Binance has set a brand new file for Bitcoin futures buying and selling, hitting its highest quantity in August. This surge is being interpreted as a transparent sign of rising speculative urge for food amongst each retail and institutional merchants.

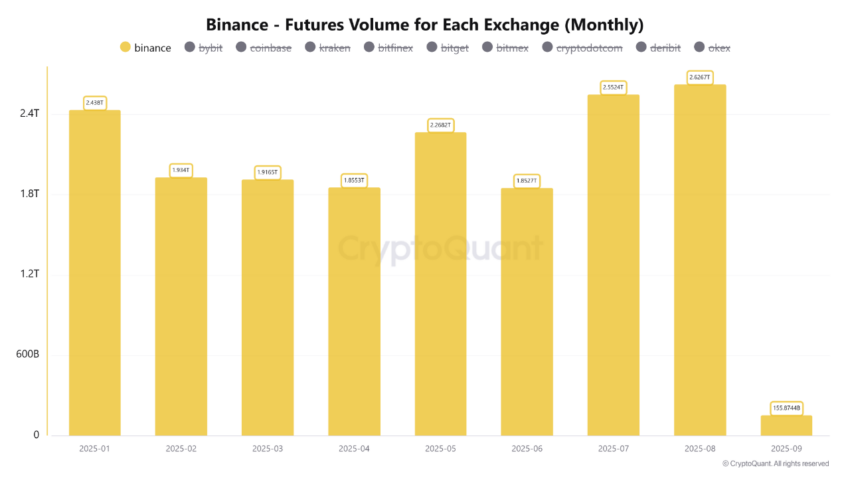

In accordance with crypto analyst Arab Chain, Binance’s complete futures quantity for August reached $2.626 trillion, an all-time excessive for 2025. This determine surpasses the earlier file of $2.552 trillion set in July, reflecting a robust return of market momentum and a recent inflow of capital. The analyst factors to strengthened liquidity on Binance, which is solidifying its place as a dominant international futures market.

Is This a Signal of Institutional Comeback?

Sponsored

Sponsored

The return of hedge funds and institutional traders could also be a key issue driving this development. Arab Chain famous that “information exhibits rising institutional exercise throughout each lengthy and brief positions on Binance, particularly following a interval of relative stabilization in ETF momentum.”

The analyst additionally highlighted that “open curiosity reached elevated ranges alongside the buying and selling quantity spike, indicating that the rise was pushed not simply by liquidations, however by the buildup of latest positions.” This means many new individuals are getting into the market slightly than merely closing out present positions.

Whereas the numbers are spectacular, not everybody sees this as a assured bull run. Arab Chain additionally warned that such excessive momentum typically precedes a market correction. “For sustained futures momentum, help from spot markets and money flows—notably from stablecoins and reserves—is essential,” he acknowledged.

The analyst’s warning reminds the trade that the derivatives-led rally might shortly lose steam with out recent liquidity. An absence of robust money inflows might lead to a pointy correction if open positions aren’t supported.

Nonetheless, current information on stablecoins exhibits promise. The worldwide stablecoin market cap, which was at $276.2 billion on August 1, grew by roughly 7.38% over the month. This development has continued into September, rising one other 0.65% to achieve $298 billion on the time of writing. If this development holds, a derivatives-fueled rally might be on the horizon.