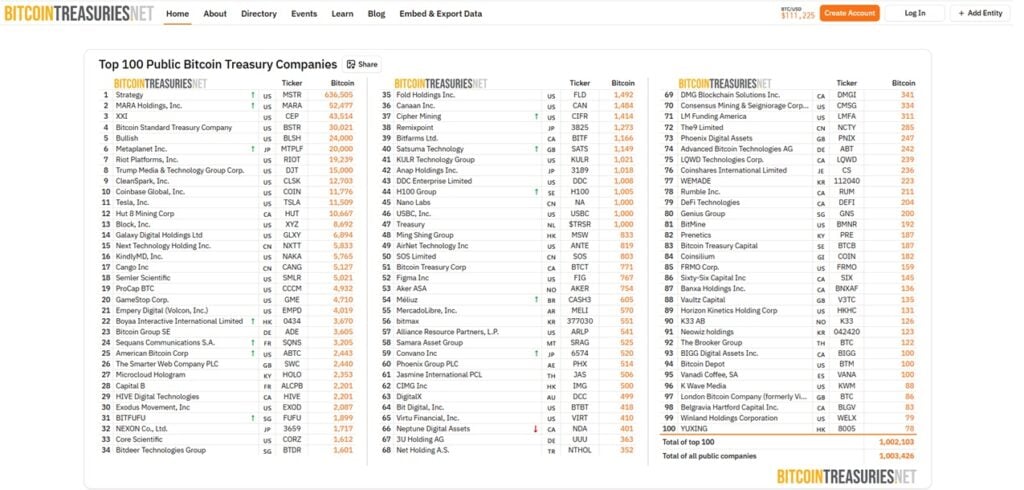

Public firms now maintain a mixed 1,003,426 Bitcoin, equal to about 5% of the full provide. This isn’t simply an fascinating statistic. It marks a serious shift in the way forward for finance.

For years, Bitcoin was primarily within the arms of particular person traders and tech fanatics. Right this moment, the image could be very completely different as main companies and even nations add Bitcoin to their steadiness sheets and reserves.

This wave of institutional adoption has been an enormous driver behind Bitcoin’s relentless upward momentum. Forecasts differ, with some calling for Bitcoin to succeed in $135,000 and even $190,000, whereas probably the most bullish outlooks counsel it may climb to $1 million per BTC.

This rising optimism can be shining a highlight on BTC-related tasks. One standout is Bitcoin Hyper (HYPER), a brand new meme coin presale that many see as the subsequent crypto to blow up.

Supply – Cryptonews YouTube Channel

Company Demand Drives Bitcoin Towards New Highs

Companies already management 5% of the full Bitcoin provide, leaving solely 95% out there. The truth is even tighter as a result of long-term holders hold massive quantities off the market, lowering what merchants and new consumers can entry.

If firms hold shopping for on the identical tempo, the affect might be dramatic. Think about company holdings doubling to 10% within the subsequent 5 years.

The availability out there to everybody else would shrink sharply, pushing demand larger and sure driving costs upward. This supply-and-demand dynamic explains why many imagine Bitcoin’s peak continues to be far forward.

Critics argue that firms will finally promote for revenue, however that view misses the larger image. Bitcoin isn’t simply one other speculative asset. Its fastened provide and decentralized design make it a hedge in opposition to inflation and a dependable retailer of worth outdoors authorities management.

That’s why leaders in finance and tech proceed to embrace it. Tim Draper even stated it’s changing into “irresponsible to not personal Bitcoin.”

Bloomberg additionally reported that Michael Saylor’s Bitcoin technique now qualifies for inclusion within the S&P 500, which may deliver Bitcoin to a fair bigger pool of institutional traders.

The bullish information retains piling up. American Bitcoin, a mining firm, just lately introduced plans to boost $2.1 billion by share gross sales to purchase extra Bitcoin and mining tools. Strikes like this present company adoption accelerating at full pace.

As extra firms and nations bounce in, Bitcoin’s shortage will intensify, probably driving its worth a lot larger. Even at at present’s worth of round $111,000, many analysts nonetheless contemplate Bitcoin undervalued.

Max Keiser warned that the US debt disaster may push Bitcoin past $2 million, with $1 million per coin seen as conservative fairly than excessive.

In the meantime, analysts on X are watching worth motion carefully. Ted just lately highlighted two sharp corrections: a 32.21% drop earlier in 2025 and a present setup hinting at a doable 30.67% pullback.

He paired each charts with Michael Saylor’s well-known line, “volatility is a present to the devoted,” sparking debate about whether or not Bitcoin will retest help earlier than resuming its climb.

The surge of company cash flowing into Bitcoin marks a turning level. Finance is remodeling, and sensible cash already sees the writing on the wall. This shift additionally highlights the seek for Layer-2 options to resolve Bitcoin’s transaction challenges.

Rising Institutional Demand for BTC Alerts the Subsequent Crypto to Explode

Even with Bitcoin’s latest dip, a brand new venture, Bitcoin Hyper (HYPER), is gaining traction. It goals to show Bitcoin from easy “digital gold” right into a platform for next-generation monetary purposes.

Bitcoin Hyper will run its upcoming Layer 2 (L2) community on prime of Bitcoin so as to add scalability and programmability. Early traders have already poured over $14 million into the presale, elevating about $800,000 every week.

Many deal with Bitcoin as only a retailer of worth as a result of its community can not help scalable apps like Solana. Bitcoin Hyper adjustments that through the use of Solana Digital Machine (SVM) know-how.

SVM lets Web3 builders run scalable sensible contracts on Bitcoin and transfer present Solana tasks to Bitcoin Hyper. This setup may host a variety of tasks, together with DeFi protocols, dApps, and NFTs, making Bitcoin a key asset in a vibrant, app-driven financial system.

Customers convert BTC right into a wrapped model by Bitcoin Hyper’s Canonical Bridge. The bridge locks the unique BTC and mints an equal quantity on the Layer 2 community, letting customers entry Web3 options akin to DeFi lending, staking, NFT gathering, and extra.

Consultants akin to Jacob Crypto Bury predict large beneficial properties for $HYPER, citing its early momentum and the community it’s going to energy.

The presale presently costs $HYPER at $0.012865, and the worth rises with every stage till it reaches its itemizing worth. The venture additionally provides a 78% staking APY, permitting traders to develop their token holdings over time.

Buyers can purchase and stake $HYPER with ETH, SOL, USDT, USDC, or a financial institution card by the presale web site or Greatest Pockets’s “Upcoming Tokens” characteristic. Sturdy demand may finish the presale early, so newcomers ought to act shortly to safe their spot.

Go to Bitcoin Hyper

This text has been supplied by one in every of our industrial companions and doesn’t replicate Cryptonomist’s opinion. Please remember our industrial companions could use affiliate packages to generate revenues by the hyperlinks on this text.