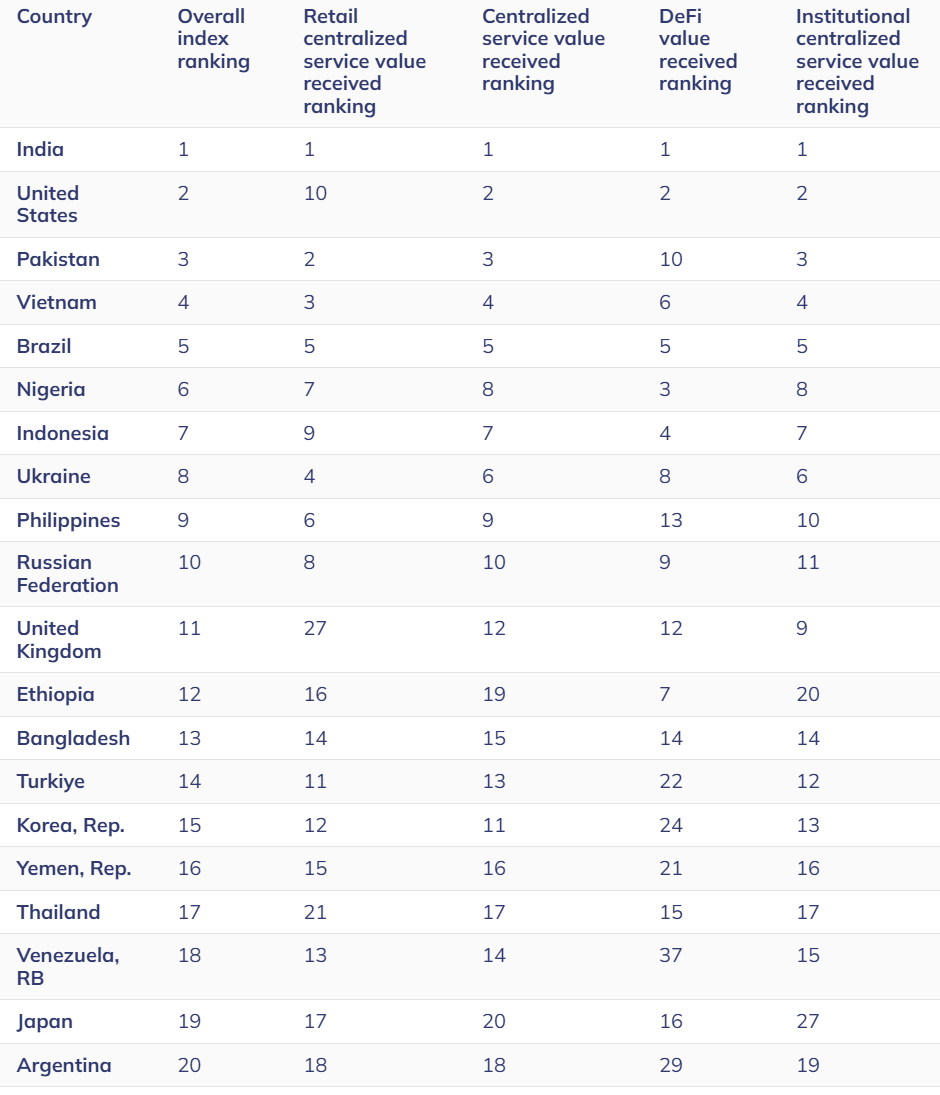

Chainalysis has launched its sixth annual International Crypto Adoption Index, naming India the world’s prime marketplace for grassroots crypto adoption in 2025, with the US in second place, adopted by Pakistan, Vietnam and Brazil. Revealed on September 2, 2025 as an excerpt from the forthcoming Geography of Cryptocurrency Report, the research blends on-chain and off-chain knowledge to rank 151 international locations by how broadly and intensively strange individuals and establishments are utilizing crypto, relatively than by headline market capitalization alone.

International Crypto Adoption Report 2025

On the coronary heart of the rating is a composite rating constructed from 4 sub-indices: on-chain worth obtained by centralized providers; retail-sized on-chain worth obtained by centralized providers; on-chain worth obtained by DeFi protocols; and institutional-sized on-chain worth obtained by centralized providers. Chainalysis says it ranks every nation throughout these pillars, weights the outcomes by components akin to inhabitants and buying energy, after which takes a geometrical imply to supply a normalized 0–1 rating. The agency emphasizes scale, noting that its inputs embody “a whole lot of thousands and thousands of cryptocurrency transactions and greater than 13 billion net visits,” whereas acknowledging web-traffic-based geolocation limits.

