Metaplanet shareholders reportedly accepted a proposal to boost $884 million by promoting as much as 550 million new shares abroad.

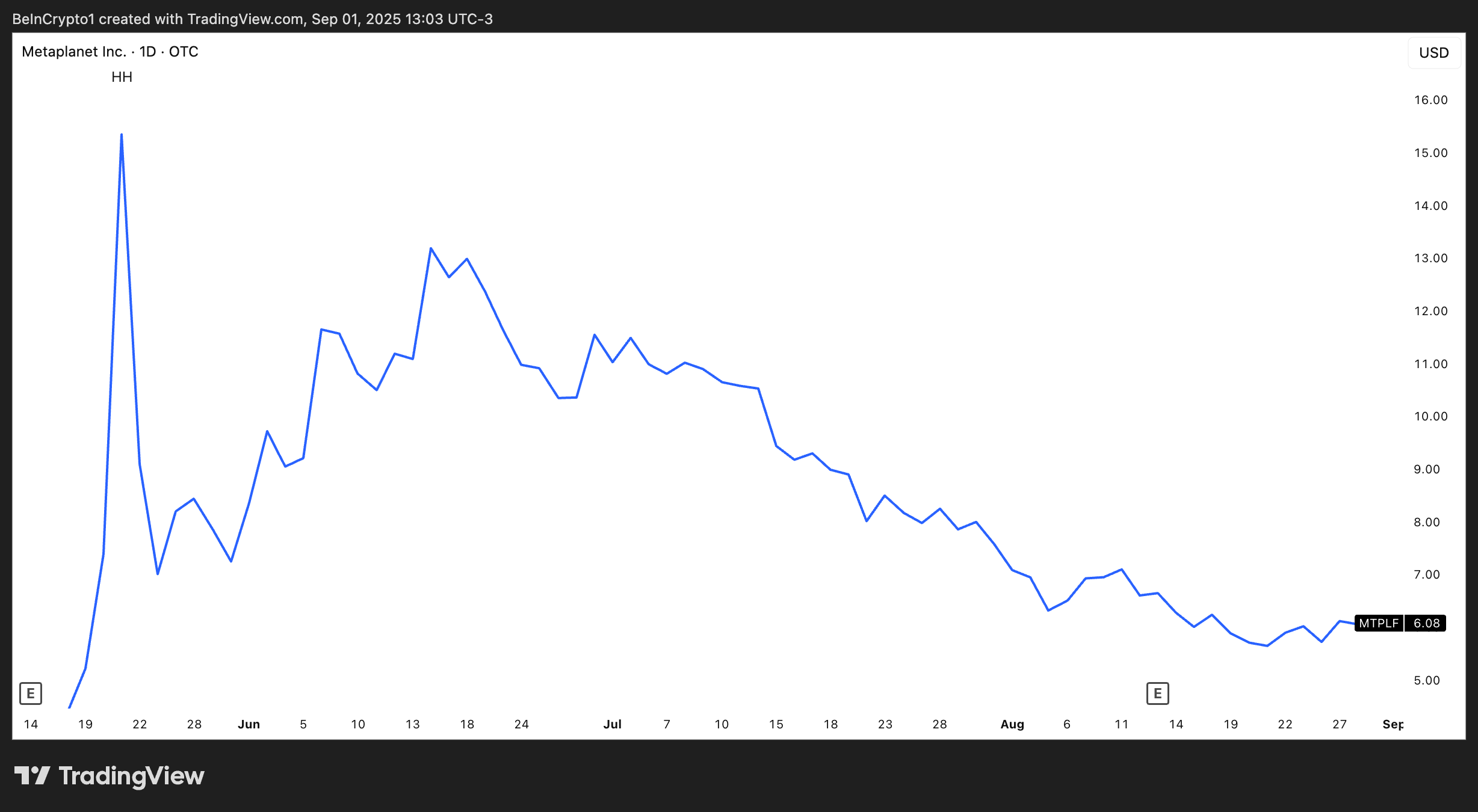

The choice comes at a time of specific monetary problem for the corporate. Since mid-June, Metaplanet’s inventory has plummeted 54 p.c.

The Plan to Replenish Bitcoin Funding

In an important transfer to rescue its bold Bitcoin accumulation technique, Metaplanet shareholders have reportedly accepted a proposal to boost $884 million by promoting as much as 550 million new shares abroad.

The extraordinary shareholder assembly occurred earlier at present within the Shibuya district of central Tokyo.

The choice addresses a big financing crunch triggered by the corporate’s inventory plummeting 54% since mid-June. This collapse in share value made an important funding association with its key investor, Evo Fund, unworkable.

The unique association was a self-sustaining cycle by which rising share costs inspired Evo Fund to transform its warrants into firm shares. This motion injected capital into Metaplanet, which the corporate used to purchase extra Bitcoin. The expectation was that these Bitcoin purchases would improve the corporate’s worth, increase the share value, and proceed the cycle.

This new $884 million capital push is meant to exchange the funding this cycle is now not producing. A lot of the proceeds will likely be earmarked for additional Bitcoin purchases.

Past the Capital Push

To supply further monetary flexibility, shareholders additionally reportedly accepted a parallel proposal to difficulty most well-liked inventory, which may elevate an additional $3.8 billion.

The transfer permits the corporate to generate capital with out additional diluting widespread shareholders ought to the inventory proceed to say no. This twin method emphasizes the seriousness of Metaplanet’s monetary headwinds.

Regardless of these challenges, Metaplanet is just not abandoning its ambitions for Bitcoin.

The corporate introduced throughout the assembly that it has already acquired a further 1,009 BTC for roughly $112.2 million, bringing its whole holdings to twenty,000 BTC. This acquisition has made it the sixth-largest public Bitcoin treasury firm, surpassing Riot Platforms. The corporate goals to personal an much more than 210,000 BTC by 2027.

The presence of Eric Trump, who was appointed as the corporate’s strategic advisor in March 2025, added to the assembly. Trump publicly supported the corporate’s CEO, Simon Gerovich. He in contrast him to Technique’s Michael Saylor and affirmed Metaplanet’s mission to pioneer a brand new principle of credit score in Japan based mostly on digital belongings.

His attendance strengthened the rising worldwide and high-profile curiosity in corporations adopting Bitcoin treasury methods.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.