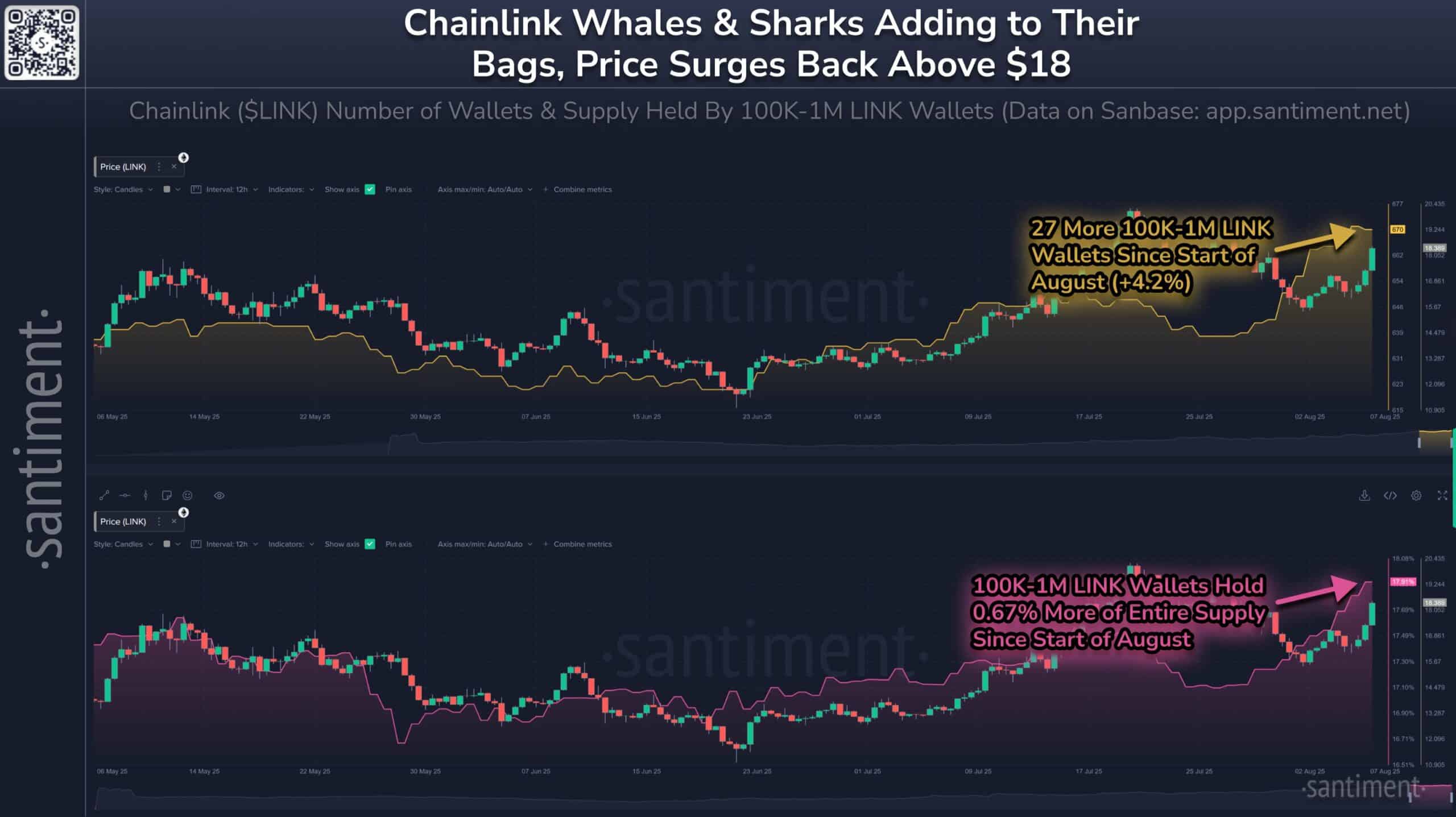

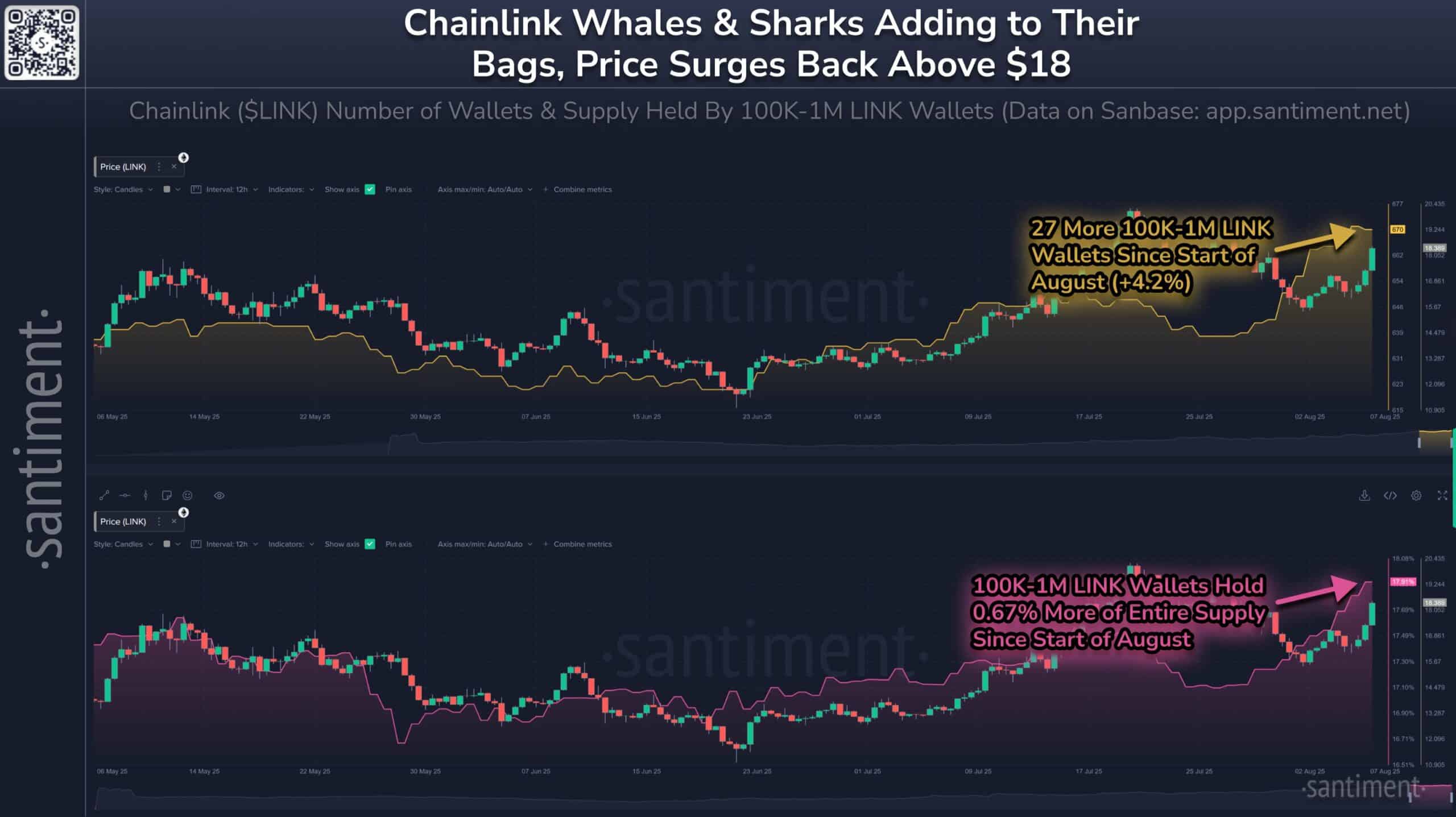

One thing is stirring within the Chainlink market. All through August 2025, the community’s greatest gamers, referred to as whales, have been quietly loading their baggage. We’re not speaking about small buys. In actual fact, on-chain information revealed a tidal wave of enormous transactions and a mass exodus of LINK tokens from crypto exchanges, pointing to a severe perception within the coin’s future.

Exercise from these crypto giants hit a seven-month peak. The analytics workforce at Santiment clocked round 4,624 whale-sized transactions, every shifting greater than $100,000 value of LINK. This frenzy has introduced the community to life, with day by day lively wallets spiking to six,463 – A excessive not seen in eight months. It’s clear the massive fish are getting extra concerned.

Maybe, essentially the most telling signal is that these whales aren’t simply buying and selling – They’re hoarding. In a single frantic 48-hour stretch this month, a staggering 2.07 million LINK tokens vanished from exchanges. When cash transfer into non-public wallets like this, it normally means they’re being stashed away for the lengthy haul, squeezing the provision accessible on the market.

This isn’t an remoted occasion; liquidity on exchanges has already plummeted by 40% this 12 months – Suggesting a wider pattern of traders taking self-custody.

Whales making waves

We are able to even see a few of these accumulators in real-time. On 17 August, one pockets snatched up 210,000 LINK for simply over $5 million. The identical day, one other dropped $6.63 million to accumulate 276,000 LINK. A 3rd main participant was additionally noticed shopping for closely.

One of the crucial fascinating tales is a whale who, after sitting on the sidelines for 2 years, immediately roared again to life. Over twelve days, this dealer spent $16.44 million to purchase up 663,580 LINK. When seasoned gamers who’ve been worthwhile previously bounce again in with this type of money, individuals take discover.

This shopping for spree isn’t only a few remoted billionaires both. The variety of wallets holding at the very least $1 million in LINK has shot up by 25%. On prime of that, a file for 2025 was shattered when over 9,600 new LINK wallets have been created in a single day.

Supply: Santiment

this commotion has helped push Chainlink’s worth previous a number of hurdles to about $25.40. Many analysts now have their eyes on the $30-$32 mark, with some whispering a few potential run to $50.

Can LINK struggle its strategy to $50?

Reaching $50 received’t be a stroll within the park for Chainlink.

For now, LINK has a stable flooring of help between $20 and $21.60. If it breaks beneath that on a day by day chart, we might see it slide in the direction of $19.50, and even check the a lot stronger long-term base round $13 to $15.

To maneuver up, LINK first has to smash via the ceiling between $25 and $27.14. Clearing that may be an enormous win for the bulls. Nevertheless, the actual boss battle is on the $30.85 to $32-level. If it might probably conquer that zone, the doorways to the $40-$42 vary might swing large open. After that, the following main resistance clusters can be discovered between $40 and $47, with the ultimate hurdle being its previous all-time excessive close to $52.

On the intense facet, LINK has been buying and selling above its key long-term shifting averages. The 50-day and 200-day averages lately crossed in a “golden cross,” a sample that always alerts a strong uptrend is in place.

Some chart watchers additionally see bullish formations like a multi-year ascending triangle, which might give LINK the momentum it wants for a severe push in the direction of that $50-target.

Supply: LINK/USD, TradingView

If LINK ever hits $50 a token, its market cap would swell to almost $34 billion, placing it in the identical league as among the greatest names in crypto.

Blockchains are like remoted computer systems; they’ll’t see or get data from the skin world. Chainlink fixes this. It acts as a safe bridge, feeding real-world information—like inventory costs or climate experiences—to good contracts. This expertise is the important thing that unlocks numerous sensible makes use of for blockchains.

Chainlink’s worth comes from its dominance and utility. It’s the go-to oracle community, with partnerships that embrace giants like Google Cloud and SWIFT, to not point out many of the main DeFi apps. All the DeFi trade is determined by Chainlink’s worth feeds to perform, with over $93 billion in on-chain worth counting on its community. Its attain can also be spreading into insurance coverage, gaming, and provide chain administration.

CCIP – Chainlink’s secret weapon for development

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is catching on quick, and it’s an enormous deal for the community. It’s being adopted by everybody from DeFi tasks to old-school monetary giants.

Supply: Dune Analytics

Because it turned broadly accessible, CCIP has unfold to greater than 60 completely different blockchains. Within the conventional finance world, it’s working with large establishments like SWIFT, the DTCC, and the ANZ financial institution. A challenge with the DTCC, as an illustration, makes use of CCIP to convey mutual fund information onto blockchains, displaying the way it might reshape capital markets. A brand new take care of Japan’s SBI Group is targeted on utilizing CCIP to tokenize actual property throughout completely different chains.

