Good Morning, Asia. Here is what’s making information within the markets:

Welcome to Asia Morning Briefing, a day by day abstract of high tales throughout U.S. hours and an outline of market strikes and evaluation. For an in depth overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

Bitcoin treasury corporations are dealing with a easy however brutal take a look at: can they outperform BTC itself, or ought to buyers skip them and purchase the asset outright?

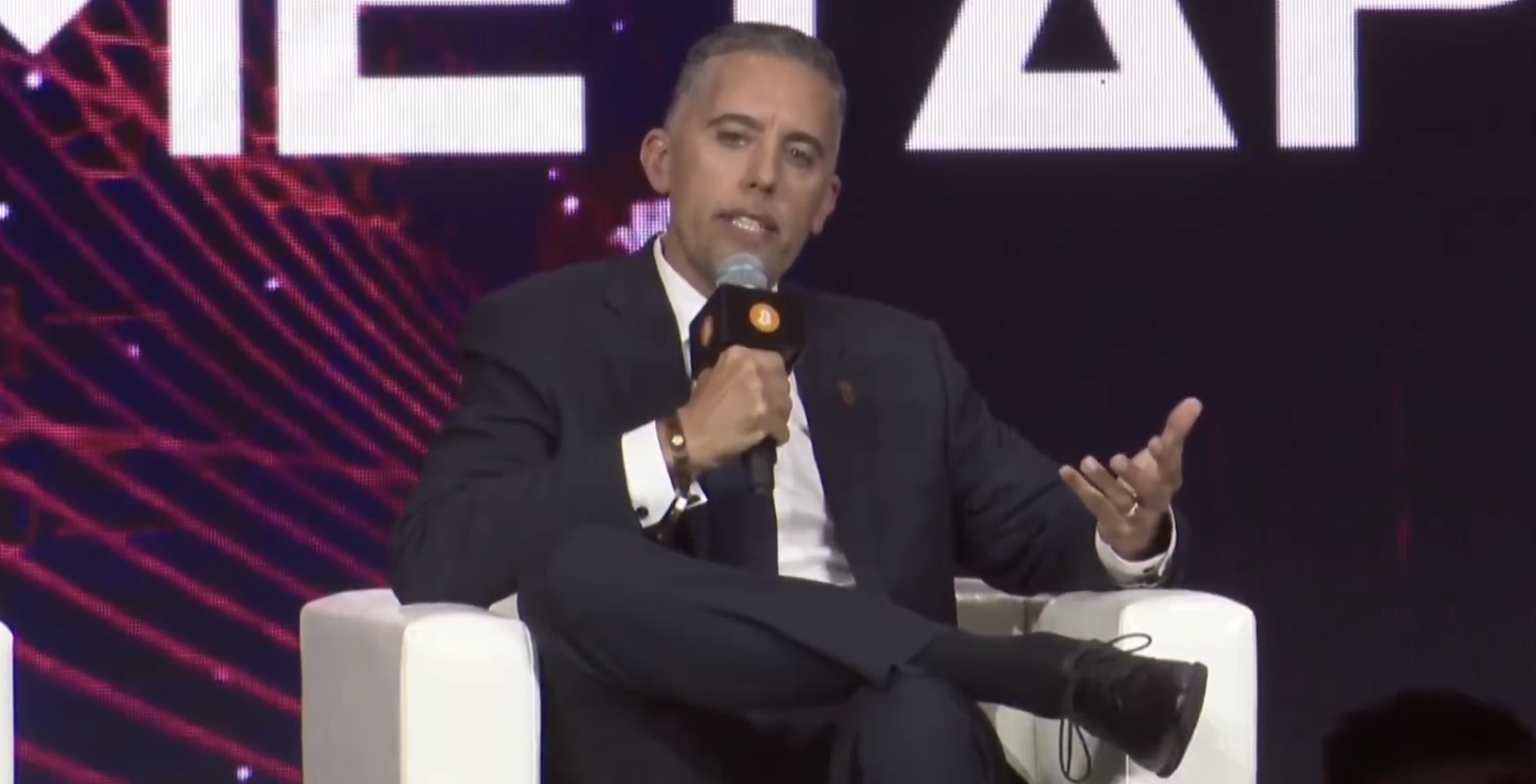

“In the event you aren’t doing that, there’s no purpose to do the methods, simply purchase a Bitcoin ETF,” stated Matt Cole, CEO of Attempt Asset Administration, throughout a panel at BTC Asia in Hong Kong.

Cole may be finest identified for being a staunch advocate of GameStop placing BTC on its stability sheet.

On stage, Cole described the playbook as a seek for alpha, discovering methods to outperform BTC with out merely piling on bitcoin-specific danger. Cole defined that this comes all the way down to financing, the place he pointed to a shift from convertibles to perpetual most popular fairness as a method to lock in leverage.

He added that the toughest milestone is scale: reaching $1 billion in capital, the purpose the place financing turns into low-cost sufficient to assist IPOs and greater groups.

“The toughest factor to do for bitcoin treasury corporations is attending to a billion {dollars},” he stated, citing MicroStrategy’s Michael Saylor.

That scale, Cole confused, solely works with bitcoin. Ethereum and different tokens, he stated, act an excessive amount of like equities with shifting financial insurance policies.

“Ethereum makes for a horrible asset for a treasury firm,” Cole stated. “Bitcoin perpetually goes up versus fiat currencies as a result of they’re being debased.”

In his view, BTC’s fastened provide makes it the one asset able to supporting a levered treasury technique designed to compound over time.

Andrew Webley of The Smarter Net Firm, a publicly listed U.Okay. net designer with BTC on the stability sheet, struck a extra measured tone concerning market NAV, Bitcoin yield versus dilution, and firm measurement.

Smaller corporations, he stated, have a bonus in elevating capital, however transparency and clear danger communication stay simply as necessary as the maths.

“A very powerful factor that you are able to do as a public firm, for my part, is to publish our guidelines first,” Webley stated, including that clear disclosure helps buyers perceive the trade-offs of a BTC treasury mannequin.

“If anyone can perceive the dangers, then in our opinion these items are the perfect worth alternatives in the entire world,” he added.

The break up underscored the selection dealing with buyers: spend money on corporations pursuing aggressive methods to outperform BTC or favor corporations that promise regular development with clear transparency.

Both manner, panelists agreed that bitcoin’s position as a treasury asset is just increasing as fiat continues to be debased.

Market Motion:

BTC: Bitcoin is buying and selling above $110,500, buying and selling barely decrease following a minor pullback, although indicators of accumulation, resembling resilient demand close to key assist, recommend market individuals stay bullish on its subsequent breakout, in line with CoinDesk’s market insights bot.

ETH: ETH is buying and selling at $4300, down 0.6%. ETH continues to profit from sturdy institutional curiosity and ETF inflows, which assist its longer-term structural upside.

Gold: Gold continues to commerce close to report highs supported by price‑minimize expectations and rising safe-haven demand, although it noticed a slight pullback amid revenue‑taking.

Nikkei 225: Japan’s largest index continues to rally, buoyed by a mixture of sturdy international shopping for, pushed by the nation’s shift away from lengthy‑time period stimulus, company reforms, and rising yields, and dovish financial cues from the U.S., boosting world fairness sentiment.

S&P 500: The S&P 500 rose 0.83% to a report 6,502.08 as merchants shrugged off weak non-public jobs knowledge whereas awaiting Friday’s employment report for clues on rate-cut prospects and recession dangers.

Elsewhere in Crypto:

- World Liberty Monetary Blacklists Justin Solar’s Tackle With $107M WLFI (CoinDesk)

- SEC Goes All In on Professional-Crypto Agenda With Slew of Digital Asset Rulemakings (Decrypt)

- NFL Opener Attracts $600K on Polymarket as Platform Targets $107B Sports activities Betting Business (CoinDesk)