Whereas Wall Avenue could also be satisfied the Federal Reserve (Fed) is about to slash rates of interest, many consultants argue the exhausting financial information says in any other case.

In the meantime, Bitcoin (BTC) is trying a restoration, reclaiming above the $111,000 threshold after exhibiting weak point earlier within the week.

Why Specialists Say Chopping Charges Now May Backfire

Sponsored

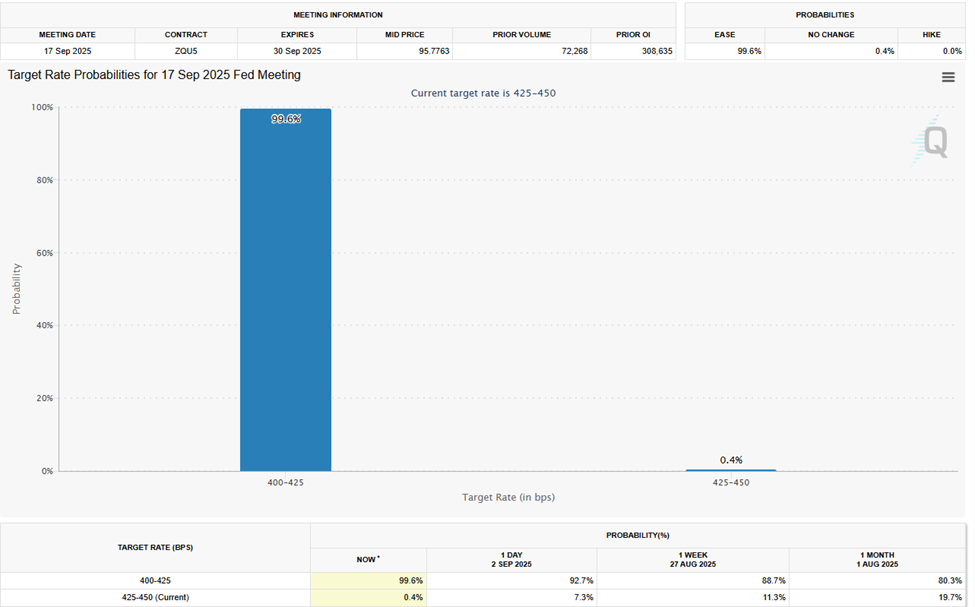

In line with the CME FedWatch Device, markets are pricing in a 99.6% likelihood that the Fed will lower charges at its September assembly.

With barely two weeks to the subsequent FOMC assembly, merchants deal with easing as a close to certainty. They guess a softer coverage stance will ignite one other spherical of liquidity-driven asset rallies.

Nonetheless, analysts warn that this consensus rests extra on sentiment surveys than on precise financial fundamentals.

Onerous Information vs. Smooth Narratives

Justin D’Ercole, founder and CIO at ISO-MTS Capital Administration, advised TradFi media that the exhausting information alerts the Fed shouldn’t lower charges.

Sponsored

He argued that policymakers threat being swayed by a false narrative arising from smooth financial surveys.

D’Ercole famous that these surveys solely replicate client frustration with excessive costs however fail to seize the broader power of the economic system.

“The economic system is rising at potential, inventory valuations are excessive, inflation is operating at 3%, and unemployment stays traditionally low,” The Monetary Instances reported, citing D’Ercole.

He added that out there mixture labor revenue is rising at a 4–5% tempo, whereas bank card delinquencies are down yr over yr. Even industrial actual property, typically painted as a looming disaster, exhibits enhancing asset high quality and decrease mortgage delinquencies.

Markets Need Cuts, However Information Says In any other case Amid 2024 Echoes

Sponsored

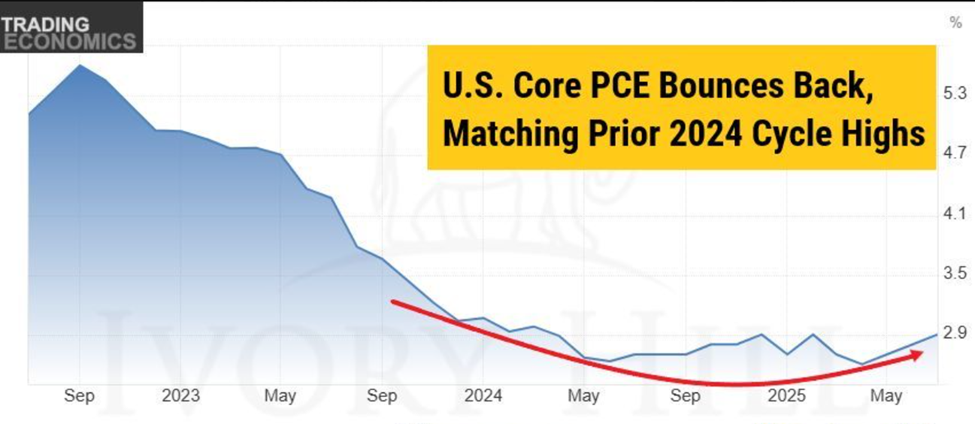

Elsewhere, Kurt S. Altrichter, founding father of Ivory Hill, echoed the sentiment. In a latest submit on X (Twitter), he referred to the PCE (Private Consumption Expenditure) inflation information.

“Core PCE is again at 2.9%. Inflation isn’t useless, it’s re-accelerating. GDP simply printed 3.3%. That’s not a backdrop for charge cuts. If the Fed forces the lower by means of, it’s possible the one lower earlier than Powell’s time period ends on Could 15, 2026. Keep in mind: the market desires a rate-cutting cycle. The info says no,” Altrichter articulated.

Altrichter argued that the danger is that the Fed will cave to market stress on the expense of its long-term credibility in its inflation combat.

Different observers warn of monetary market instability if the Fed repeats the 2024 playbook. Impartial analyst Ted in contrast the present setup to September 2024.

Sponsored

A shock rate of interest lower final yr initially drove crypto markets increased earlier than triggering a pointy reversal.

“September 2024 Fed lower charges, and #Altcoin MCap pumped 109% in simply 3 months. After that, $BTC dumped 30%, whereas alts crashed 60%-80%. In September 2025, the Fed will lower charges once more and decide to extra cuts. It looks as if historical past will repeat itself. First, a pump for 1–2 months after which a significant crash,” wrote Ted.

Sponsored

The broader debate boils right down to credibility versus aid. Chopping charges could quickly ease stress on indebted households and companies. Nonetheless, critics argue it dangers fueling inflationary pressures, asset bubbles, and long-term instability.

“Is saving extra marginal jobs within the US economic system now extra essential than sustaining inflation-fighting credibility and monetary stability for all shoppers?” D’Ercole posed.

With markets already celebrating a lower but to occur, the Fed faces one in every of its hardest coverage exams in a long time, deciding whether or not to observe the information or the gang.