In keeping with reviews, the Trump household’s internet value jumped by about $5 billion after the launch of the WLFI token by way of their World Liberty Monetary enterprise.

The debut silently grew to become certainly one of their largest milestones in a long time. It pushed digital property to the middle of their portfolio and even outpaced actual property in worth.

WLFI Token Launch Reshapes Trump Household Wealth

Donald Trump is listed as “Co-Founder Emeritus.” His three sons are official co-founders of World Liberty. The household holds lower than 25% of WLFI tokens. Their allocations are nonetheless locked, however the buying and selling debut gave them billions in paper wealth by way of market valuation.

WLFI’s launch labored like an preliminary public providing. Earlier than buying and selling, early traders couldn’t resell their privately purchased tokens. The debut opened secondary markets and locked in billions in paper positive factors.

Additionally, the Wall Road Journal famous that World Liberty raised $750 million final summer season. A round deal let the Trumps maintain as much as three-quarters of income from WLFI gross sales, including as a lot as $500 million. The enterprise additionally purchased a public firm to strengthen its steadiness sheet earlier than launch.

Alongside WLFI, World Liberty launched USD1, a stablecoin tied to the greenback and backed by US Treasuries and money. It’s already listed on main exchanges akin to Binance and Upbit, as BeInCrypto reported.

In its first hour, WLFI hit about $1 billion in buying and selling quantity, in keeping with CoinMarketCap.

Early Buyers Rating Huge Positive factors

Presale consumers acquired WLFI at $0.015 and $0.05. As soon as secondary buying and selling started, they made returns of over 2,000%. The surge gave insiders large windfalls and confirmed each the upside and dangers of early crypto launches.

The Trump household’s crypto attain goes past WLFI. Entities linked to the household management about 80% of $TRUMP, a memecoin value billions. Trump Media — the operator of Fact Social — is valued at round $2.5 billion and in addition holds crypto property.

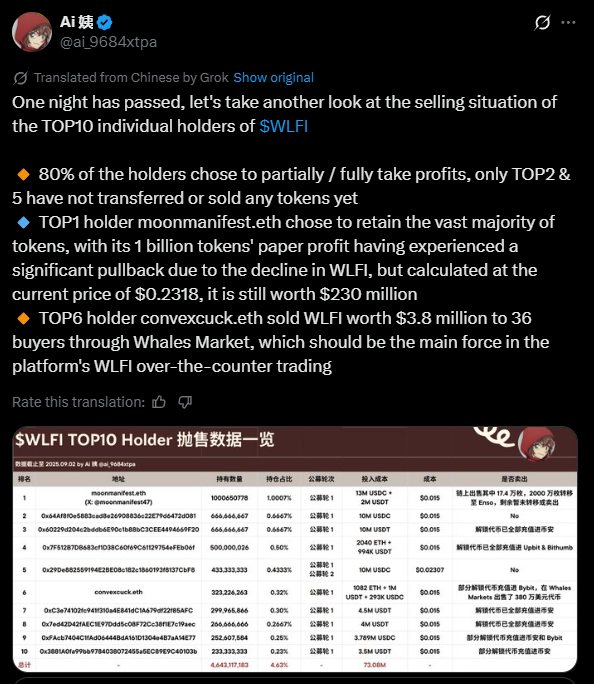

Nonetheless, many traders rushed to money out after the launch. On-chain knowledge posted on X reveals that 80% of the highest 10 WLFI wallets have been both partly or absolutely bought. Solely the second—and fifth-largest wallets stayed intact.

The highest pockets, moonmanifest.eth, nonetheless holds most of its 1 billion tokens, but its paper income have fallen for the reason that peak.

One other huge holder, convexcuck.eth, bought $3.8 million value of WLFI to 36 consumers by way of Whale Market, making it a significant off-exchange vendor. Such concentrated actions present how whale trades can spark volatility and form sentiment in new token markets.

Buyback Plan Sparks Debate

To ease early promoting strain, the WLFI group proposed a buyback-and-burn plan. BeInCrypto reported that every one protocol-owned liquidity charges would go towards shopping for tokens and sending them to a burn handle. This is able to minimize provide for good.

“This isn’t some meme coin,” Donald Trump Jr. tweeted after the launch. He introduced WLFI as a governance token with greater ambitions.

Supporters name the plan a deflationary software to reward long-term holders. In addition they see it as a technique to hyperlink protocol use with shortage. Critics argue it may drain treasury funds, block reinvestment, and add volatility in skinny markets. The collapse of Terra Luna 2.0 nonetheless serves as a warning.

Centralization Issues

WLFI additionally faces questions over governance. In July, a BeInCrypto report flagged the “World Liberty paradox.” Whereas marketed as decentralized, the token continues to be formed by the Trump household and a small group of traders.

Donald Trump personally holds billions in WLFI governance tokens. Exterior backers akin to Justin Solar and Abu Dhabi’s Aqua 1 Basis have invested tens of hundreds of thousands.

“In crypto markets, the beliefs of decentralization typically conflict with the fact of capital focus and brand-driven affect,” Erwin Voloder of the European Blockchain Affiliation advised BeInCrypto that WLFI displays a wider rigidity

The Trump household’s transfer into crypto has already reshaped their wealth. Nevertheless, WLFI’s long-term success will rely on greater than early paper positive factors.

With whales promoting, governance in elite fingers, and political scrutiny rising, WLFI should present it may be greater than only a speculative play.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.