Bitcoin (BTC), the most important cryptocurrency, bottomed at $107,000 as traders are shedding curiosity in BTC ETFs. In the meantime, Bitcoin OI on exchanges is concentrating on $40 million in equal.

Bitcoin (BTC) hits native backside at $107,000

Bitcoin’s (BTC) worth recovered as we speak after hitting a neighborhood low at $107,000 on some exchanges. Yesterday, on Sept. 1, 2025, Bitcoin (BTC) dipped beneath $107,500 on CoinGecko.

Picture by CoinGecko

After touching the bottom stage in two months, Bitcoin’s (BTC) worth is recovering. At printing time, the orange coin is altering arms at $110,900, trying to remain above the crucial stage of $110,000.

Bitcoin’s (BTC) buying and selling quantity dropped to $46 billion in equal. Within the final 24 hours, $74 million in Bitcoin (BTC) positions have been liquidated, with $37 million being lengthy.

Bitcoin dominance (BTC.D) is down by 3% in a single day:

- Bitcoin dominance: 57.8%

- Ethereum dominance: 13.8%

- Different cryptocurrencies: 28.4%

Proper now, BTC.D is shedding traction as liquidity flows into altcoins.

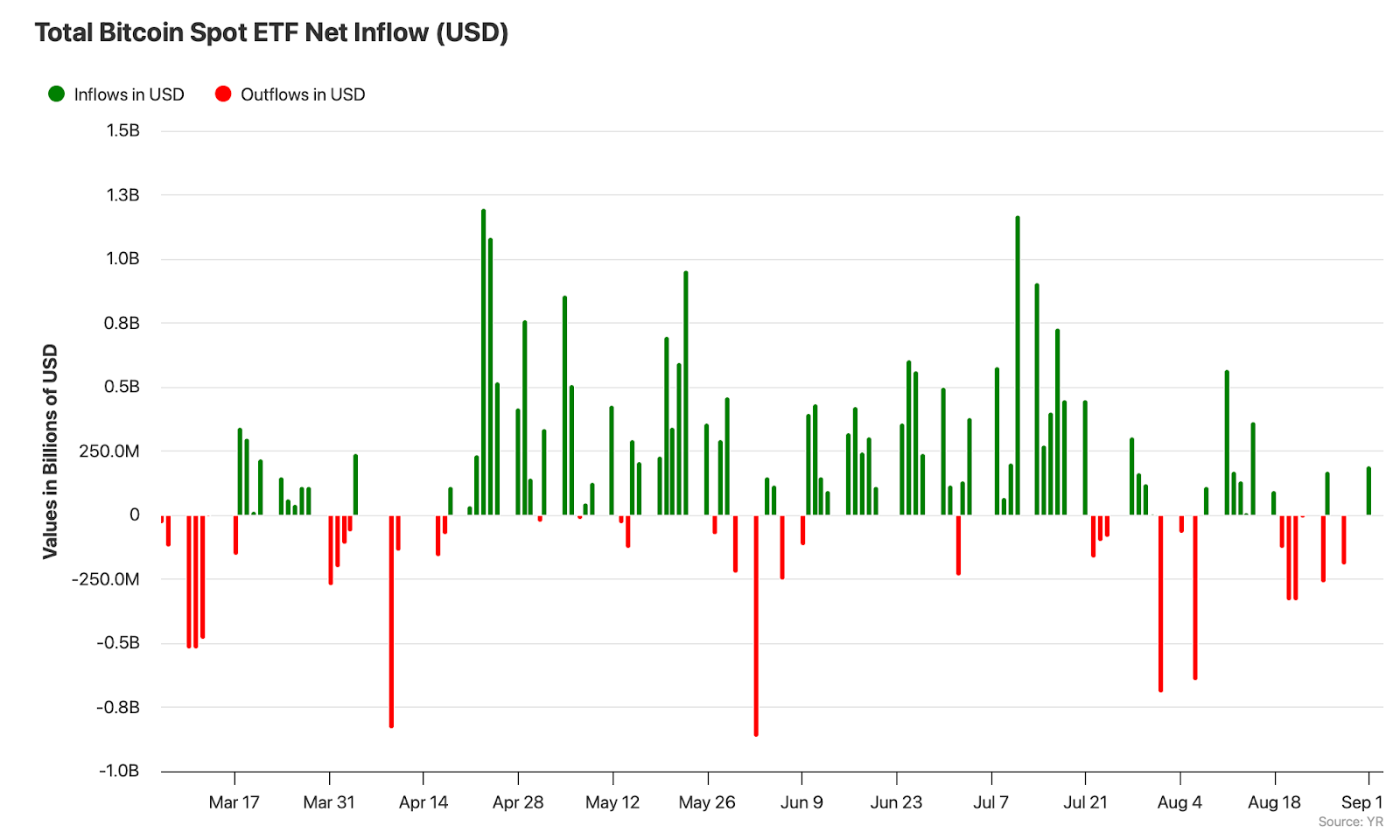

Bitcoin ETFs shedding steam: Inflows shrinking for 2 months

Spot Bitcoin ETFs within the U.S. mirror the pessimism of long-term traders. Beginning in mid-July, the amount of inflows into Bitcoin-based exchange-traded merchandise has been plummeting.

The Sept. 1, 2025 session was constructive, however solely introduced $192 million in inflows to all Bitcoin ETFs mixed. IBIT and FBTC historically have been among the many most energetic funds.

Picture by Bitbo

With $83 billion allotted within the complete market cap, BlackRock’s IBIT is the seventh largest ETF within the U.S. solely surpassed by TradFi heavyweights VOO, IVV, QQQ, GLD, SPY, XLK.

In complete, the phase’s AUM dropped to $142 billion in comparison with the $155 billion mid-August peak. Throughout this era, Ethereum ETFs’ market cap elevated from $22 billion to $24 billion.

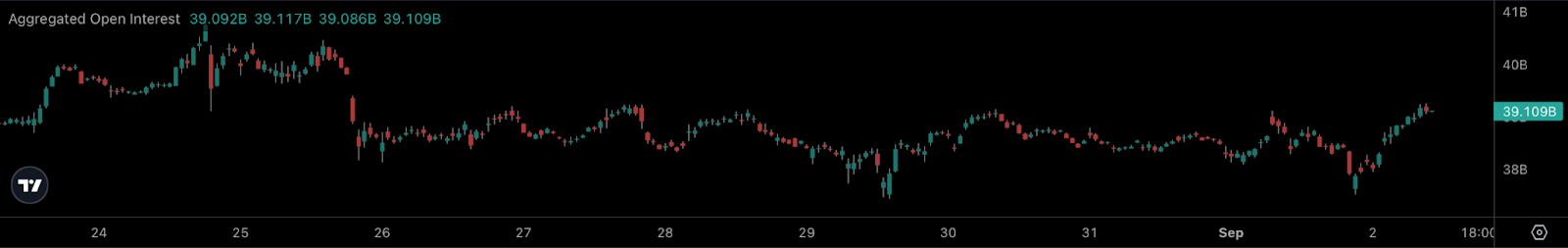

Bitcoin (BTC) open curiosity near $40 billion, offers bulls hope

Bitcoin’s open curiosity, i.e., the whole worth of opened futures (contracts) on derivatives exchanges, can be recovering.

Picture by CoinAlyze

Within the final hours, it nearly surged to $40 billion in equal, which is near weekly highs. That is an indicator of rising volatility coming mixed with traders displaying curiosity within the asset.

With its ups and downs, Bitcoin’s (BTC) open curiosity has remained comparatively excessive in current months. To supply context, a yr in the past it was sitting at $15-16 billion.

Accompanied by notable institutional circulation, that is one more sign that Bitcoin’s (BTC) bull rally peak may not but be in. Usually, This autumn of the post-halving yr marks the height stage of the cycle.

WLFI makes controversial debut on exchanges

WLFI, a cryptocurrency token by World Liberty Monetary, debuted on centralized exchanges yesterday, Sept. 1, 2025. Instantly upon itemizing, its worth jumped above $0.3, phishing market capitalization to unbelievable $8.26 billion. WLFI appeared on all Tier-1 centralized exchanges and a few minor platforms.

Right this moment, the WLFI worth stabilized round $0.22. WLFI is the twenty seventh largest cryptocurrency by market capitalization as of now. Its totally diluted valuation exceeds $22 billion.

On the similar time, the launch confronted a lot criticism from the cryptocurrency neighborhood. A complete of 80% of the token’s provide stays locked with no correct vesting schedule. As such, the WLFI provide is just too concentrated and is susceptible to manipulations.

WLFI’s launch already allowed its group and beneficiaries to earn $5-6 billion.

No, Venus Protocol was not hacked for $30 million

Right this moment, within the early morning hours, a rumor began spreading about Venus Protocol, a preferred DeFi platform, being drained for $30 million. Nonetheless, shortly, safety researcher PeckShield debunked this principle.

As an alternative, a Venus Protocol person misplaced $27 million, being hit by a phishing rip-off. The dealer mistakenly accredited a malicious transaction, granting token approval to the attacker’s deal with for the asset switch.

Because the cryptocurrency market remains to be in its bullish part, scammers’ exercise surges. As coated by U.Right this moment beforehand, malefactors drained Bunni DeFi for $2.4 million as we speak.

The alternate is constructed on Uniswap v4 code. The Bunni DEX group froze all exercise on the protocol whereas the investigation was ongoing.