Very doubtless, the height of the cryptocurrency cycle — which began in November 2022 with the restoration post-FTX collapse — is shut. On the identical time, the approaching weeks may deliver some alternatives for getting cryptocurrency belongings, or no less than Bitcoin (BTC) and main altcoins.

Put up-halving peak is perhaps close to — subsequent one anticipated in late 2029

This fall of a post-halving 12 months is often thought of to be the height of Bitcoin (BTC) efficiency. Bitcoin (BTC) set its 2017 excessive in December — the 12 months after the 2016 halving. The scenario repeated itself in November 2021, when Bitcoin (BTC) reached its $69,000 high within the 12 months after the 2020 halving occasion.

The final Bitcoin (BTC) halving occurred in April 2024. Thus, This fall of 2025 will probably mark the highest of this Bitcoin (BTC) rally. Whereas there’s a main threat of “shopping for the highest,” the volatility within the peak phases of a bullish run may open up house for extra earnings alternatives.

Additionally, because the phase matures and its internet capitalization surges, the cycles are getting longer and longer. Ought to we assume that the height is available in Q1, 2026, it is perhaps value shopping for Bitcoin or Ethereum in September-December 2025. If not, the following cycle will certainly begin from the decline of crypto costs. Whereas the diminished charges open up extra profitable shopping for alternatives, those that purchase Bitcoin or Ethereum in 2026 might be pressured to carry till no less than late 2029.

In fact, all of those implications solely work for long-term holders. Alternatives for futures buying and selling might be accessible in each interval of present and upcoming cycles.

Establishments are coming for Ethereum (ETH): Worth discovery within the playing cards

What’s particular in regards to the present bullish rally of cryptocurrencies is that it’s actually pushed by establishments excited about gaining publicity to crypto worth volatility. Not like beforehand, institutional patrons — household workplaces, retirement funds, investing conglomerates, banks and TradFi VCs — don’t have to seek out unique methods to profit from crypto.

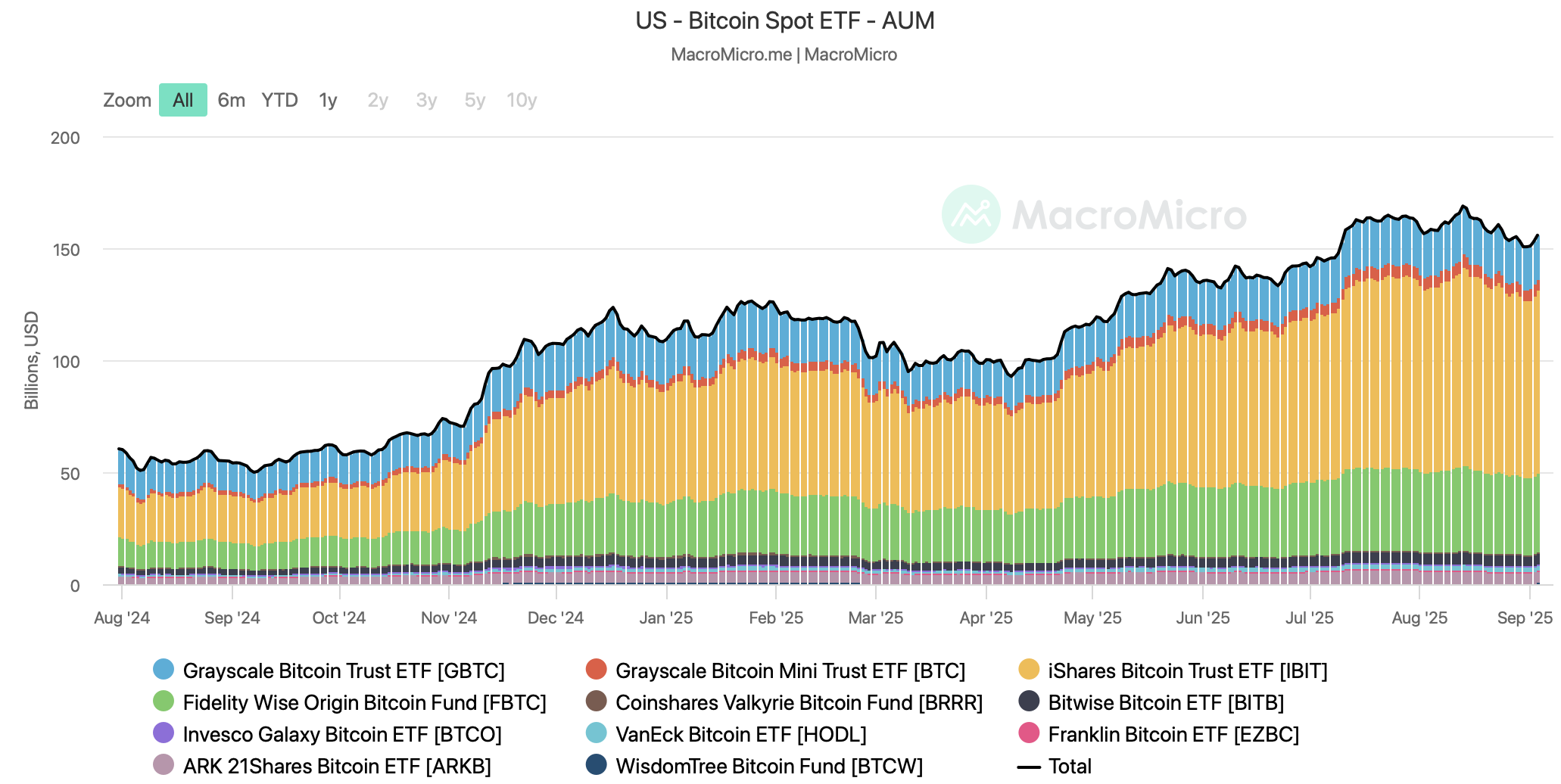

Throughout earlier cycles, they have been pressured to both purchase the shares of mining corporations or search off-shore devices in addition to OTC shopping for offers. In 2024, cryptocurrency spot ETFs within the U.S. arrived. In January 2024, 11 Bitcoin ETFs went stay within the U.S., whereas in July, they have been accompanied by Spot Ethereum ETFs. With these devices, large-scale traders now have dependable and safe strategies to profit from crypto buying and selling with out holding personal keys bodily.

This resulted in an enormous influx of liquidity into such merchandise. The cumulative quantity of Spot Bitcoin ETFs and Spot Ethereum ETFs as of press time is focusing on $200 billion. Whereas that is positively a landmark milestone for Web3 economics and the digital belongings phase as such, for normal merchants it would end in too-high costs.

Ought to the institutional influx speed up, with Spot ETFs and Digital Belongings Treasury corporations like Sharplink or ETHZilla siphoning an increasing number of liquidity, Ethereum (ETH) and Bitcoin (BTC) may skyrocket too excessive for bizarre customers. Merely put, you is perhaps excited about shopping for when you nonetheless should purchase.

Bitcoin (BTC) safety funds underneath strain; this is perhaps final huge cycle

Additionally, this cycle may truly be the final wherein we see the established order, with Bitcoin (BTC) dominating right here and there. As of press time, the Bitcoin (BTC) dominance price eyes 60%, even within the context of a decline registered in Q3, 2025.

Nevertheless, with the inception of quantum computer systems, Bitcoin’s (BTC) 21 million provide cap — one among its biggest long-term investing narratives — is perhaps destroyed. An increasing number of researchers are warning that if the Bitcoin (BTC) mining mechanism is altered by quantum computer systems, the asset is not going to be verifiably scarce any longer. Subsequently, its attractiveness to traders will fade.

Additionally, Bitcoin (BTC) is going through huge hassle on the subject of the so-called safety funds, i.e., to rewards for miners collaborating within the Bitcoin (BTC) financial system. As lined by U.As we speak beforehand, some analysts are certain that Bitcoin (BTC) is not going to be safe any extra in 2030.

Given these details, there are no less than three apparent causes to think about shopping for crypto in 2025.