The stablecoin market stays dominated by Tether (USDT) and Circle’s USDC, each of which had been based greater than a decade in the past and now account for the overwhelming majority of world provide.

However as new entrants emerge, analysts are questioning whether or not the network-based mannequin pioneered by newer initiatives like USDG (International Greenback Community) affords the one viable path ahead.

A decade of dominance

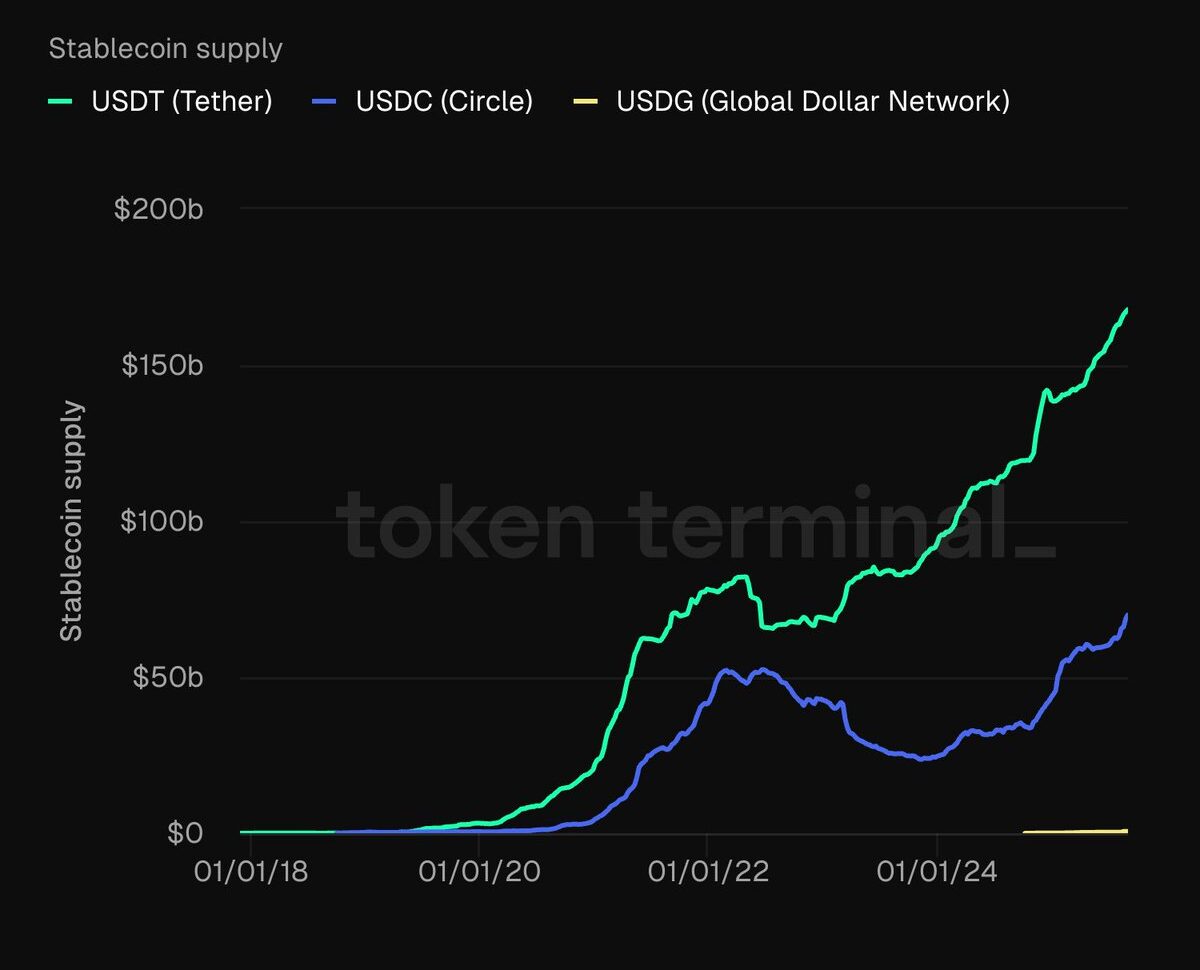

In accordance with knowledge from Token Terminal, USDT and USDC have seen exponential progress since 2020. Tether’s provide has surged to round $200 billion, whereas USDC maintains a considerable share above $60 billion. Their long-standing monitor data, liquidity depth, and integrations throughout exchanges have entrenched their positions because the go-to steady belongings for merchants and establishments.

The network-based mannequin

In contrast to conventional issuers that function centrally, initiatives resembling USDG are experimenting with decentralized, network-based issuance. This strategy distributes management and collateral obligations throughout contributors, aiming to scale back focus danger whereas scaling provide via broader adoption.

The query posed by Token Terminal is whether or not this mannequin represents the one aggressive pathway for brand spanking new stablecoins. Given the huge lead of incumbents, challengers could have to depend on community results, interoperability, and decentralized infrastructure to carve out relevance.

What’s at stake

Stablecoins underpin a lot of the crypto financial system, from buying and selling pairs to funds and DeFi collateral. As regulators intensify scrutiny and competitors heats up, the battle between centralized incumbents and decentralized challengers may decide whether or not the market consolidates additional, or evolves right into a multi-model ecosystem.

For now, Tether and Circle stay firmly forward. However as network-based initiatives acquire traction, the following decade could deliver a reshuffling of stablecoin energy dynamics.