Company treasuries are holding extra Bitcoin than ever, however the newest CryptoQuant knowledge exhibits cracks beneath the document.

As of August 2025, publicly listed treasury firms now management 840,000 BTC, with Michael Saylor’s Technique main the cost at 637,000 BTC. Regardless of this milestone, the tempo of accumulation has slowed sharply, elevating questions on institutional urge for food.

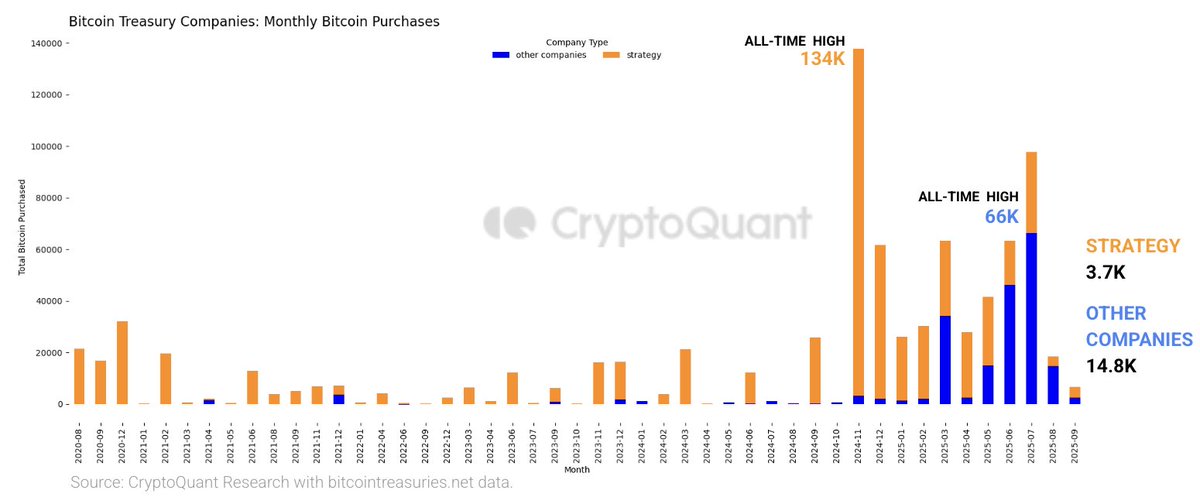

On the headline degree, August marked document holdings. But Technique’s month-to-month purchases collapsed from 134,000 BTC in November 2024 to simply 3,700 BTC in August 2025. Different firms added 14,800 BTC, additionally far under early-year ranges. Transactions stay active-53 purchases had been logged in June, however the measurement of every purchase has fallen to multi-year lows. The typical transaction dropped to 1,200 BTC for Technique and 343 BTC for others, an 86% plunge from early 2025 highs.

This shift suggests establishments should not pulling again solely however are shopping for extra cautiously, maybe ready for readability on market path and regulatory alerts. The slowdown is very notable given the backdrop: U.S. spot Bitcoin ETFs launched in late 2024, and Trump’s election win earlier this 12 months added momentum to company adoption.

Even with cautious positioning, the broader pattern stays clear-corporations proceed to deal with Bitcoin as a treasury asset. The problem is that development is slowing simply as Bitcoin hovers close to cycle highs. If demand doesn’t choose up, it might mood bullish expectations constructed on the concept of infinite institutional inflows.

For now, Bitcoin’s company treasuries mirror a paradox: document possession on paper, however waning enthusiasm in follow. The approaching months will present whether or not that is merely a pause earlier than one other wave of accumulation-or the primary signal that huge consumers are reaching their limits.

Supply