September has historically been a tough month for Bitcoin (BTC), with worth charts usually exhibiting weak point. Nonetheless, some specialists predict a possible surge, pointing to falling change reserves as a sign of upward momentum.

The optimistic outlook comes regardless of Bitcoin’s current struggles. The most important cryptocurrency has slipped 2% over the previous week, reflecting broader market uncertainty.

Bitcoin Outlook: Seasonal Lows or Rally Forward?

Sponsored

Based on knowledge from Coinglass, Bitcoin’s common return in September stood at -3.33%, making it the cryptocurrency’s worst month. BTC ended the month in crimson for six consecutive years between 2017 and 2022, making its prospects for this 12 months additionally somber.

Notably, many specialists agree on this angle. An analyst has characterised the present market as resembling a ‘traditional inventory market high.’ This indicated potential vulnerability to additional corrections.

Moreover, analyst Timothy Peterson highlighted that Bitcoin’s worth dipped 6.5% final month. The analyst predicted a worth vary of $97,000 to $113,000 by the top of September, reflecting a continuation of this pattern.

‘It’s a part of a seasonal sample that has performed out over a few years,” Peterson added.

Sponsored

In the meantime, many anticipate that whereas declines could come, the coin will bounce again subsequent quarter. Based mostly on previous patterns, October and November are the strongest months for Bitcoin, so that would very nicely occur.

“Traditionally, Bitcoin has all the time bottomed out in September after the 12 months of the halving. After that, it’s largely easy crusing. Regardless of me often not wanting on the previous and utilizing it as a sign for accuracy (I have a look at worth motion right this moment). Taking a look at charts proper now, this might truly very nicely play out once more,” Crypto Nova wrote.

This view is supported by Benjamin Cowen, CEO of Into The Cryptoverse. He famous that September usually marks a low level in post-halving years, sometimes adopted by a rebound right into a market cycle peak within the fourth quarter.

Sponsored

Nonetheless, some keep a extra optimistic view. Knowledge shared by crypto analyst Rand confirmed a gradual decline in BTC held on exchanges. Furthermore, the change provide has plunged to a six-year low.

This alerts lowered promoting stress. As well as, if demand will increase, this shrinking provide can help a extra bullish outlook for Bitcoin.

“Bullish provide shock,” Cade Bergmann added.

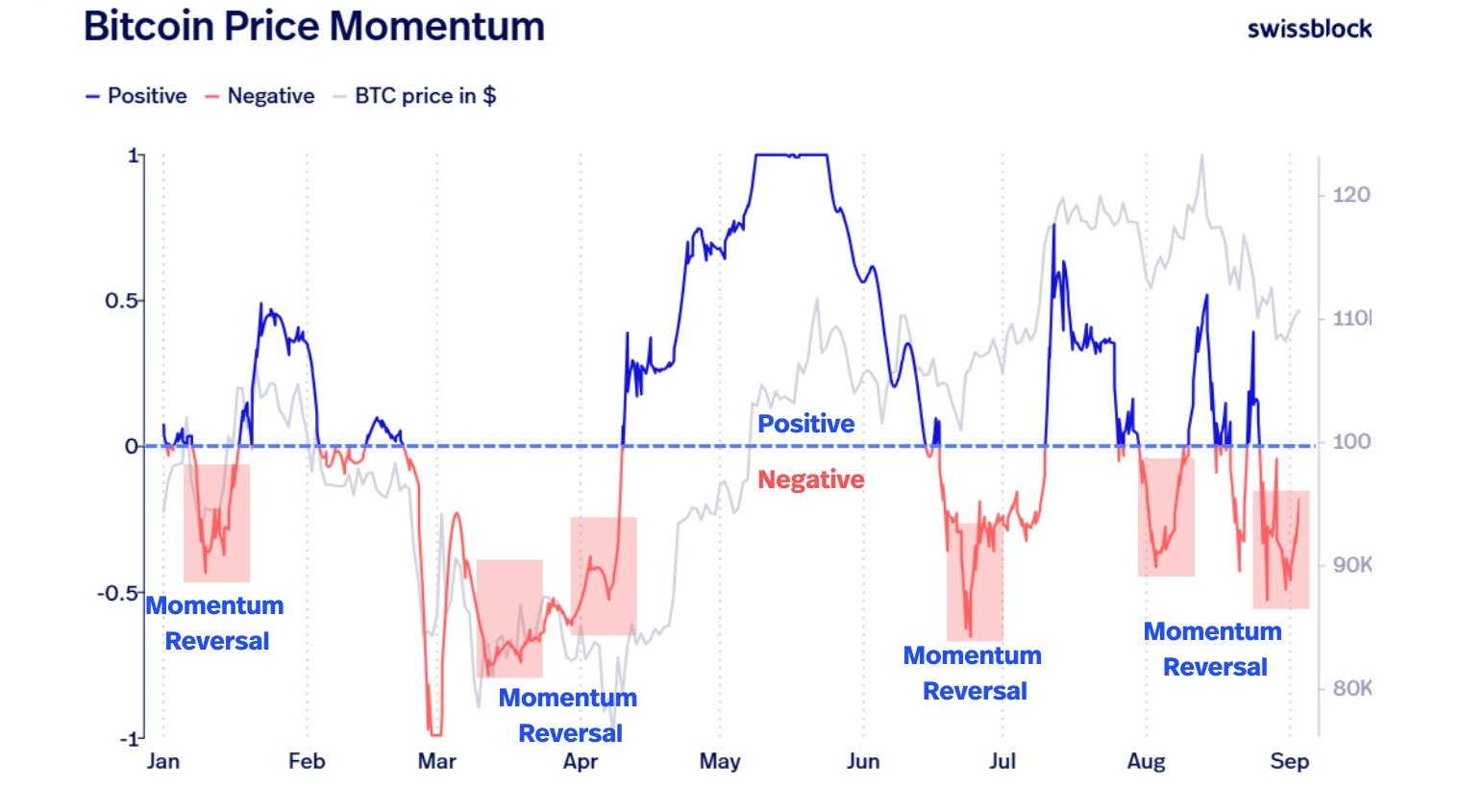

Rand additionally emphasised that momentum seems to be reversing from adverse to optimistic, signaling a possible shift in market sentiment. With slightly below two weeks till the market anticipated Fed fee cuts, the analyst instructed the coverage shift might present the catalyst for a stronger restoration in September.

Sponsored

Lastly, market watchers are additionally eyeing key dates. Analyst Marty Social gathering pointed to September 6 as a possible set off, tied to market maker exercise.

Sponsored

“Bitcoin market makers have cooked on the sixth of every month. IMO: Sept sixth is a transfer. That’s the occasion window until Sept seventeenth FOMC,” he stated.

Now, Bitcoin’s worth stays below stress, with specialists divided on whether or not September will mark a backside or a continued decline. The approaching weeks, notably across the forecasted Fed resolution, can be crucial in figuring out whether or not the cryptocurrency can defy its seasonal weak point and capitalize on the present provide dynamics.