Bitcoin’s latest downturns have led many observers to marvel concerning the worth flooring, when BTC will attain it, and the way the worth will rebound. One interpretation requires continued sharp downturns earlier than a restoration.

Bitfinex analysts shared these insights completely with BeInCrypto. None of this commentary straight constitutes monetary recommendation.

Will Bitcoin Hit a Worth Flooring Quickly?

Regardless of a protracted bull run all through the summer time, Bitcoin has seemingly hit a roadblock. Though the asset reached an all-time excessive early final month, its efficiency has been traditionally weak since.

For the previous week, Bitcoin has remained beneath the $112,000 assist stage, as whales proceed to rotate to altcoins, particularly Ethereum. These large-scale rotations assist the Bitfinex evaluation.

“Main cryptocurrency property endured a tough week as macro jitters and the post-PPI sell-off weighed closely on worth motion. This pullback is according to our thesis that in the summertime months BTC is prone to be liable to retracements and vary buying and selling…We consider the market is nearing the underside of this downturn as we transfer into September,” Bitfinex claimed.

A few of these “macro jitters” are pretty straightforward to elucidate: bearish PPI experiences precipitated huge liquidations all throughout the business, and Trump’s belligerent commerce insurance policies are inflicting additional downturns.

These and different components, like low commerce volumes, led Bitcoin to drop 13%, however the flooring isn’t right here but.

Key Altcoin Indicators

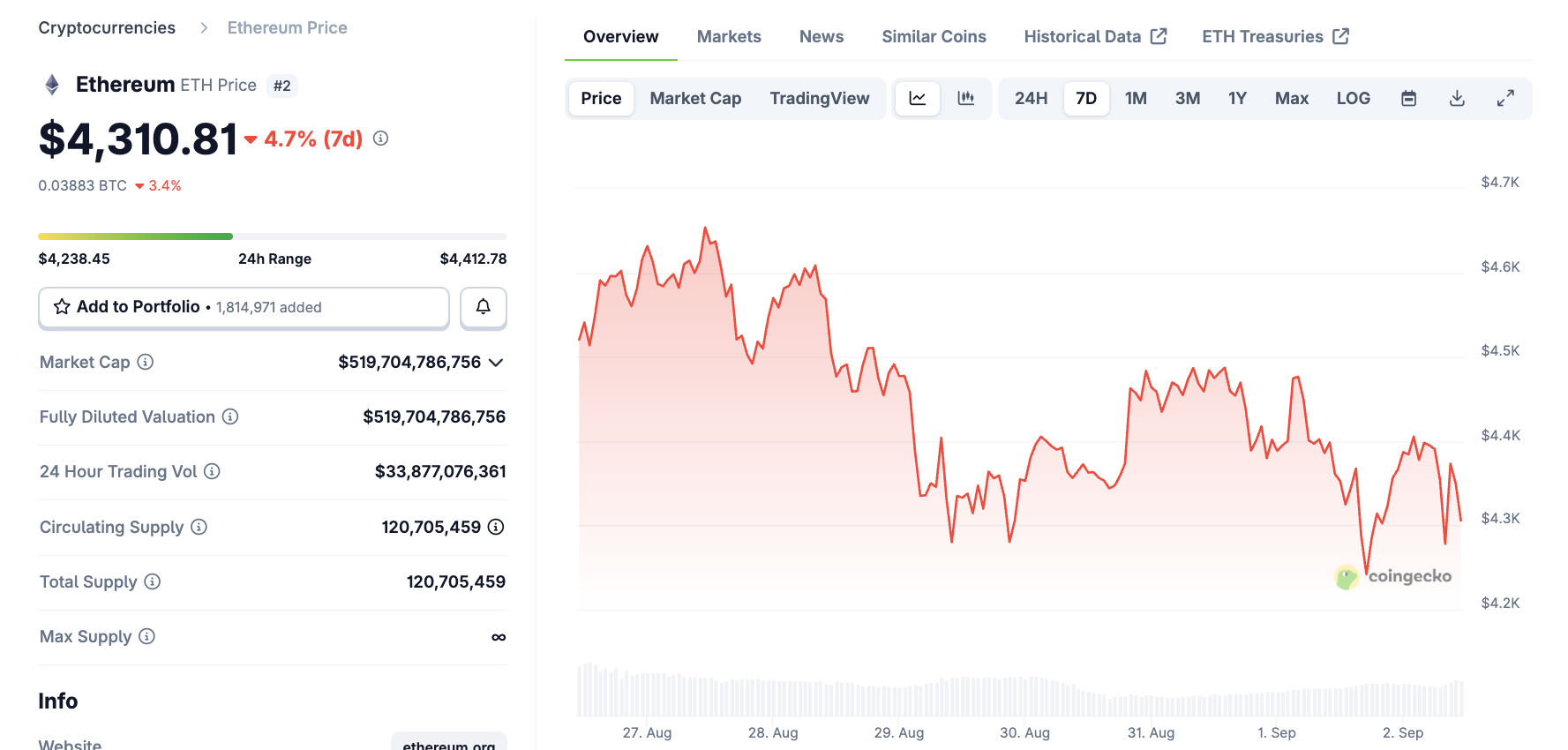

Total, the altcoin market has been attracting a variety of consideration, with Ethereum outpacing BTC on a number of latest events. Nonetheless, just a few altcoins replicated this success, which supplies telltale indicators about broader well being:

“With [altcoins], the majors surrendered latest positive factors, whereas focused rotations into mid-caps and sector performs created sharp divergences — producing each standout winners and heavy laggards. The Altcoin market seeing sharp rotations is likely one of the indicators nonetheless that may consequence within the majors seeing capital ultimately flowing again in, notably if the general market declines farther from present ranges,” Bitfinex’s analysts added.

Basically, even these altcoin leaders have been posting latest losses. These counsel that the entire market is in a interval of decline, which helps the September Bitcoin flooring concept.

ETFs Might Energy This autumn Inflows

Nonetheless, Bitfinex’s analysts don’t consider that this downward pattern will proceed for lengthy. They posit that Bitcoin’s worth flooring will probably be round $93,000, at which level institutional ETF traders may begin shopping for the dip. BTC, in flip, may considerably profit from this.

Though Ethereum ETFs have obtained a variety of consideration currently, Bitcoin merchandise stay a formidable pressure. These merchandise have big benefits in institutional buy-in; in spite of everything, they represented greater than 90% of crypto fund investments a number of quick months in the past.

Any broader crypto ETF rally will nearly definitely elevate Bitcoin off its worth flooring.

Briefly, this learn implies a worthwhile run for BTC in This autumn 2025. To be clear, this is only one interpretation of the out there information. Some have prompt a faster restoration, or claimed that Bitcoin’s flooring could be larger than $93,000.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.