Prime Tales of The Week

Banking giants now forecast no less than two rate of interest cuts in 2025

A number of monetary establishments and market analysts are actually projecting the US Federal Reserve, the nation’s central financial institution, will slash rates of interest from the present goal fee of 4.25%-4.5% no less than twice in 2025.

The banking forecasts adopted a weak August jobs report that noticed solely 22,000 jobs added for the month, versus expectations of about 75,000.

Analysts at Financial institution of America, a banking and monetary companies firm, reversed their long-held stance of no fee cuts in 2025 and are actually projecting two 25 foundation level (BPS) cuts — one in September and one other in December — in response to Bloomberg.

Economists at funding banking agency Goldman Sachs are projecting three 25 BPS cuts in 2025, starting in September and persevering with all through October and November.

Trump Media closes Crypto.com deal to construct $6.4B CRO treasury

Trump Media & Expertise Group, the father or mother firm of US President Donald Trump’s Fact Social platform, finalized an settlement with crypto alternate Crypto.com on Friday that establishes a brand new entity to build up the alternate’s native Cronos token, starting with an preliminary buy of 684.4 million CRO as a part of a joint treasury technique.

In a Friday discover, Trump Media stated it could purchase the tokens at a worth of roughly $0.153 every, bringing the whole preliminary buy to almost $105 million. The transaction will probably be carried out as an equal alternate of inventory and money between the businesses.

The announcement adopted Trump Media Group CRO Technique, a three way partnership established by Trump Media, Crypto.com and Yorkville Acquisition Corp., to determine a $6.4 billion crypto treasury of the CRO token.

In accordance with the corporate, the settlement will permit Fact Social customers to probably purchase CRO on the platform as a part of a rewards program.

Justin Solar urges Trump-linked WLFI to unlock ‘unreasonably’ frozen tokens

Tron founder Justin Solar is urging World Liberty Monetary (WLFI), a crypto mission linked to the Trump household, to unfreeze his token allocation. His wallets have been blacklisted after suspicious transactions flagged by blockchain trackers sparked accusations of promoting.

Solar’s WLFI token deal with was blacklisted on Thursday, after blockchain information from Nansen and Arkham flagged the deal with for a $9 million switch, Cointelegraph reported.

In a Friday response to the blacklisting, Solar stated his pre-sale tokens have been “unreasonably frozen,” urging the group behind World Liberty Monetary to unlock his funding, in respect to the ideas of decentralized blockchain know-how.

World Liberty’s determination to dam his tokens is a violation of investor rights and dangers “damaging broader confidence in World Liberty Monetary,” wrote Solar in an X submit.

Trump Jr.-linked media firm initiatives $100M Dogecoin mining haul

Trump family-linked media company Thumzup plans to accumulate 3,500 Dogecoin mining rigs and expects to herald as a lot as $103 million in annual income, relying on whether or not Dogecoin hits a greenback.

In a shareholder letter launched on Thursday, Thumzup Media Company revealed that it has executed definitive agreements, pending shareholder approval, to accumulate a Dogecoin mining operation with an preliminary 2,500 rigs and 1,000 extra ordered.

In August, the corporate stated it’s pivoting from an adtech platform to cryptocurrency mining via the pending acquisition of DogeHash Applied sciences, which operates the Dogecoin miners.

The mixed firm will probably be renamed Dogehash Applied sciences Holdings and commerce underneath the ticker XDOG. The agency reported the completion of a $50 million share providing in August.

‘Avoidable errors’ wiped a yr’s price of Gary Gensler’s texts… oops

A US Securities and Change Fee (SEC) investigation into lacking textual content messages from former SEC chair Gary Gensler’s telephone between October 2022 and September 2023 has concluded that “avoidable errors” led to their loss.

The SEC Workplace of Inspector Common (OIG) launched an inquiry into how practically a yr’s price of textual content messages from Gary Gensler have been completely misplaced between October 2022 and September 2023, in the course of the peak of the company’s crypto enforcement motion marketing campaign.

In a report launched on Wednesday, the OIG revealed that the SEC’s IT division “carried out a poorly understood and automatic coverage that precipitated an enterprise wipe of Gensler’s government-issued cellular gadget,” which deleted saved textual content messages and working system logs.

Learn additionally

Options

As Cash Printer Goes Brrrrr, Wall St Loses Its Worry of Bitcoin

Options

Loopy outcomes when present legal guidelines utilized to NFTs and the metaverse

The loss was worsened by poor change administration, lack of correct backups, ignored system alerts and unaddressed vendor software program flaws.

Winners and Losers

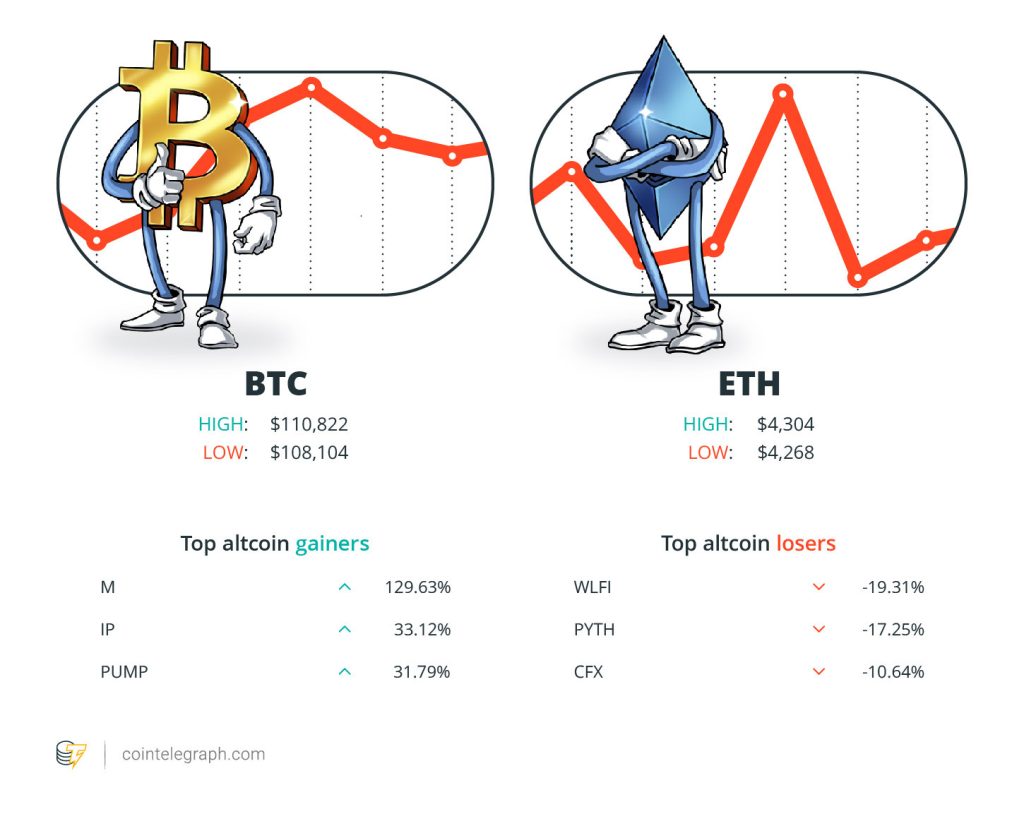

On the finish of the week, Bitcoin (BTC) is at $110,822, Ether (ETH) at $4,304 and XRP at $2.81. The whole market cap is at $3.81 trillion, in response to CoinMarketCap.

Among the many largest 100 cryptocurrencies, the highest three altcoin gainers of the week are MemeCore (M) at 129.63%, Story (IP) at 33.12% and Pump.enjoyable (PUMP) at 31.79%.

The highest three altcoin losers of the week are World Liberty Monetary (WLFI) at 19.31%, Pyth Community (PYTH) at 17.25% and Conflux (CFX) at 10.64%.

For more information on crypto costs, be certain that to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“What if, from right here on, Bitcoin merely slow-grinds up and to the correct, with lengthy, drawn-out, uneventful 10–30% corrections and consolidations?”

PlanC, pseudonymous Bitcoin analyst

“ETH will probably 100x from right here. Most likely far more.”

Joseph Lubin, CEO and founding father of Consensys

“Pokémon and different [trading card games] are about to have their ‘Polymarket second.”

Danny Nelson, analysis analyst at Bitwise Asset Supervisor

“The one purpose we’re not at $150k proper now could be two large whales.”

David Bailey, CEO of Nakamoto Holdings

“It’s a stark reminder of why crypto exists within the first place: if an middleman can unilaterally reduce you off from fundamental monetary companies for attempting to construct monetary independence, then the monetary system itself is essentially damaged.”

