Pi Coin (PI) value has slipped again into detrimental territory after a short-lived rally. At press time, it traded a bit above $0.35, down nearly 8% previously 24 hours.

The sharp drop has erased most of its latest positive factors, leaving solely 2.3% progress during the last seven days. However even these modest positive factors might vanish quickly, because the token stares at recent lows.

Cash Flows Dry Up, Bears Step In

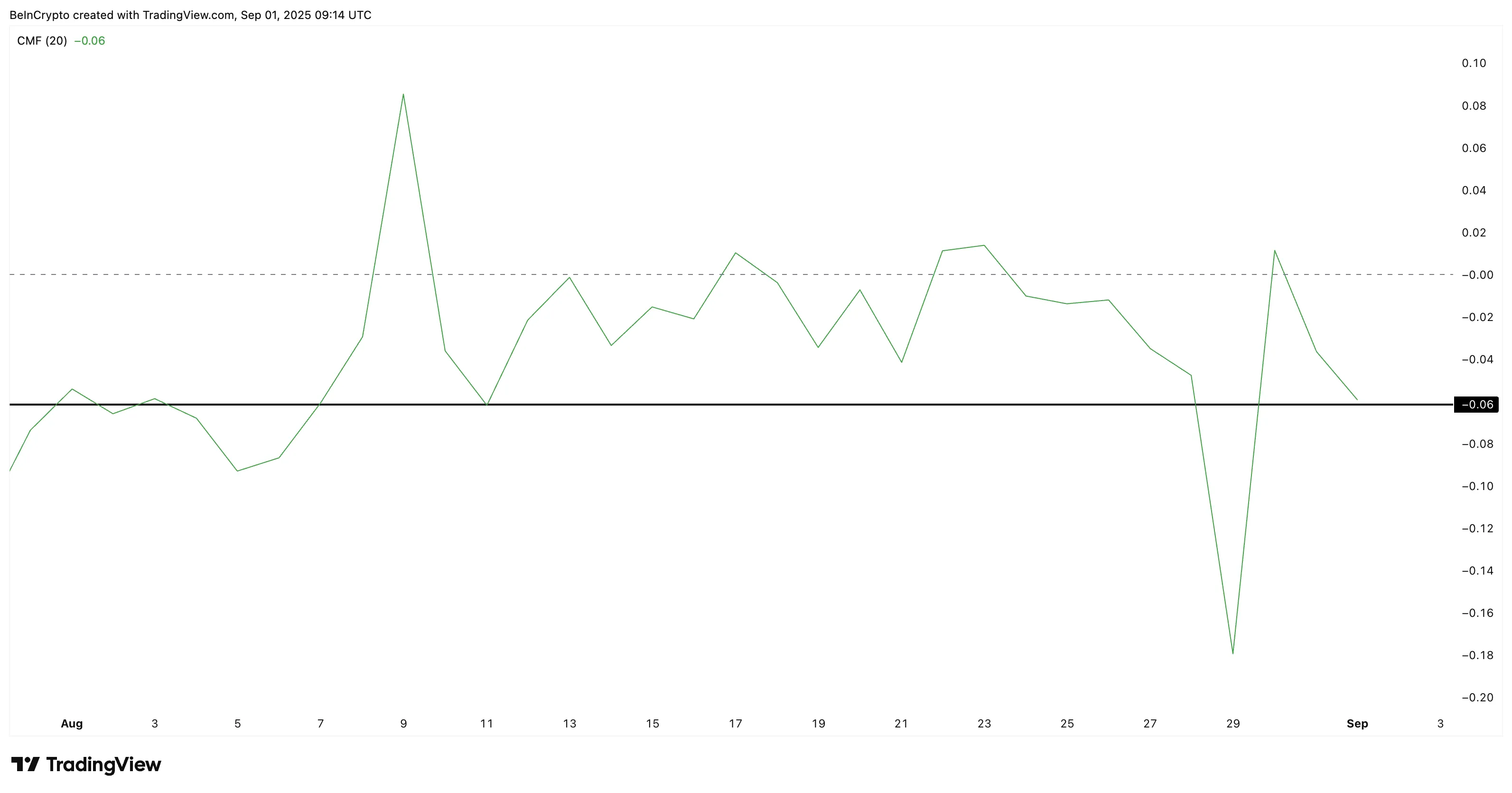

The Chaikin Cash Stream (CMF) measures whether or not cash is getting into or leaving an asset. It briefly spiked above zero when Pi Coin rallied from $0.32 to $0.39, exhibiting patrons had stepped in.

However now it has dropped to -0.06, near the August 11 low, signaling that capital inflows have dried up and sellers are taking management once more.

The Bull Bear Energy (BBP) provides to this bearish image. BBP compares shopping for strain to promoting strain. When it turns detrimental, it exhibits bears have the higher hand.

The final time BBP flipped detrimental, proper after the August 9–11 highs, the Pi Coin value tumbled from $0.46 to $0.32, a fall of over 30%. The identical flip has occurred once more, warning of one other potential drop.

Pi Coin’s transient rally has already misplaced steam. With cash outflows rising and bearish strain dominating, the token appears uncovered to additional draw back. Until the $0.34 help holds, the Pi Coin value might revisit $0.32 — and maybe sink even decrease.

For now, bulls are struggling, and bears seem able to take full management.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

Crossover Looms as Key Pi Coin Worth Assist Will get Examined

To seize smaller value actions, the main target shifts from the day by day chart to the 4-hour chart.

Right here, the short-term 20-day Exponential Shifting Common (EMA) or the crimson line is on the verge of crossing beneath the longer-term 100-day EMA (sky blue line). An EMA provides extra weight to latest costs, making it faster to reply to adjustments than a easy shifting common.

When a shorter EMA falls under an extended EMA, it’s referred to as a bearish “Dying” crossover. This typically alerts that promoting momentum is strengthening and that the asset may very well be prone to setting new native lows.

Pi Coin trades close to $0.35, simply above the vital help of $0.34. If that degree breaks, the PI value might slide to $0.32, its late August low. Any deeper fall would possibly expose new lows beneath $0.32.

On the opposite aspect, bulls want a robust day by day shut above $0.36 to regain momentum. However with each CMF and BBP stacked in opposition to them, the percentages stay with the bears.

Pi Coin’s transient rally has already misplaced steam. With cash outflows rising and bearish strain dominating, the token appears uncovered to additional draw back. Nonetheless, if Pi Coin, in a roundabout way or the opposite, manages to cleanly reclaim $0.36 after which $0.38, we will count on the short-term value breakdown danger to get delayed.

Disclaimer

In keeping with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.