In crypto, main tasks like Aave are utilizing it for cross-chain voting, whereas Metis has made it their official bridge for shifting tokens. All of this adoption does extra than simply make Chainlink look good; it creates a strong financial engine.

Turning the whole lot right into a token…

The monetary trade is gearing up for an enormous change – Turning real-world property, from skyscrapers to shares, into digital tokens. Specialists suppose this market might be value as much as $30 trillion by 2030. Chainlink is positioning itself to be the important expertise that makes this all doable.

To tokenize actual property, you want a trusted strategy to join them to the blockchain. Chainlink supplies precisely that. Its information feeds give good contracts correct costs, its Proof of Reserve system transparently verifies {that a} token is definitely backed by an actual asset, and its CCIP protocol lets these new tokenized property transfer securely between completely different blockchains. CCIP is already concerned in over 15% of all RWA tasks.

Chainlink isn’t ready for the trade to come back to them; it’s constructing bridges immediately into conventional finance. Pilot packages with Swift, the community used for many worldwide financial institution transfers, proved that old-school banks can use Chainlink to deal with tokenized property. Initiatives with JPMorgan and UBS have additionally proven that Chainlink’s tech is prepared for the massive leagues.

Its newest partnership with Japan’s SBI Group goals to construct instruments for the Asian market, the place a current survey discovered that 76% of monetary establishments are planning to get into tokenized property. Chainlink isn’t just a part of this pattern; it’s constructing the inspiration for it.

How LINK’s shortage might drive Its worth

Chainlink’s financial design, particularly its staking system, is constructed to make the community safer whereas additionally making the LINK token extra scarce.

The LINK token has a easy job – Pay the pc operators who present the community with dependable information. With a tough cap of 1 billion tokens ever to be created, shortage is constructed into its DNA. The extra individuals use Chainlink’s providers, the extra demand there’s for the LINK token.

The launch of staking utterly modified the sport. The most recent model, v0.2, beefed up the staking pool to 45 million LINK. That pool stuffed up nearly immediately, successfully pulling an enormous chunk of LINK off the market. Anybody locally can stake as much as 15,000 LINK, incomes a base reward of round 4.32% a 12 months.

To forestall panic promoting, there’s a 28-day “cooldown” interval earlier than you will get your tokens again. And, if a node operator supplies unhealthy information, they’ll get their staked LINK “slashed” as a penalty, which retains everybody sincere.

The mathematics is easy – With 45 million LINK locked up for staking, there are fewer tokens in the stores. As demand for Chainlink’s providers grows from institutional customers who depend on its safety, that shrinking provide might create a strong squeeze, pushing the value greater.

Will altcoins lastly have their second?

Whether or not we’ll see an enormous altcoin rally in 2025 is determined by a tug-of-war between the worldwide economic system and big-money traders. If issues go proper, just like the Federal Reserve reducing rates of interest, we might see an enormous growth. But when inflation stays scorching, that optimism might evaporate quick.

Decrease rates of interest are like rocket gas for riskier investments like altcoins. When secure investments pay much less, traders search for greater returns elsewhere. On the flip facet, if central banks need to hold charges excessive to struggle inflation, there might be much less cash to gamble on crypto. A worldwide recession can be even worse, as traders would doubtless run for the security of property like gold and authorities bonds.

The opposite large issue is institutional cash. The launch of spot crypto ETFs is opening the floodgates for mainstream traders. After the success of Bitcoin and Ethereum ETFs, there’s lots of hope that ETFs for different main altcoins might be subsequent, which might create a gradual stream of latest consumers.

Lastly, keep watch over Bitcoin. Traditionally, the largest altcoin events have began proper after Bitcoin’s worth both stalls out or its share of the full crypto market begins to fall. That’s when merchants typically take their Bitcoin earnings and roll them into altcoins, hoping for even larger beneficial properties.

The setup for an altcoin rally is there, nevertheless it all is determined by whether or not the economic system performs alongside.