TON is getting into a stage of excessive expectations as two main catalysts emerge concurrently: a $250 million buyback program and a digital asset treasury technique tailor-made for the Telegram ecosystem.

Behind this optimism, nevertheless, the market nonetheless faces heavy “promote partitions” and key resistance zones that will decide whether or not TON can surge 50% or stay caught in a slim buying and selling vary.

Institutional Push

Toncoin has drawn consideration with a sequence of institutional-level strikes. The official announcement of TON Technique’s $250 million buyback program alerts capital development expectations and proactive capital administration, whereas not all buyback applications assist improve token costs.

Sponsored

Sponsored

On the similar time, AlphaTON Capital not too long ago launched a digital asset treasury technique specializing in the Telegram ecosystem. The corporate is anticipated to initially accumulate round $100 million price of TON, creating an extra institutional demand channel and increasing TON’s potential for storage and utility.

Beforehand, Verb Know-how held over $780 million in TON property, marking a strategic shift towards Toncoin as its main reserve asset.

TON at a Essential Juncture

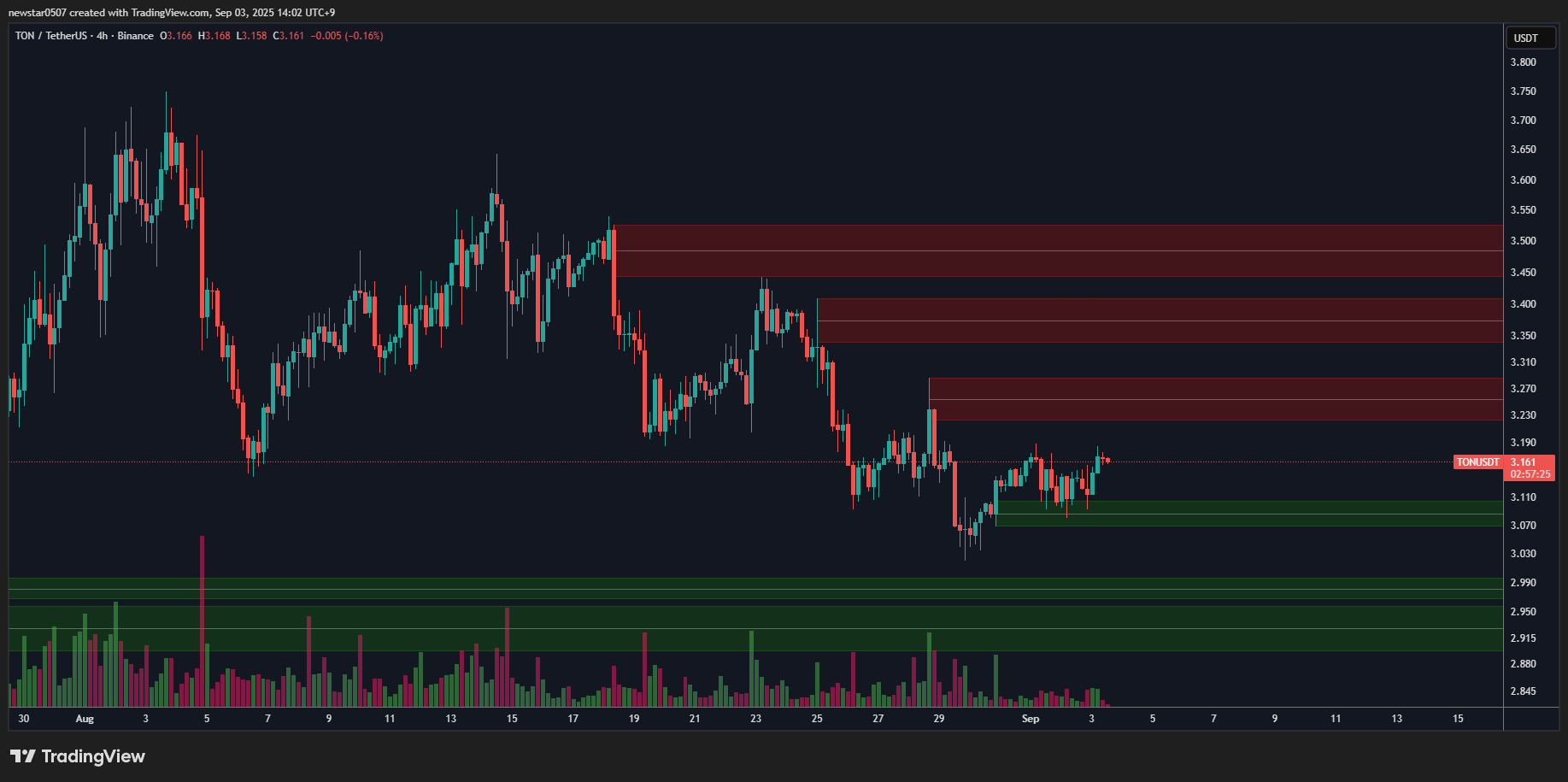

Available on the market aspect, Toncoin is buying and selling across the $3.1–$3.4 vary, effectively under its current short-term peak. Usually, the emergence of treasury funds and buyback applications helps scale back circulating provide and improve holding sentiment, which might assist a possible rally if substantial buying and selling volumes affirm it.

