall battery.

Cyber Capital founder and ETH skeptic Justin Bons criticized these as “insane {hardware} necessities for provers, approach past that of even SOL validators…”

However Bons is evaluating apples with oranges, as validators and provers have very completely different roles. Ladislaus factors out that Ethereum solely wants one right ZK-proof to point out the transactions had been executed accurately — as a result of a ZK-proof is both right or it’s not.

“I’m very optimistic we’ll at all times discover one [correct proof] with $100,000 and 10-kW necessities. That’s why we put the necessities beneath information middle ranges. Even garage-grown fans will be capable of show Ethereum,” says Ladislaus.

“We’ll want only one sincere garage-prover to maintain Ethereum working.”

The tech specs are additionally simply an preliminary goal to goal for, with Gold estimating they’ll be met earlier than Devconnect Argentina in November.

Roy believes prices and {hardware} will proceed to fall, and Succinct ought to be capable of get GPU necessities all the way down to “16 GPUs or one thing by early subsequent 12 months.” That {hardware} would price roughly $10,000-$30,000.

Succinct has already established a decentralized community of “tons of of provers” on testnet with “thousands and thousands of proofs generated.” The concept is that contributors compete to carry down proving instances and prices. However whereas a number of provers compete for every job, “as soon as one is chosen then only one particular person does the proof,” explains Roy.

The dangerous enterprise of switching the Ethereum L1 to ZK

Managing this transition to ZK is comparable in complexity to the swap from proof-of-work to proof-of-stake within the Merge in 2022 and requires consideration of a variety of edge instances and eventualities that would carry the community down.

On the EthProofs name in July, Drake raised potential points, together with dangerous actors inserting malicious prover killers into blocks to knock the community offline and the likelihood that exercise might drop so low there isn’t sufficient transaction price income to pay for the price of proving a block.

“It’ll take a couple of years,” says Ladislaus. “We significantly must take care concerning the safety implications. ZkVMs are nascent tech, advanced beasts and extra probably than not vulnerable to bugs. Over time, instruments like proof variety, sturdy prover incentives and in addition formal verification could make their use within the context of Ethereum L1 rather more viable.”

In live performance with all of this, Ethereum’s consensus layer is being overhauled because the Beam Chain to make it so ZK pleasant from day one, the entire thing will be capable of be confirmed utilizing a single laptop computer CPU in accordance with Drake.

Learn additionally

Options

Assist! My mother and father are hooked on Pi Community crypto tapper

6 Questions for…

6 Questions for Kei Oda: From Goldman Sachs to cryptocurrency

“Snarkifying” the Ethereum L1 can assist make native rollups a actuality

Integrating a zkEVM in mainnet may also assist the protocol set up native rollups.

Native rollups are theoretical at current however would use Ethereum’s L1 validators to switch the proof system employed by present L2s. The proposal requires including code for an “execute precompile” to the L1 shoppers that allows them to confirm ZK-proofs of the L2’s state transitions (which refers to all of the transactions that simply occurred on the L2). “Validators devour these proofs of a rollup’s execution and confirm their correctness,” explains Ladislaus.

Additionally learn: What are native rollups? Full information to Ethereum’s newest innovation

So, if native rollups get off the bottom, not solely will the L1 validators be checking proofs of what occurred on the L1, they’ll even be checking proofs of what occurred on native rollups.

That might imply storing $10 million on a local rollup is each bit as safe as storing it on Ethereum itself.

Fox says Linea intends to turn out to be a local rollup, which he likens to a extra programmable and customizable model of the deserted ETH 2.0 sharding plan (which was principally like working 64 blockchains in tandem).

“These are higher than the previous sharding plan as native rollups could be heterogeneous, whereas the ETH 2.0 sharding plan had 64 homogenous shards limiting customization and differentiations for finish customers,” he says.

Native rollups are but to be formally adopted, however it is smart to improve the L1 for them because the ZK overhaul will get moving into earnest.

“There’s numerous synergies between snarkifying the EVM and making native rollups occur, as each mechanisms share widespread underlying applied sciences,” explains Ladislaus.

“Native rollups require a tough fork on L1 (i.e., shoppers implementing the precompile), and it thus has to undergo the Ethereum governance course of. My bullish take could be to have an EIP by the top of the 12 months, very optimistically focusing on the fork after Glamsterdam.”

“Take this with a grain of salt,” he says concerning the timeline.

Subscribe

Essentially the most participating reads in blockchain. Delivered as soon as a

week.

Andrew Fenton

Andrew Fenton is a journalist and editor with greater than 25 years expertise, who has been overlaying cryptocurrency since 2018. He spent a decade working for Information Corp Australia, first as a movie journalist with The Advertiser in Adelaide, then as Deputy Editor and leisure author in Melbourne for the nationally syndicated leisure lift-outs Hit and Switched on, printed within the Herald-Solar, Every day Telegraph and Courier Mail.

His work noticed him cowl the Oscars and Golden Globes and interview a number of the world’s largest stars together with Leonardo DiCaprio, Cameron Diaz, Jackie Chan, Robin Williams, Gerard Butler, Metallica and Pearl Jam.

Previous to that he labored as a journalist with Melbourne Weekly Journal and The Melbourne Instances the place he received FCN Greatest Characteristic Story twice. His freelance work has been printed by CNN Worldwide, Impartial Reserve, Escape and Journey.com.

He holds a level in Journalism from RMIT and a Bachelor of Letters from the College of Melbourne. His portfolio contains ETH, BTC, VET, SNX, LINK, AAVE, UNI, AUCTION, SKY, TRAC, RUNE, ATOM, OP, NEAR, FET and he has an Infinex Patron and COIN shares.