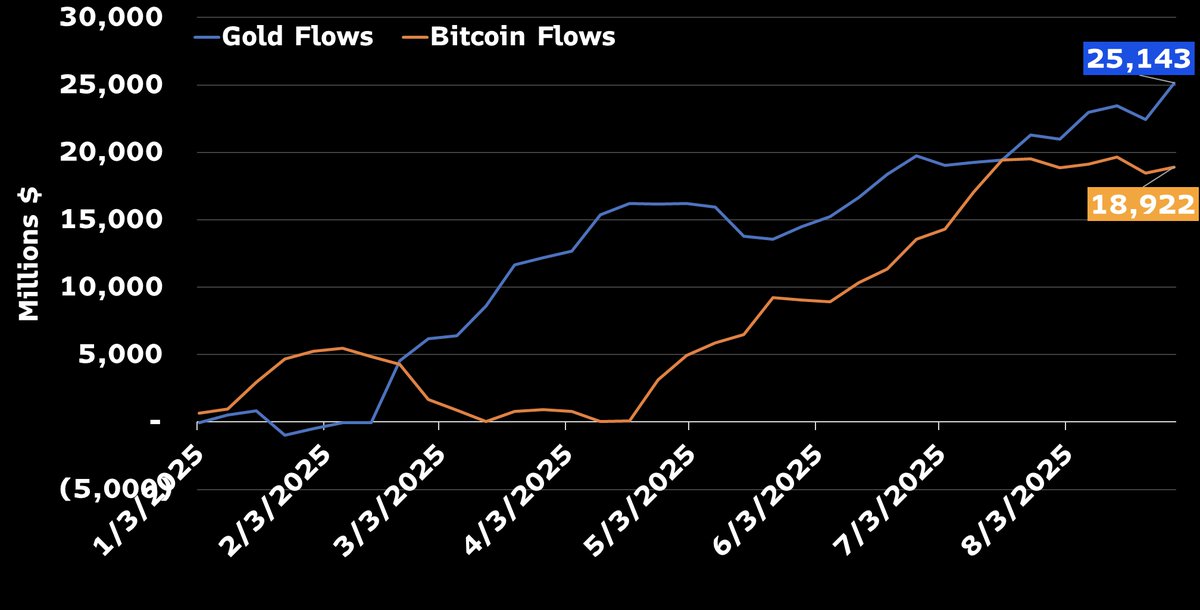

Gold funds are again within the highlight, pulling forward of Bitcoin ETFs in cumulative inflows after a summer season rally reshaped the leaderboard.

Information from Bloomberg’s Eric Balchunas exhibits that gold ETFs now maintain roughly $25.1 billion in internet inflows, in contrast with $18.9 billion for Bitcoin-linked funds.

The 12 months started with Bitcoin dominating flows, briefly overtaking gold earlier in 2025. However the momentum has shifted once more, with conventional safe-haven demand serving to bullion-linked merchandise reclaim the highest spot. Analysts be aware that whereas crypto ETFs stay robust performers, the battle for dominance underscores the cyclical nature of investor urge for food.

I don’t suppose I’ve ever seen an OG ETF and its Mini-Me (a less expensive model of identical factor aimed toward advisors) because the #1 and #2 on any stream leaderboard ever however that’s what occurred at present as $GLD and $GLDM holding prime 2 spots in 1W flows. Gold is as sizzling as you may get rn. pic.twitter.com/V4Zikf8cPt

— Eric Balchunas (@EricBalchunas) September 4, 2025

Including gas to gold’s momentum, the SPDR Gold Shares (GLD) and its low-cost counterpart GLDM captured the highest two positions in one-week ETF flows, an uncommon pairing for a flagship fund and its low cost model. Mixed, the merchandise introduced in additional than $4 billion in recent property over the previous week, a uncommon feat within the ETF world.

Nonetheless, Bitcoin ETFs are removed from completed. With practically $19 billion in cumulative flows, they continue to be among the many fastest-growing classes ever launched. Balchunas maintains that crypto funds might in the end triple gold’s totals – although he cautions that such development will take time, not occur in a single day.