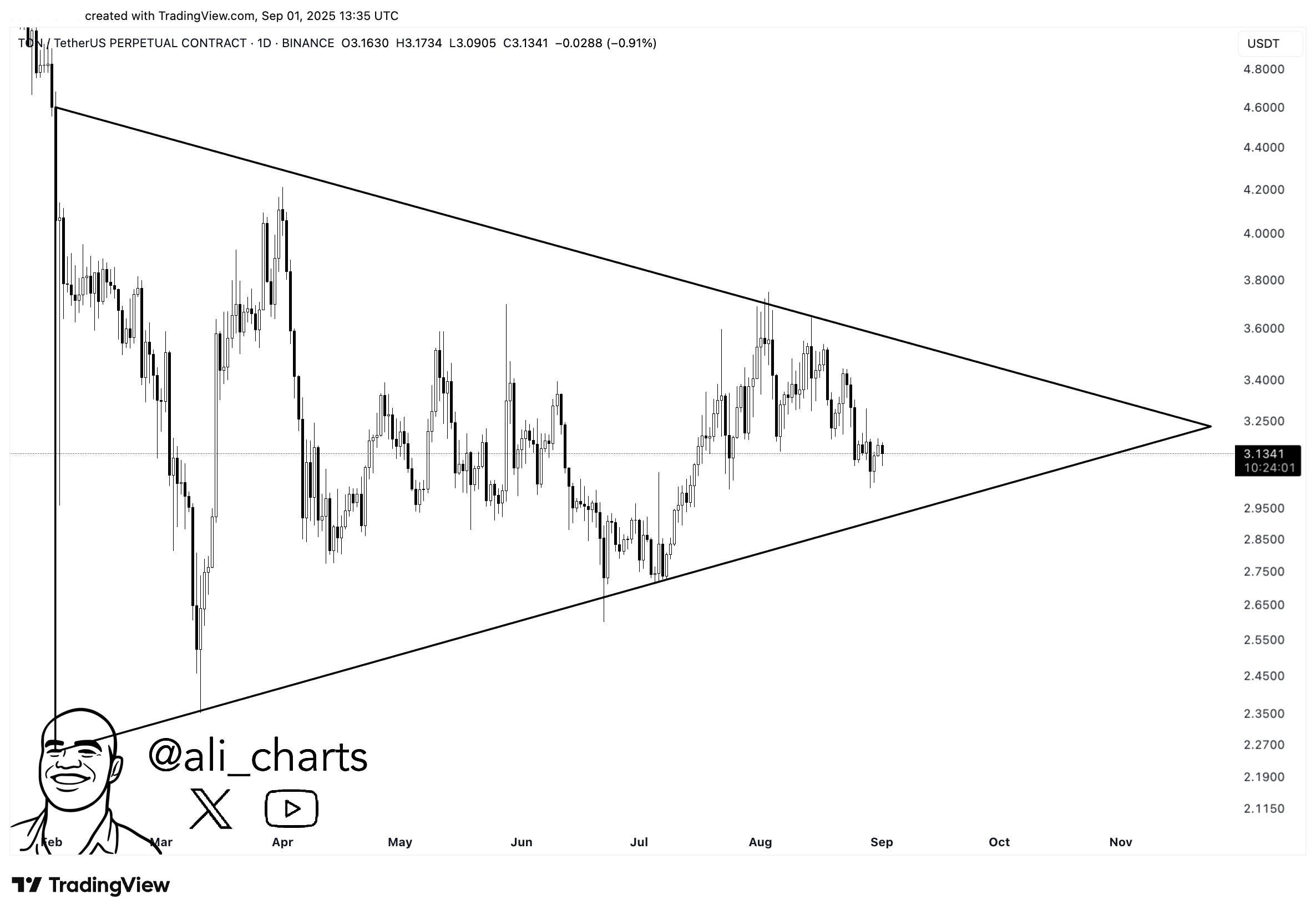

From a technical perspective, a number of analyses present that TON consolidates inside a triangle sample, usually a precursor to main value actions. Analyst Ali notes that if a decisive breakout happens, the worth might swing as a lot as 50%.

Nevertheless, in shorter timeframes, the market faces giant “promote partitions.” Earlier than reaching $3.525, TON should break via three extra promote partitions, which might act as near-term resistance to its upward momentum.

Within the brief time period, supply-demand dynamics are evident: TON has been repeatedly rejected across the $3.4–$3.45 zone, broadly seen as a powerful provide block. With out adequate shopping for strain, the worth might retest the $3.00–$3.27 ranges earlier than selecting its subsequent course. In a much less optimistic state of affairs, TON may even retrace towards $2.68.

“Market construction exhibits EQL shaped, which regularly acts as liquidity magnets. A clear sweep right here might gas a transfer again up into the imbalance zone,” one X consumer famous.