- Bitcoin holds close to $111K whereas gold hits report highs above $3,500.

- Fed anticipated to chop charges in September, however lengthy easing cycles look unlikely.

- BTC dominance robust at 60%, reinforcing its position as a market anchor.

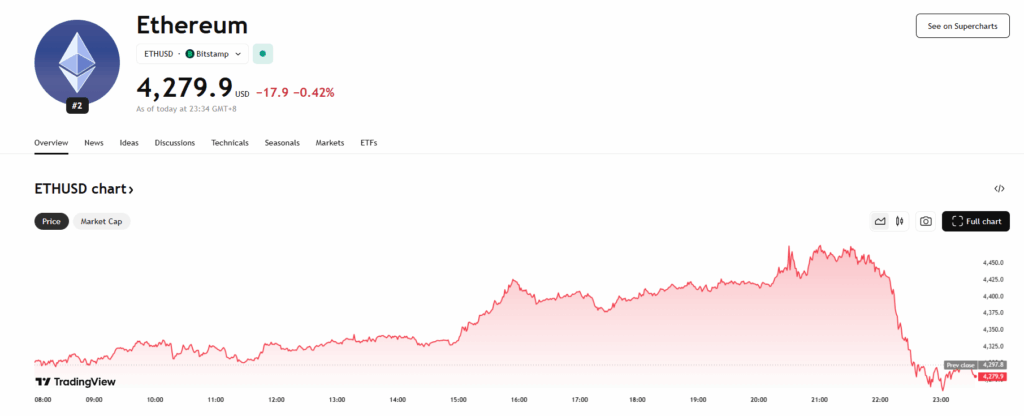

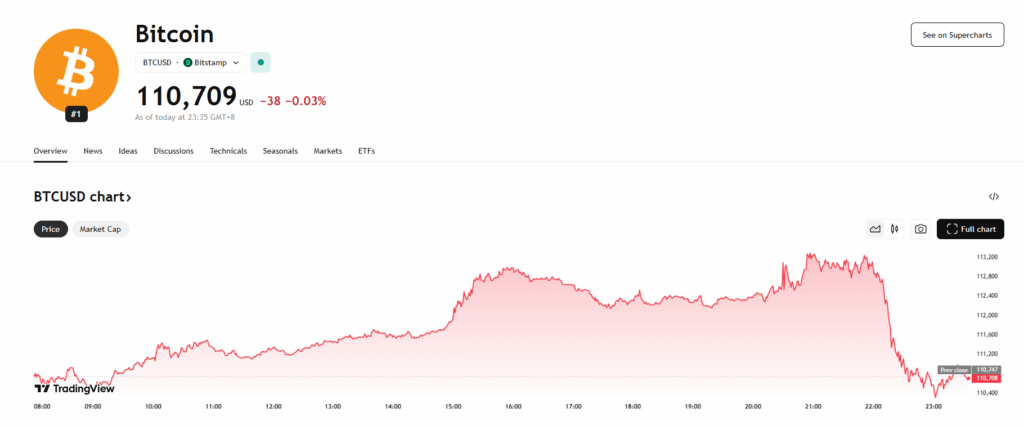

Bitcoin (BTC) managed to maintain its footing round $111,600 on Friday morning, exhibiting resilience whereas international markets felt the burden of shaky U.S. labor knowledge and contemporary Fed uncertainty. Ether (ETH) slid barely by 0.7% to $4,330, Solana (SOL) ticked increased by 1.3% above $204, and XRP (XRP) hovered flat close to $2.81—although nonetheless up greater than 3% for the week.

The week’s tone has been set by U.S. financial indicators. All eyes are on Friday’s jobs report, anticipated to point out unemployment climbing—pushing merchants to lean on bets for a September fee minimize. However right here’s the catch: markets aren’t anticipating a deep easing cycle this time.

Gold Soars, Fed Retains Merchants Guessing

Gold costs ripped to contemporary highs above $3,500 an oz. earlier this week, underscoring investor urge for food for secure havens. That surge solely sharpened comparisons between gold and Bitcoin as onerous shops of worth.

Jeff Mei, COO at BTSE, summed up the sentiment: “Sure, excessive unemployment factors towards cuts, however the Fed gained’t go overboard. They concern including an excessive amount of liquidity and reigniting inflation. That’s why gold is hovering whereas crypto and shares take a success.”

Bitcoin Narrative Retains Evolving

Bitcoin’s story isn’t simply hypothesis anymore—it’s shifting towards legitimacy. “Bitcoin has matured past a speculative commerce. It’s more and more acknowledged as a hedge in opposition to foreign money debasement, fiscal instability, and even geopolitical danger,” mentioned Vikrant Sharma, CEO of Cake Pockets.

He added that volatility is tamer than earlier than, although not gone. “Durations of calm typically come earlier than large strikes. A $100,000 flooring makes Bitcoin really feel much less like a high-risk gamble and extra like a world reserve asset within the making,” Sharma defined.

Dominance Holds Regardless of Volatility

Regardless of uneven buying and selling, Bitcoin’s dominance stays round 60% of your entire crypto market cap. That stability helps offset the sharp swings seen in altcoins. “Bitcoin’s solely dropped 3% by way of current volatility, but dominance is agency at 60%,” mentioned Nassar Achkar, Chief Technique Officer at CoinW.

He added that upcoming Fed strikes, ETF adoption, and tokenization proceed to offer stable help—however merchants ought to nonetheless brace for sudden policy-driven swings. September traditionally tends to be crypto’s weakest month, which solely provides extra warning to the combo.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.