Be a part of Our Telegram channel to remain updated on breaking information protection

The Ethereum worth dropped 2% to $4,304 up to now 24 hours because the ETH staking queue hit its highest stage in two years, and the Ethereum Basis introduced plans to promote $43 million value of ETH for monetary assist.

The Ethereum validator entry queue has climbed above 860,000 ETH, value roughly $3.7 billion at present costs, the very best since Sept. 2023, exhibiting a strong urge for food for Ethereum staking regardless of ETH’s current market situations.

Ethereum’s staking queue has surged to its highest stage since Sept 2023.

Over 860,369 ETH (~$3.7B) is now ready to be staked, as institutional gamers and crypto treasuries transfer to seize rewards. pic.twitter.com/dThYnE3Uqu

— Satoshi Membership (@esatoshiclub) September 3, 2025

The fast accumulation of pending validators is an indication of deep confidence within the token’s prospects, as each retail and institutional gamers are dedicated to long-term participation within the community.

Staking acts as a provide squeeze, as validators successfully take away tokens from lively circulation, which may in flip create potential upwards stress on the value.

The sudden surge in staking exercise comes at a time when the crypto market is exhibiting indicators of institutional maturation, with long-term hodlers more and more viewing ETH as a yield-generating asset somewhat than only a speculative play.

As an illustration, a current announcement by BitMine Immersion Applied sciences states that it holds roughly 1.9 million ETH, practically 1.55% of the whole ETH provide. This makes the corporate the world’s largest company Ether treasury, in keeping with Strategic ETH Reserve knowledge.

O’Leary Ventures and Beanstox Chairman Kevin O’Leary, also called ‘Mr.Fantastic,’ says his two largest positions are in Bitcoin and Ethereum, which he feels seize ”90% of the whole crypto market.”

“I think about BTC and ETH the true gold,” he mentioned.

My two largest positions are Bitcoin and Ethereum, and collectively they seize nearly 90% of the whole crypto market.

Past that, I’ve constructed methods to generate yield on prime of my holdings, identical to dividends or bond curiosity. That’s why I think about BTC and ETH the true gold… pic.twitter.com/rIGLKpKVgT

— Kevin O’Leary aka Mr. Fantastic (@kevinolearytv) September 2, 2025

Ethereum Basis Strikes To Promote $43M In ETH To Gas Operations

The Ethereum Basis plans to promote 10,000 ETH, value roughly $43 million, to fund analysis, growth, grants, and neighborhood donations.

0/ Transparency Discover: Over a number of weeks this month, EF will convert 10K ETH by way of centralized exchanges as a part of our ongoing work to fund R&D, grants, and donations.

Conversions will happen over a number of smaller orders, somewhat than as a single giant transaction.

— Ethereum Basis (@ethereumfndn) September 2, 2025

The funds from the sale might be allotted to boost Ethereum’s scalability and safety, in addition to its decentralization, assist builders and initiatives, and fund public items inside the blockchain area.

Based on the Basis’s announcement, the conversion will happen in smaller tranches somewhat than one giant commerce to keep away from any disruption within the ETH worth.

The Basis makes use of centralized exchanges and communication to scale back volatility and foster belief inside the Ethereum neighborhood.

Ethereum Worth Indicators Level Towards Consolidation Earlier than Subsequent Transfer

The ETH worth on the each day timeframe reveals a powerful bullish pattern that started in mid-April 2025. After consolidating close to the lows round $1,420, the market surged upward and has since been buying and selling inside a clearly outlined rising channel sample.

The Ethereum token presently hovers round $4,304, consolidating after testing the higher vary of the channel close to $4,900. Regardless of this pullback, ETH stays above each the 50-day and 200-day Easy Shifting Averages (SMAs), which have been offering dynamic assist.

ETH has revered the 0.786 retracement stage close to $4,181, bouncing above it a number of occasions. This stage now acts as short-term assist, whereas the $4,932 stage represents main resistance, aligning with the highest of the channel.

In the meantime, the Relative Energy Index (RSI) is at 50.19, which exhibits that patrons and sellers are in some indecisive part, indicating that ETH is neither overbought nor oversold and suggests the market is pausing earlier than deciding its subsequent path.

ETH Eyes $5,000 Whereas Watching $4,100 Assist

ETH is more likely to proceed consolidating inside the rising channel within the quick time period.