Methodologically, 2025 marks a notable pivot. Chainalysis “eliminated the retail decentralized finance (DeFi) sub-index” after concluding it over-weighted a “comparatively area of interest habits,” and added a brand new institutional exercise lens capturing transfers over $1 million, reflecting the post-ETF surge in skilled participation. The goal, the agency writes, is a “fuller view of world crypto engagement, capturing each bottom-up (retail) and top-down (institutional) exercise.”

The headline desk underscores Asia’s weight. India sits first total and first throughout all 4 underlying classes; Pakistan and Vietnam be a part of it within the international prime 4, whereas Brazil rounds out the highest 5. Nigeria, Indonesia, Ukraine and the Philippines rank sixth by way of ninth, with the Russian Federation at ten and the UK at eleven. Notably, Ethiopia and Yemen enter the highest twenty at twelfth and sixteenth, respectively, whereas Japan ranks nineteenth and Argentina twentieth. Chainalysis attributes the regional momentum to a surge in each centralized and decentralized utilization throughout main APAC markets.

Regional stream knowledge deepen that image. Over the twelve months to June 2025, APAC’s on-chain worth obtained jumped 69% yr over yr—from roughly $1.4 trillion to $2.36 trillion—making it the fastest-growing area. Latin America adopted at 63% progress and Sub-Saharan Africa at 52%. In absolute phrases, Europe and North America nonetheless dominate, receiving about $2.6 trillion and $2.2 trillion respectively over the interval; North America’s exercise grew 49% amid renewed institutional participation, whereas Europe rose 42%. MENA expanded by 33%.

