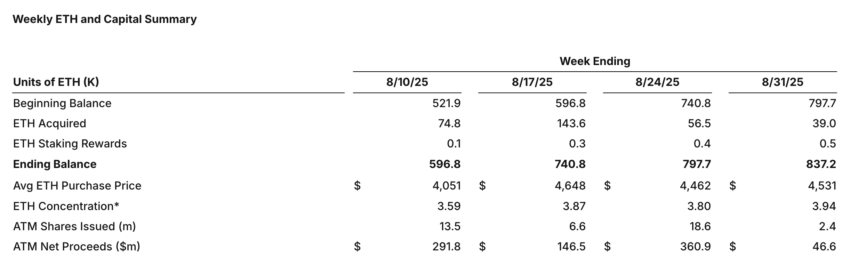

SharpLink Gaming (SBET) disclosed that it bought greater than $176 million in ETH in the course of the remaining week of August. The acquisition raised its complete stash to 837,230 ETH, valued at almost $3.6 billion as of August 31.

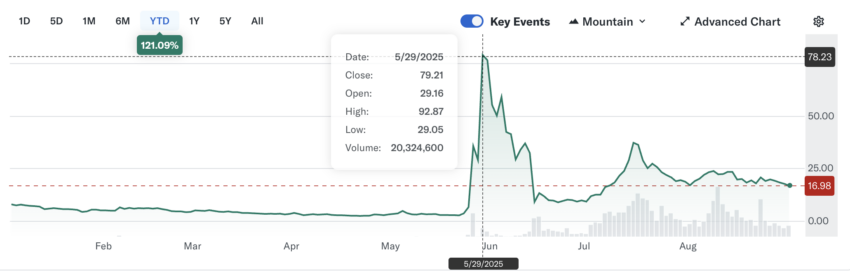

Whereas its ETH technique attracts consideration, the corporate’s inventory efficiency has provided little pleasure for buyers, notably as September started with a waning danger urge for food for equities and different risky property.

SharpLink’s $176 Million Ether Shopping for Spree

SharpLink, the Minnesota-based agency, purchased 39,008 ETH between August 25 and August 31 at a median worth of $4,531. The purchases had been partly funded by $46.6 million raised by means of its at-the-market (ATM) fairness program.

Sponsored

Sponsored

SharpLink reported its ETH focus ratio—measuring digital property relative to money—jumped to three.94, almost doubling since early June. At this degree, the corporate holds near 4 {dollars} of ether for each greenback of money readily available, assuming full deployment of its remaining $71.6 million liquidity.

Cumulative staking rewards have reached 2,318 ETH for the reason that agency launched its Ethereum-denominated treasury technique on June 2.

Co-CEO Joseph Chalom mentioned, “We proceed to execute our treasury technique with precision, rising our ETH holdings and persistently incomes staking rewards. We stay opportunistic in our capital elevating initiatives and can carefully monitor market circumstances to maximise shareholder worth.”

SharpLink’s transformation into an Ethereum treasury automobile accelerated in Might after a $425 million non-public funding spherical led by Consensys, Galaxy Digital, ParaFi Capital, Ondo, and Pantera Capital. That identical month, Consensys founder Joseph Lubin was appointed Chairman, solidifying the corporate’s pivot away from its prior give attention to playing advertising and marketing know-how.

Shares Swing as Ether Treasuries Balloon

Regardless of its aggressive shopping for, SharpLink’s inventory has been risky. SBET traded at $16.98 on Tuesday, down almost 5% on the day, although the shares have risen greater than 400% since mid-Might, once they traded under $3.

On the identical day, BitMine Immersion Applied sciences (BMNR), which can be pursuing an Ethereum-based treasury technique, mentioned it holds about 1.87 million ETH — the world’s largest company Ether treasury — and traded at $42.49, down 2.59% from the day prior to this.

In the meantime, Ethereum traded at $4,343, up 0.3% from 24 hours earlier, down about 11.4% since topping $4,900 on August 24.