The US labor market despatched shockwaves by Wall Road, with Bitcoin (BTC) transferring in response.

Information exhibits that the August jobs report delivered the weakest payroll good points since 2021, elevating alarms concerning the well being of the US financial system whereas fueling contemporary demand for different property like crypto.

Bitcoin Positive aspects as Traders React to Cracks within the US Employment Image

Sponsored

Sponsored

The US Bureau of Labor Statistics (BLS) reported that the financial system added solely 22,000 jobs in August, far under forecasts of 75,000.

In the meantime, the unemployment price climbed to 4.3%, its highest since October 2021. This highlights cracks in a labor market that had beforehand appeared resilient.

Revisions to previous stories deepened the gloom, with June and July figures revised down by a mixed 285,000 jobs.

“That’s a complete of -285,000 jobs in 2 months. What is occurring right here?” analysts posed.

Heather Lengthy of The Washington Publish highlighted the August print as one other weak jobs report. Nonetheless, whereas wages rose 3.7% year-on-year (YoY), outpacing inflation at 2.7%, the broader slowdown is plain.

The deterioration comes with placing element. Bloomberg reported that American firms introduced simply 1,494 new jobs in August, the bottom for that month since 2009. In the meantime, layoffs surged 39% to 85,979.

Sponsored

Sponsored

Much more regarding, for the primary time since April 2021, the variety of unemployed People surpassed obtainable job openings.

July knowledge confirmed 7.18 million job openings towards 7.24 million unemployed folks.

Weak Jobs Information Reinforces Bitcoin’s Function as a Macro Hedge

With simple job good points not on the desk, analysts level to a number of causes. Amongst them is Trump’s tariffs dampening enterprise confidence.

Sponsored

Sponsored

Others additionally level to the disruptive position of synthetic intelligence (AI) in reshaping the employment market.

However, markets reacted shortly, with Bitcoin climbing towards $113,000, amid an tried restoration rally. As of this writing, BTC was buying and selling for $112,974, up by over 2% within the final 24 hours.

The surge comes as US labor market knowledge grows as an important macro for Bitcoin. The pioneer crypto’s attractiveness as a substitute asset is gaining traction, presenting as a hedge towards weakening macroeconomic fundamentals.

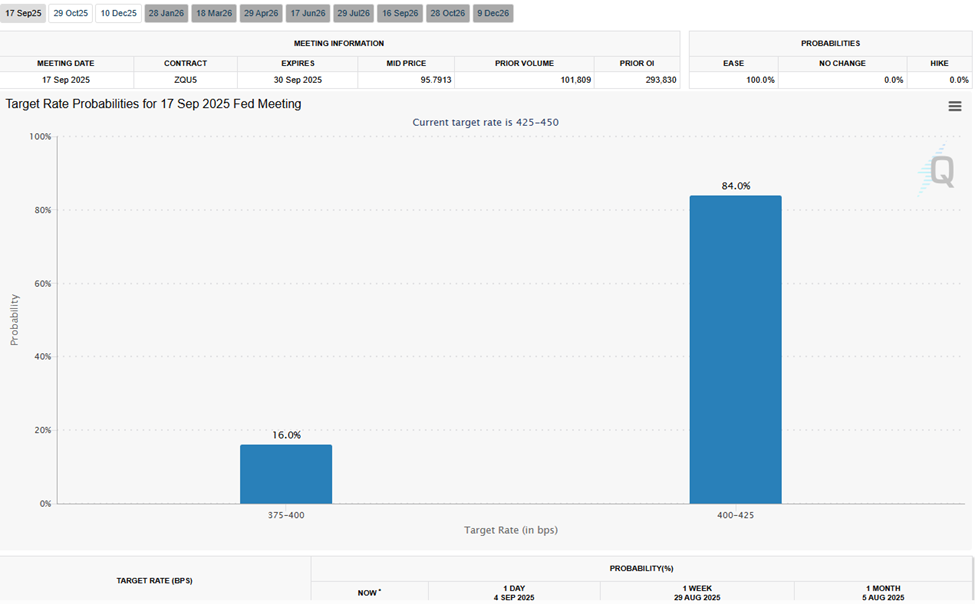

The divergence between jobs and inflation complicates the image. Wage progress stays regular, however the slowdown in hiring means that the Fed faces a troublesome balancing act forward of its September coverage assembly.

Sponsored

Sponsored

Price expectations are shifting quick, but the underlying theme is that financial momentum is faltering, and traders are looking for security in locations far past the roles market.

Financial institution of America now tasks the Fed to chop rates of interest twice this 12 months. This can be a vital revision after it predicted no price cuts in 2025.

Sponsored

Sponsored

With layoffs accelerating, job creation stalling, and unemployment rising, the August jobs report highlights a turning level for the US financial system.

Nonetheless, that is one more alternative for Bitcoin as a worldwide barometer of worry, threat, and resilience.