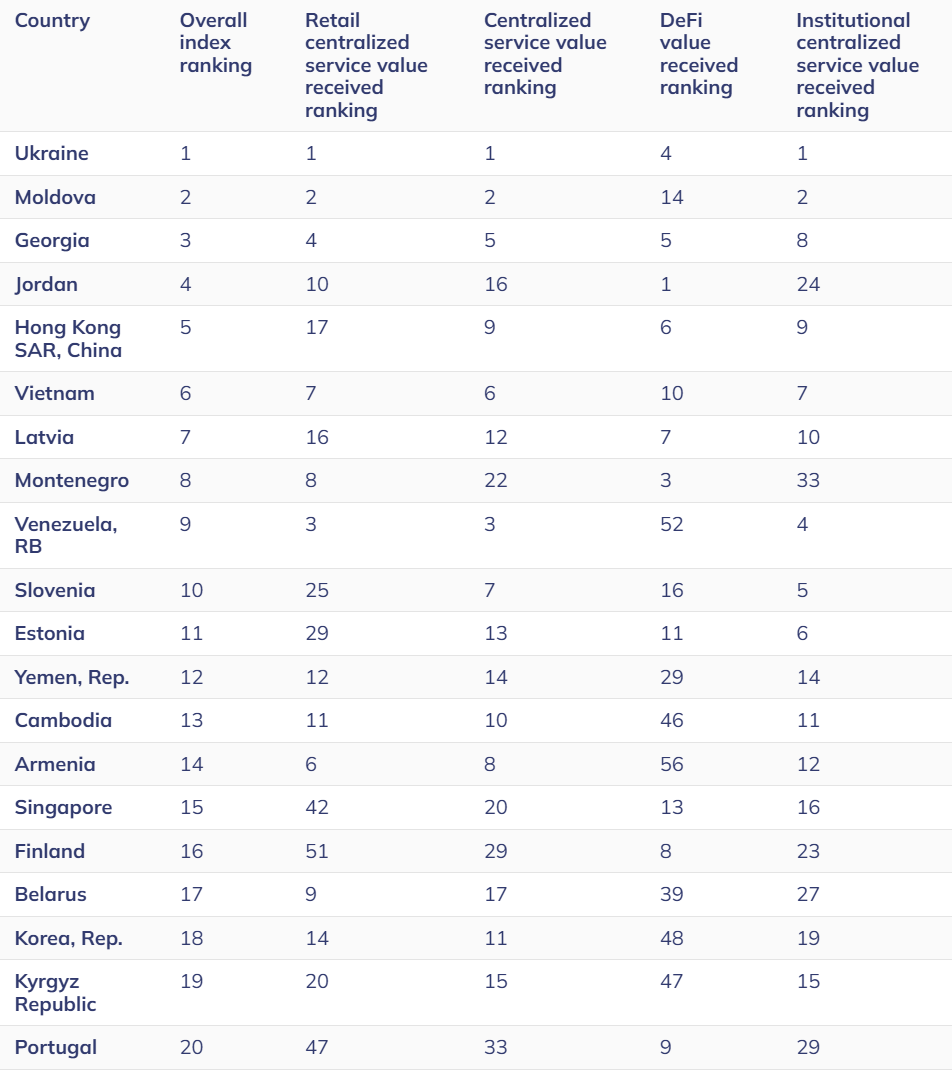

A population-adjusted minimize of the index tells a unique story, highlighting the place crypto has penetrated most deeply relative to nation dimension. On that foundation, Jap Europe is ascendant: Ukraine ranks first, Moldova second and Georgia third, forward of Jordan and Hong Kong SAR. Chainalysis hyperlinks the area’s management to financial uncertainty, mistrust in banks, and excessive technical literacy that make crypto enticing for wealth preservation and cross-border transfers. Vietnam once more seems close to the highest on this view, underscoring its broad-based retail engagement.

Stablecoins stay the connective tissue of world crypto commerce. Chainalysis finds that USDT and USDC proceed to dwarf friends in transaction quantity, with USDT processing over $1 trillion per 30 days between June 2024 and June 2025 and USDC ranging roughly from $1.24 trillion to $3.29 trillion month-to-month, whilst newer, extra regulated or regionally tailor-made tokens speed up. EURC’s month-to-month quantity, for instance, rose from about $47 million to greater than $7.5 billion over the interval, whereas PYUSD climbed from roughly $783 million to $3.95 billion.

The agency situates these flows inside shifting rulesets—MiCA’s stablecoin regime within the EU and US legislative momentum exemplified by the GENIUS Act—alongside increasing service provider rails from funds giants and card-linked integrations by main crypto platforms.

Crucially, the report analyzes the fiat “on-ramp” into crypto throughout centralized exchanges. “Bitcoin leads by a large margin,” Chainalysis writes, accounting for over $4.6 trillion in fiat buy quantity from July 2024 to June 2025—greater than double Layer-1 tokens ex-BTC and ETH (about $3.8 trillion), with stablecoins at $1.3 trillion and altcoins round $540 billion. The USA is the biggest nationwide on-ramp at greater than $4.2 trillion, adopted by South Korea above $1 trillion and the European Union slightly below $500 billion; Bitcoin’s share of fiat influx is very pronounced within the UK and EU at roughly 47% and 45%.

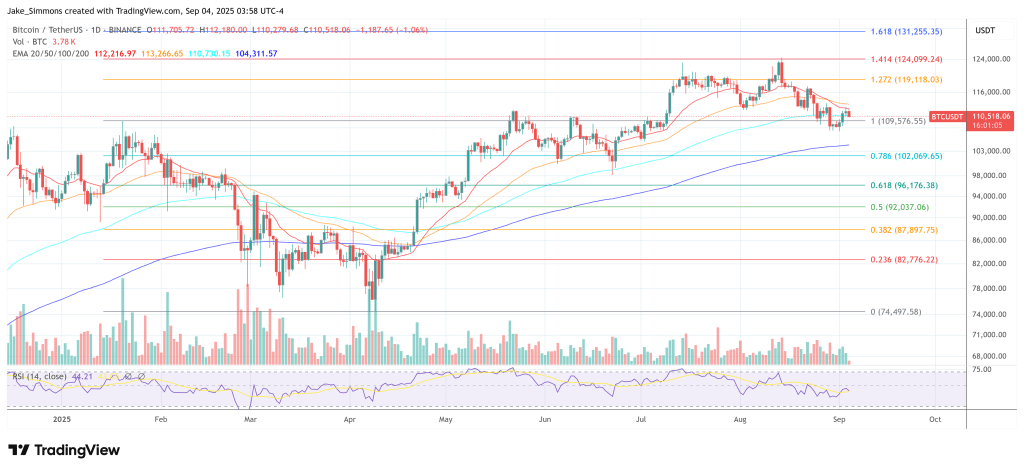

At press time, Bitcoin traded at $110,518.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.