Prediction markets are rising strongly, from the a whole lot of hundreds of thousands of {dollars} raised by Kalshi and Polymarket to their rising functions throughout crypto and conventional finance.

Thought-about a brand new asset class, prediction markets promise to alter how folks eat info — as a substitute of studying headlines, they are going to take a look at odds to evaluate possibilities. Behind this monumental potential, nevertheless, lie the dangers of regulation, manipulation, and herd conduct, forcing buyers to stay cautious within the face of this “knowledge wave.”

When Prediction Markets Turn out to be “An Asset Class”

Prediction markets are rising as forecasting instruments and a brand new asset class inside the crypto ecosystem. Platforms and enterprise funds are starting to wager on commoditizing info and possibilities.

Sponsored

Sponsored

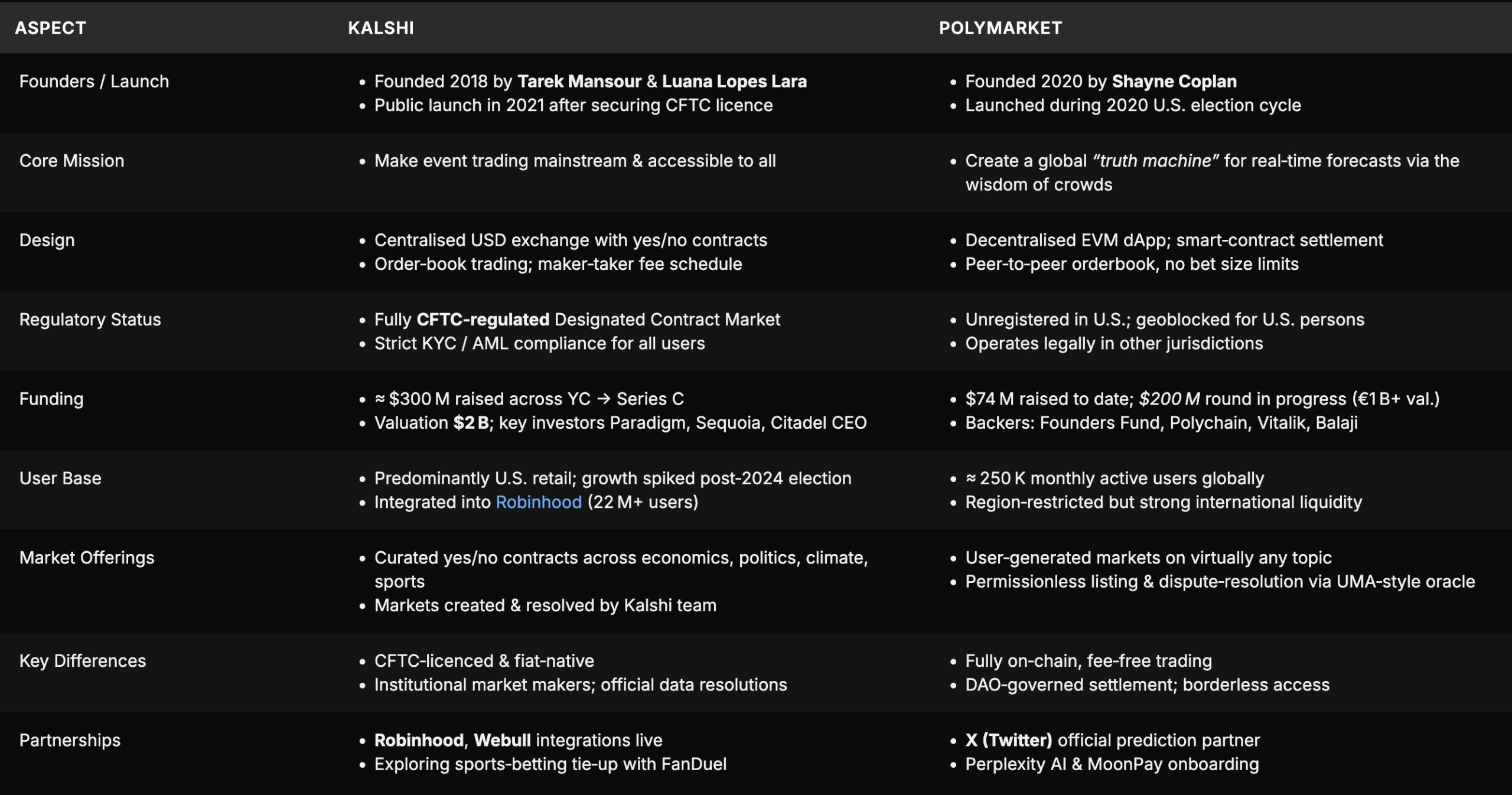

This has triggered a “prediction market struggle,” with large fundraising rounds, backing from prime enterprise capital corporations, and enlargement into new use instances — all fueling competitors. It reveals how the market is shifting from “information” to “odds” as a supply of worth.

Buyers more and more view prediction markets as a strategic asset class, not simply leisure or analysis merchandise. Whereas this competitors accelerates innovation, it additionally introduces systemic dangers if the enterprise fashions aren’t but sustainable.

Many neighborhood members name this the “subsequent massive wave” of the present cycle. They argue that the following technology of customers received’t learn headlines anymore however will “verify the percentages.”

In concept, prediction markets work properly as a result of they mixture scattered info from many individuals and switch it right into a quantity representing collective knowledge — generally much more correct than knowledgeable forecasts. This explains why protocols and tasks targeted on prediction spotlight the “knowledge of crowds” benefit in pricing occasion possibilities.

Then again, this benefit solely materializes when the market has sufficient liquidity, transparency, and safety from manipulation by important capital.

The Darkish Facet

On the sensible aspect, prediction markets have been examined throughout varied contexts — from resolving launchpad wars on sure chains to pricing financial occasions, sports activities, and on-chain governance. These examples spotlight their excessive applicability and lift considerations about dispute decision mechanisms, potential oracle errors, and administrative prices when transaction volumes surge. With out correct frameworks, “settling outcomes” might change into a major bottleneck.

The darkish aspect of prediction markets shouldn’t be ignored: dangers of market manipulation by bigger capital, front-running info, wash buying and selling to distort odds, and even being exploited for cash laundering or obfuscating transactions. These warnings have grown louder because the sector expands quickly; with out strong oversight and transparency, the so-called “supercycle” of prediction markets could result in a sooner erosion of belief reasonably than creating actual worth.

Furthermore, regulatory acceptance stays a important issue for the way forward for this area. Whether or not authorities classify prediction markets as respectable monetary devices or playing will instantly have an effect on retail adoption.

“The whole sector is dependent upon whether or not regulators deal with prediction markets as respectable monetary devices or playing, and whether or not institutional merchants or retail speculators drive adoption.” an X consumer famous.