Be a part of Our Telegram channel to remain updated on breaking information protection

Metaplanet has scooped up 1,009 Bitcoin for about $112 million to overhaul Riot Platforms because the sixth-largest company Bitcoin holder.

The Japan-based agency now holds 20,000 BTC on its steadiness sheet, with plans to increase that stash to 30,000 BTC by the top of the 12 months, it stated in a put up on X at present.

The newest buy price Metaplanet a mean of $110,987 per Bitcoin, bringing its whole Bitcoin holdings to an estimated $2.05 billion.

Its aggressive accumulation technique has put it inside putting distance of Bullish, the crypto change backed by former PayPal govt Peter Thiel, which at present ranks fifth with 24,000 BTC, in accordance to information from BiTBO.

Metaplanet Shares Plunge As Bitcoin Shopping for Faces Fundraising Crunch

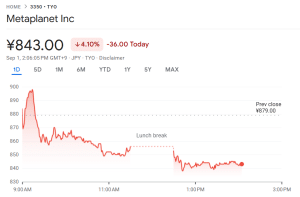

Metaplanet’s shares tumbled over 4% following the announcement of the newest Bitcoin purchase, and its shares have tumbled greater than 20% over the previous 30 days, information from Google Finance reveals.

Metaplanet share value (Supply: Google Finance)

Which means the corporate’s skill to train MS warrants issued to Evo Fund, its key investor, is not engaging for Evo, in response to a Bloomberg report. Metaplanet’s liquidity may consequently dry up quickly, bringing a pause to the corporate’s Bitcoin accumulation technique.

With that being the case, Metaplanet’s CEO, Simon Gerovich, who can also be a former Goldman Sachs dealer, is popping to different fundraising strategies.

Final week, Metaplanet unveiled plans to subject new shares abroad to lift between $880 to $884 million.

海外募集による新株式発行に関するお知らせ pic.twitter.com/9d9w1un2c7

— Metaplanet Inc. (@Metaplanet_JP) August 27, 2025

Of that quantity, about $835 million can be used for Bitcoin purchases throughout September to October this 12 months.

Bitcoin Worth Drop Provides To Fundraising Strain

Including additional stress to Metaplanet’s fundraising efforts is the continued drop in Bitcoin’s value. BTC’s value plummeted beneath $108K within the final 24 hours.

Throughout that interval, the crypto market chief fell from an intraday excessive of $109,240.34 to a 24-hour low of $107,293.01. BTC has since recovered barely to commerce at $107,406.70 as of 1:00 a.m. EST, information from CoinMarketCap reveals.

BTC can also be down greater than 3% on the weekly timeframe and over 5% within the final 30 days.

Although Metaplanet’s shares dropped and BTC continues to say no, doubtlessly drying up funding in the interim, the corporate was not too long ago upgraded from a small-cap to a mid-cap inventory in FTSE Russell’s September 2025 Semi-Annual Overview, bumping it up for inclusion within the flagship FTSE Japan Index.

Metaplanet’s inclusion within the FTSE Japan Index means it’s routinely added to the FTSE All-World Index, which tracks the biggest publicly-listed corporations by market cap in every geographic area.

With that inclusion, Metaplanet not solely offers inventory traders oblique publicity to Bitcoin, however can also be capable of faucet the standard monetary markets for added funding.

The corporate had introduced a collection of fundraising initiatives this 12 months to safe the required capital to fund extra Bitcoin buys.

Earlier this 12 months, Metaplanet launched a zero-coupon bond issuance value 2 billion yen, valued at roughly $13.3 million. Then, in June, the corporate introduced its “555 million plan.” Beneath this plan, Metaplanet initiated an fairness elevate through shifting strike warrants.

The purpose behind that second initiative is to lift $5.4 billion, which the corporate will then use to amass 210K BTC, or 1% of Bitcoin’s whole provide, by 2027. Shareholders will vote on whether or not to approve or block this issuance later at present.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection