Be part of Our Telegram channel to remain updated on breaking information protection

Ondo Finance has launched tokenized entry to over 100 US shares and ETFs in a landmark push for `Wall Avenue 2.0’ forward of a Federal Reserve convention on funds innovation and tokenization.

The Ondo International Markets platform is obtainable to eligible Asia-Pacific, European, African, and Latin American traders, and permits customers to mint and redeem tokenized US inventory and ETFs.

These digital representations are backed 1:1 by the real-world property (RWAs) held at a number of US-registered broker-dealers and money in transit, the undertaking mentioned in an announcement.

It’s immensely rewarding to see this method dwell after years of interested by its design. We’ve constructed on unbelievable know-how and distribution created by the group, and we’re proud to play our half in bettering international accessibility to monetary markets. https://t.co/a4zd3saycp

— Nathan Allman 🌊 (@nathanlallman) September 3, 2025

Main Crypto Platforms Accomplice With Ondo Finance To Energy Wall Avenue 2.0

The launch is being hailed as a landmark improvement for the Web3 business and the beginning of “Wall Avenue 2.0” as blockchain know-how slowly begins to combine itself into the normal monetary system.

With the launch, Ondo Finance has democratized entry to US shares and ETFs, giving traders outdoors of the US the power to simply achieve publicity to those funding alternatives. Constructed on the Ethereum blockchain, these tokenized merchandise are additionally tradable 24/7.

The mannequin of tokenizing RWAs has been tried and examined by stablecoins, which have proven a capability to take care of a direct peg to their underlying fiat reserves.

Now, with Ondo Finance’s new tokenized shares, traders is not going to solely be capable of earn dividends, however will even be capable of reinvest the dividends for doable compound curiosity.

That may doubtless appeal to traders who have already got stablecoin publicity, since stablecoin issuers are presently prohibited from instantly providing yields to traders within the US.

A number of main crypto wallets, exchanges, protocols and infrastructure suppliers have thrown their assist behind Ondo Finance’s tokenized shares. These embody OKX Pockets, Bitget Pockets, Belief Pockets, Gate, BitGo, Ledger, LayerZero, Morpho, 1inch, Chainlink and CoinMarketCap.

With these companions backing the launch, Ondo Finance has expressed plans to broaden the variety of funding choices to 1,000+ property by the tip of the 12 months. The platform additionally needs to increase to different blockchains together with Solana and BNB Chain.

Whereas Ondo Finance’s launch of tokenized US shares and ETFs is seen as a watershed second for the Web3 house, dangers nonetheless stay. For one, traders is probably not shopping for the precise inventory by investing in these tokenized choices. The merchandise may additionally come beneath scrutiny from international regulators now that non-US traders can purchase in.

The 24/7 entry may additionally result in weaker value discovery and wider spreads when the first US market is closed. Regulators have already began displaying issues about skinny, liquid secondary markets for these merchandise.

Fed Prepares To Host Decentralized Finance And Funds Convention As RWAs’ Onchain Worth Hits ATH

The Ondo information comes because the Fed Reserve introduced that it’ll host a convention on funds innovation and tokenization on Oct. 21. that wunwell deliver collectively business consultants to debate “the right way to additional innovate and enhance the funds system.”

The occasion will characteristic a panel discussions on a number of facets of funds innovation, together with the tokenization of economic services, the convergence of decentralized and conventional finance, rising stablecoin use circumstances and enterprise fashions, in addition to the intersection of AI in funds.

The convention will even be livestreamed on the Fed’s web site.

“I sit up for inspecting the alternatives and challenges of recent applied sciences, bringing collectively concepts on the right way to enhance the protection and effectivity of funds, and listening to from these serving to to form the way forward for funds,” mentioned Fed Governor Christoper Waller in an announcement.

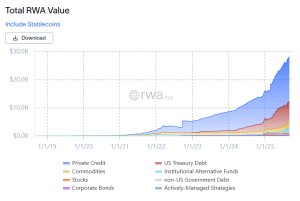

The Fed convention and Ondo Finance’s tokenized inventory launch comes as the worth of on-chain RWAs hits an all-time excessive (ATH) of $27.8 billion. Because the starting of the 12 months, the worth of those digital RWAs has soared 223% because the begin of the 12 months, knowledge from RWA.xyz exhibits.

Whole worth of digital RWAs (Supply: RWA.xyz)

The on-chain worth of the property has additionally jumped over 7% within the final thirty days. Throughout this era, the quantity of on-chain RWA asset holders has additionally spiked greater than 8% to 376,609 as of seven:25 a.m. EST.

Most of that worth is dominated by tokenized personal credit score and US Treasury debt. In the meantime, Ethereum stays the blockchain of selection for issuers of digital RWAs, with a 56% market share.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection