The Pi Coin value has steadied into early September. It’s down 2% month-on-month, up 0.6% over seven days, and about 1% within the final 24 hours—muted strikes for a token nonetheless 60% decrease year-on-year.

That restraint, nevertheless, is exactly why the present construction issues: a bullish cup-and-handle might be taking form once more. However beneath the fractal, different issues are cooking up as nicely for the Pi Community.

Sponsored

Sponsored

Shopping for And Bullish Strain Construct Beneath The Pi Coin Value

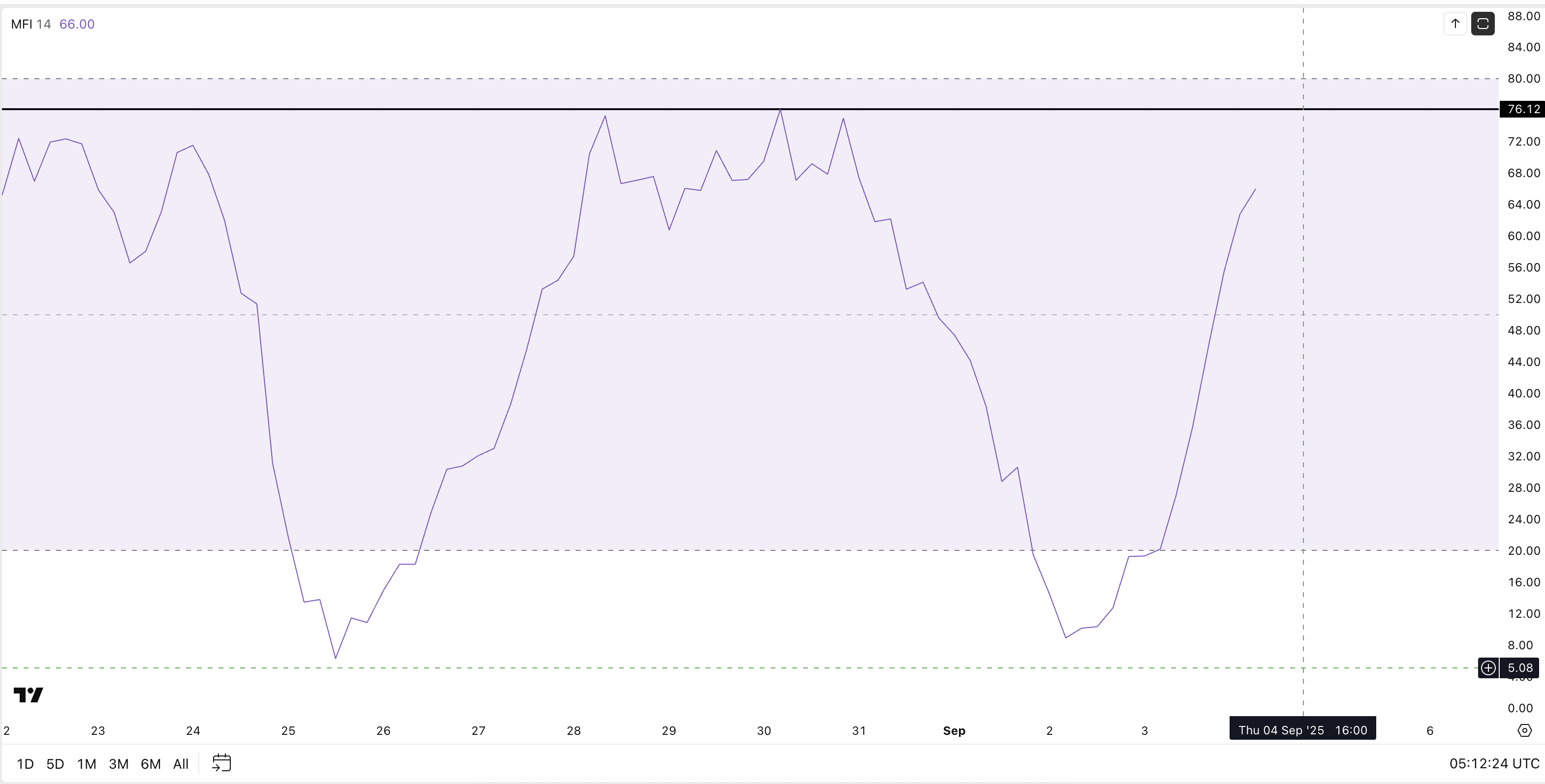

The Cash Move Index (MFI)—a volume-weighted momentum gauge that signifies whether or not precise cash is flowing in (shopping for) or out (promoting)—has rebounded to 66 on the 4-hour chart, even because the PI value wobbled.

Sponsored

Sponsored

In plain buying and selling phrases, consumers are quietly absorbing dips. If MFI pushes by way of 75–76, it will mark a better excessive in cash movement in opposition to a still-fragile pattern, a traditional signal that consumers are taking management reasonably than simply defending helps.

