- Jack Ma’s Yunfeng Monetary simply purchased 10,000 ETH ($44M) for its treasury.

- ETH is holding above $4K, with analysts eyeing $5,000–$6,000 targets.

- Institutional adoption and RWA tokenization may drive Ethereum’s subsequent leg increased.

Ethereum has managed to remain above the important thing $4,000 mark, even because the broader crypto market appears to be like a bit sluggish. That resilience hasn’t gone unnoticed—particularly by huge gamers with deep pockets. The newest to leap in is Yunfeng Monetary Group Restricted, a Hong Kong-listed agency co-founded by Alibaba’s Jack Ma.

Yunfeng Buys 10,000 ETH for Its Treasury

In a Tuesday announcement, Yunfeng Monetary confirmed it scooped up 10,000 ETH, price round $44 million, utilizing its personal money reserves. The transfer is a part of the corporate’s wider push into Web3, AI, real-world asset tokenization (RWAs), and digital forex.

“The Board believes that ETH’s inclusion because the Firm’s strategic reserve property is in keeping with the Group’s structure of enlargement into frontier areas,” Yunfeng defined, pointing to Ethereum’s function as infrastructure for tokenization and DeFi.

Different publicly traded corporations have been following an analogous playbook—suppose SharpLink Gaming, Tom Lee’s Bitmine Immersion Applied sciences, and Ether Machine—all shopping for ETH for his or her treasuries. It’s a transfer that echoes Michael Saylor’s well-known Bitcoin technique, however this time with Ethereum within the highlight.

Ethereum’s Worth Outlook

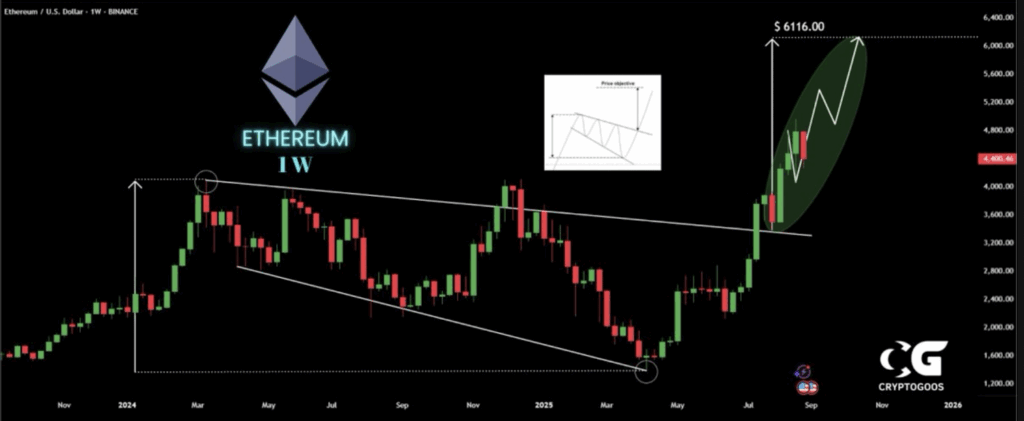

Ethereum is at present buying and selling at about $4,279, down 2.1% up to now 24 hours. Nonetheless, analysts stay bullish. CryptoGoos, a preferred chartist, says ETH’s breakout from a falling wedge sample on the weekly chart continues to be in play, with a measured transfer pointing as excessive as $6,116.

“Don’t promote your $ETH too early!” he warned on X, suggesting that the subsequent huge milestone might be $5,000 if institutional inflows proceed constructing momentum.

Why This Issues

Yunfeng’s ETH buy might be mirrored as an funding asset on its steadiness sheet and will diversify its holdings away from conventional fiat. The agency additionally hinted at exploring Ethereum’s use in insurance coverage operations and DeFi-focused merchandise, signaling this isn’t only a treasury play but in addition a tech guess.

For ETH holders, this type of institutional adoption is the gas that usually precedes larger worth runs. Whether or not it occurs subsequent week or takes a number of months, the $5K degree is firmly on the radar.

The put up Jack Ma-Linked Yunfeng Monetary Makes $44M Wager on Ethereum first appeared on BlockNews.