The instant assist to look at is the 50-day SMA round $4,073, which can also be near the 0.786 Fibonacci retracement stage ($4,181).

If the worth of ETH holds above this zone, one other try on the $4,932 resistance may happen. A profitable breakout above $5,000 may permit the bulls to push Ethereum towards the $5,500 channel resistance within the coming weeks.

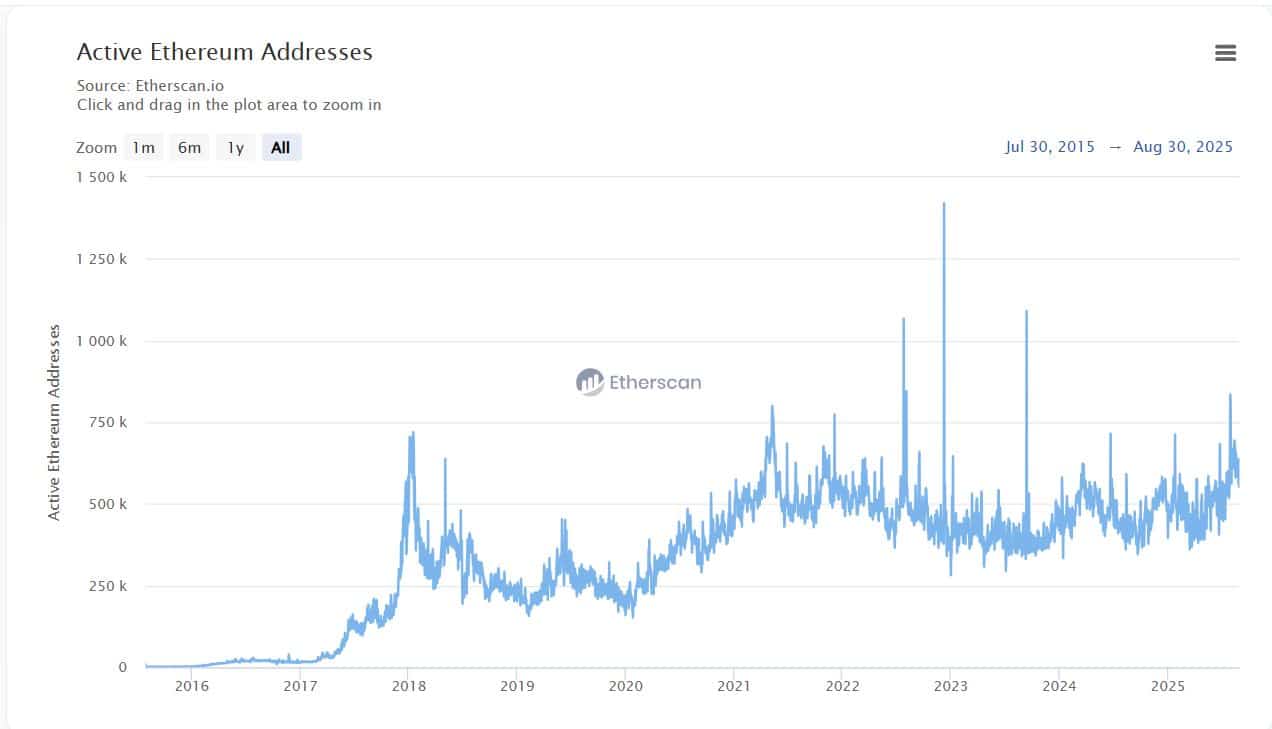

Community participation is excessive, as proven by substantial transaction volumes, up 6% to $32 billion within the final day, and the rising variety of lively addresses.

Based on Coinalyze knowledge, Ethereum’s Open Curiosity is at 27.87B, a sign that each one open futures positions out there are concentrated in ETH. This exhibits robust dealer curiosity and vital market publicity to Ethereum.

On the draw back, a decisive break beneath $4,073 would expose the decrease channel boundary and the subsequent Fibonacci helps close to $3,591 (0.618 retracement) and $3,176 (0.5 retracement). A lack of these ranges may shift momentum and push Ethereum in the direction of deeper corrections.

The bearish sentiment comes as Ethereum ETFs (exchange-traded funds) registered two consecutive days of outflows, in keeping with Coinglass knowledge.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection