It’s no information that institutional push is the core issue driving the Bitcoin value upwards, primarily making it, within the view of many, one of the best crypto to purchase now. Nonetheless, it comes as no shock that public firms now management over 1 million BTC. That is being thought-about a milestone in Bitcoin adoption, particularly since most public firms as soon as scoffed on the notion of being wherever close to the main digital asset.

With 1 million BTC below institutional management, it implies that 5% of Bitcoin’s complete provide rests with these massive gamers.

The place does this go away the retail investor then? Is a lot institutional hoarding good for the market?

MicroStrategy Leads because the Prime Establishment to Maintain Bitcoin

The largest institutional holder of BTC, because the market is already conscious, is MicroStrategy (previously Technique). At press time, it has amassed a complete of 636,505 BTC. The latest buy of over 4K BTC occurred on September 2, and MicroStrategy has achieved a BTC yield YTD of 25.7%.

In second place is MARA Holdings, which owns over 52K BTC and has purchased 702 BTC. Different institutional gamers placing their hats into Bitcoin embody Jack Mallers with over 43K BTC, adopted by Bitcoin Commonplace Treasury Firm, which holds above 30K BTC.

Bullish is one other establishment that has been very “bullish” about Bitcoin, as obvious from its holding of 24K BTC. Then there may be MetaPlanet, which has over 20K BTC.

Miners are Struggling As a result of Institutional Hegemony of BTC

Whereas institutional gamers have been a pivotal a part of pushing the BTC value to new highs, miners haven’t been in a position to make related ranges of features. Transaction charges, in accordance with CoinMetrics, have dropped to new lows, which has slashed miner income to an enormous diploma.

The reason being that profitability within the Bitcoin market is tied solely to cost appreciation, which suggests miners are going through excessive monetary strain.

Because of this, miners have began to step again. After the halving, miners have had a troublesome time staying within the inexperienced. In line with data posted on Coinlaw, the common value of mining 1 BTC is $17K, which has been a giant situation for small-time miners.

It has created an attention-grabbing ecosystem. Small-time miners and retail traders are discovering BTC unaffordable, whereas institutional gamers are taking part in their overly bullish hand to engineer a brief squeeze, resulting in what many worry is a discount of decentralization within the Bitcoin financial system.

This implies if these corporates begin to go bearish, the market would expertise heightened ranges of volatility, inflicting a steep drop within the BTC value. Moreover, the large company possession of Bitcoin is being carefully watched by regulators and policymakers, who might, in time, take measures to take care of the systemic danger it poses. This might dim adoption and weaken the only real issue presently shifting the BTC value up.

Is Bitcoin nonetheless one of the best crypto to purchase now? It relies upon available on the market context. For now, institutional gamers are giving the impression that they’d by no means go away BTC, no less than not till it reaches $1 million. This instills long-term bullishness within the token. Alternatively, retail traders now not management the BTC narrative, which suggests the BTC group doesn’t have a lot energy left.

On the time of writing, Bitcoin is buying and selling across the $110K degree, and its market cap is simply above $2.2 trillion.

Analysts’ views about BTC are additionally unfavourable. Crypto Birb not too long ago tweeted that the Bitcoin bull run will finish within the subsequent 50 days.

Bull run ends in 50 days.

Cycle Peak Countdown says BTC is 95% achieved (1,017 days in) as we bleed in typical Q3 shakeout.

Use this alpha playbook and retire wealthy.

(Thread)🧵 pic.twitter.com/rtCwKyJJec

— CRYPTO₿IRB (@crypto_birb) September 4, 2025

Greatest Crypto to Purchase Now Moreover Bitcoin

As Bitcoin is probably not one of the best crypto decide for many traders, a greater possibility might be discovered amongst crypto ICOs or tokens which have not too long ago made their solution to cryptocurrency exchanges.

Pepenode

The latest short-squeezing of Bitcoin pushed by institutional inflows has sidelined conventional miners, however the mining spirit stays alive by way of revolutionary alternate options. One such different is Pepenode, a undertaking that reimagines mining with a gamified, meme-coin-driven method somewhat than sticking to conventional hardware-heavy strategies.

Pepenode introduces a Mine-to-Earn ecosystem, the place customers can purchase Pepenodes and construct digital mining rigs. Presale traders take pleasure in a singular benefit, as they will improve their services to entry extra highly effective rigs, boosting their mining potential throughout the system.

Not like the pricey and complicated points of Bitcoin mining which aren’t producing a lot revenue as a result of emergence of halving, Pepenode simplifies the expertise and wraps it in a Pepe-inspired visible theme that resonates with the meme coin group.

The presale is much more participating due to off-chain mining mechanics, which is able to later shift to on-chain mining after the Token Era Occasion (TGE). This ensures that the digital rigs constructed throughout presale will carry over into the stay ecosystem.

On prime of this, Pepenode provides staking rewards upward of 2000% APY on the time of writing, giving contributors further incentive to lock in early.

Bitcoin Hyper

With over 1 million BTC now below the management of public establishments, retail traders danger getting the quick finish of the stick if the market turns downward. This has fueled curiosity in Bitcoin-themed property that stay accessible to most of the people, and Bitcoin Hyper is a stand-out asset on this class.

Bitcoin Hyper’s main purpose, in accordance with the official web site, is to take Bitcoin past hypothesis, whereas offering actual utility by way of scalability, interoperability, and enhanced safety. Its core use instances revolve round constructing a Bitcoin-equivalent ecosystem that’s each practical and rewarding for retail traders.

On prime of that, its meme-driven identification and Pepe-inspired imagery present short-term viral enchantment, whereas the long-term imaginative and prescient seeks to remodel Bitcoin into greater than only a retailer of worth.

To this point, Bitcoin Hyper’s presale has raised over $14 million, proving investor confidence in its mix of meme tradition and real utility.

Analysts have reviewed the undertaking positively, with 99Bitcoins even stating that it might be one of the best crypto to purchase proper now. This steadiness between accessibility, humor, and innovation offers Bitcoin Hyper the potential to rise as a robust low-cap different to BTC.

Maxi Doge

Dogecoin has managed to remain decentralized, in contrast to Bitcoin which might be pivoting towards centralization attributable to its heavy institutional backing. Whereas Dogecoin nonetheless holds worth, it has not delivered parabolic features lately, leaving area for alternate options to take the highlight.

One such undertaking is Maxi Doge, a meme coin that builds on Dogecoin’s legacy however provides a singular narrative for short-term merchants.

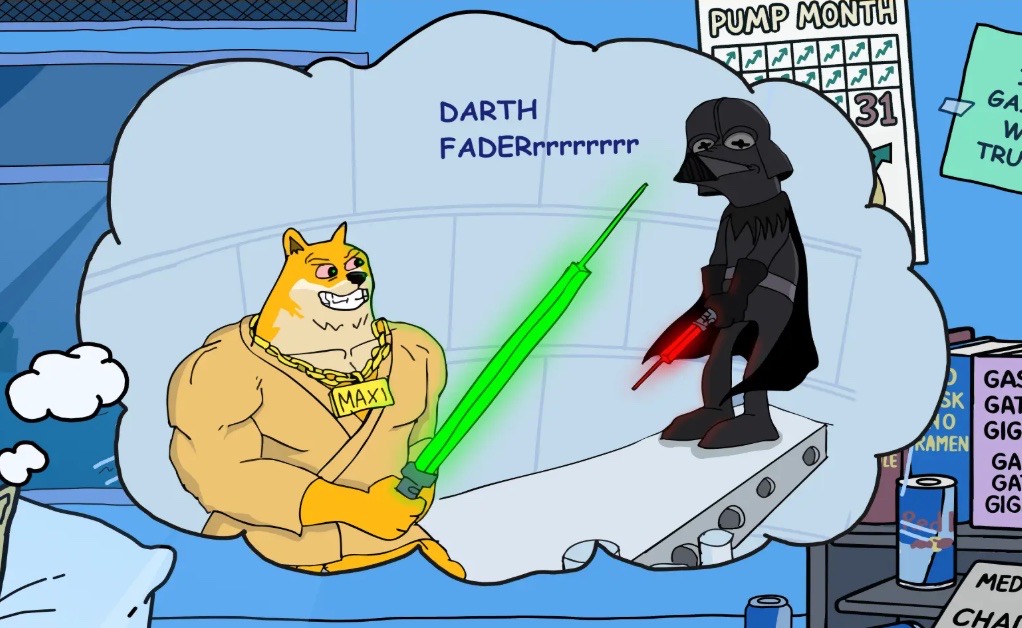

The imagery of Maxi Doge depicts a buff, gym-like Doge, equating bodily energy with monetary energy, an ideal metaphor for being “loaded” on crypto. Its distinctive GenZ-style humor matches effectively with in the present day’s cultural developments, even incorporating crossover memes like “Darth Fader.” This comedic however daring method resonates strongly with retail merchants searching for high-risk performs.

Past the memes, Maxi Doge can be constructing in direction of leverage buying and selling perks, aiming to supply customers exponential revenue potential by way of amplified buying and selling. This makes it one of many few meme cash brazenly embracing the degen spirit of volatility.

The undertaking has already raised over $1.8 million in its presale, displaying sturdy early help. Whereas it lacks deep utility, Maxi Doge positions itself as a pure meme coin that thrives on humor, relatability, and group, qualities that might maintain its momentum available in the market.

Conclusion

The huge institutional pull of Bitcoin has been a optimistic for the BTC value. Nonetheless, for miners and retail traders, it has not all been very optimistic. Due to this fact, these searching for one of the best crypto to purchase now ought to maintain a watch out for crypto ICOs and different low-cap picks, since they’ve extra room to develop.