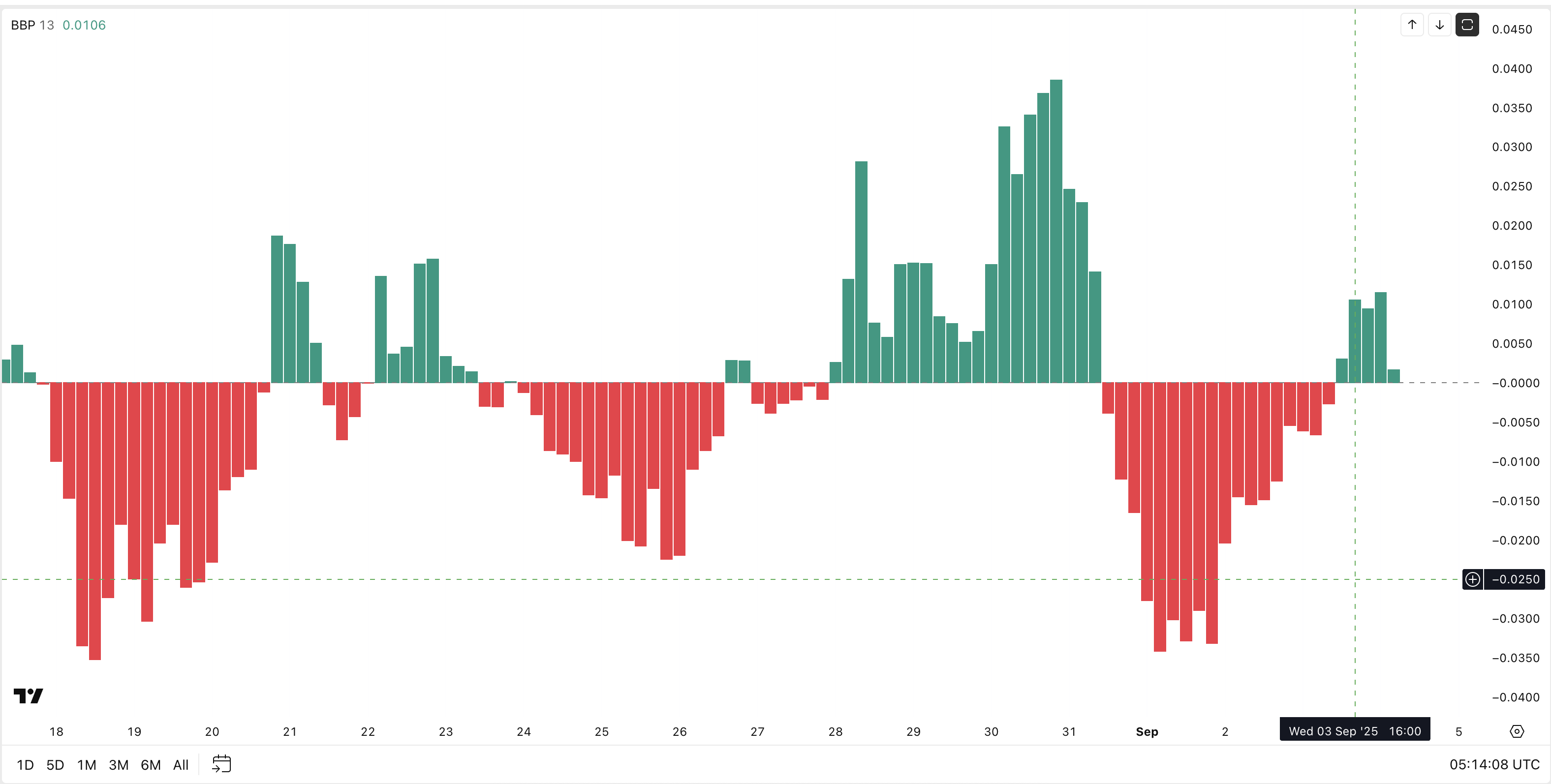

That sample strains up with the Bull–Bear Energy (BBP) histogram, which compares value extremes to a shifting common to disclose who’s in cost.

Inexperienced clustering has returned, very similar to late August, when bulls wrestled again momentum forward of Pi Coin value’s month-end burst. Put collectively, the MFI up-drift plus a constructive BBP part argues that actual buy-side strain is constructing beneath the Pi Coin value.

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

Fractal Watch: The Cup-and-Deal with; and Why $0.39 Is The Decider

Sponsored

Sponsored

We’ve seen this film earlier. Between Aug 22–29, a clear cup-and-handle breakout carried the Pi Coin value from roughly $0.35 to $0.39—an 11–12% transfer that adopted the textbook Cup-and-handle playbook.

The same setup could also be forming now, nevertheless it hinges on the neckline zone at $0.39 (with $0.3950 and $0.3983 the exact pivots on the 4-hour chart). A decisive 4-hour shut above $0.39 would “activate” the sample and unlock the measured transfer of just about 19%. Nevertheless, for that, the bulls will nonetheless have to remain in management, and the MFI must preserve trending upwards or a minimum of keep regular.

Word: The Pi Coin value nonetheless has an extended strategy to go. If and when the cup types post-hitting $0.39, we have to anticipate a fast consolidation (or reasonably deal with formation). The 19% projection can be from when the Pi Coin value breaks previous the deal with, cleanly.

Till that break, it’s simply potential. Failing to clear the neckline ensures that the Pi Coin value stays range-bound. And dropping $0.33 on a 4-hour closing foundation would invalidate the short-term bullish speculation. And that might prime the Pi Coin value to check its all-time low of $0.32.