Jonathon Miller, managing director, Australia at Kraken

“My view is that it’s usually extra prudent to concentrate on elementary evaluation quite than counting on what can typically be spurious historic patterns.”

Henrik Andersson, chief funding officer at Apollo Crypto

Prime Prediction of The Week

BitMine buys $65M of ETH as chairman touts ‘1971 second’ for Ethereum

On Wednesday, BitMine chair Tom Lee appeared on the Stage Up podcast, the place he reaffirmed his stance that ETH will attain $60,000 in the long run.

Lee stated Wall Road’s curiosity in ETH would possibly grow to be a “1971 second,” which may propel the asset larger. The New York Inventory Market exploded on Aug. 17, 1971, setting information for quantity and single-day acquire as then-President Richard Nixon froze wages and costs for 90 days, together with different strikes to combat inflation and strengthen the greenback.

“Wall Road transferring onto crypto rails, I feel, is sort of a 1971 second for Ethereum. So I feel it’s creating huge alternatives to maneuver loads of issues onto the blockchain. And Ethereum received’t be simply the one winner, but it surely’s one of many main winners,” Lee informed Stage Up co-host David Grider.

Prime FUD of The Week

‘Too few guardrails,’ CFTC’s Johnson warns on prediction market dangers

Outgoing Commodity Futures Buying and selling Fee (CFTC) Commissioner Kristin N. Johnson warned that prediction markets pose rising dangers to retail traders. She cited a scarcity of oversight and regulatory readability as main considerations.

In her farewell public deal with on Wednesday, Johnson voiced concern that some market contributors are providing leveraged prediction market contracts to retail traders with out clear regulatory boundaries.

“As of right now, we’ve got too few guardrails and too little visibility into the prediction market panorama,” she stated in a farewell speech on the Brookings Establishment. “There may be an pressing want for the fee to specific in a transparent voice our expectations associated to those contracts,” she added.

Venus Protocol recovers person’s $13.5M stolen in phishing assault

Decentralized finance lending platform Venus Protocol helped a person recuperate stolen crypto following a phishing assault tied to North Korea’s Lazarus Group.

On Thursday, Venus Protocol introduced that it had helped a person recuperate $13.5 million in crypto after the phishing incident that occurred on Tuesday. On the time, Venus Protocol paused the platform as a precautionary measure and commenced investigating.

In accordance with Venus, the pause halted additional fund motion, whereas audits confirmed Venus’ sensible contracts and entrance finish have been uncompromised.

Learn additionally

Options

Proprietor of seven-trait CryptoPunk Seedphrase companions with Sotheby’s: NFT Collector

Options

Justin Aversano makes a quantum leap for NFT pictures

An emergency governance vote allowed the pressured liquidation of the attacker’s pockets, enabling stolen tokens to be seized and despatched to a restoration deal with.

Bitcoin bear market due in October with $50K backside goal: Evaluation

Bitcoin may have only one month earlier than the tip of a four-year cycle, triggering a $50,000 collapse.

New feedback from Joao Wedson, founder and CEO of crypto analytics platform Alphractal, additionally embody a $140,000 BTC worth goal.

Bitcoin faces a brand new reckoning because the bull market endures its newest 15% correction from all-time highs.

Amid misgivings over the longer term, Wedson sees the potential for a brand new bear market beginning as quickly as October.

Importing charts of its so-called “Repetition Fractal Cycle” to X, he confirmed that BTC/USD is approaching the time when bear markets traditionally take over.

Prime Journal Tales of The Week

ChatGPT’s hyperlinks to homicide, suicide and ‘unintentional jailbreaks’: AI Eye

Might making ChatGPT behave much less like a human be the reply to AI psychosis? Plus Geoffrey Hinton’s new answer to AGI alignment.

Korean invoice to legalize ICOs, Chinese language agency’s Ethereum RWAs thriller: Asia Categorical

Hong Kong regulators reportedly skeptical of Bitcoin treasury corporations. Chinese language state agency deletes posts on Ethereum RWAs, and extra.

Astrology may make you a greater crypto dealer: It has been foretold

Can monitoring the motion of celestial our bodies make you a greater crypto dealer? The reply may be sure, in some circumstances.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Editorial Employees

Cointelegraph Journal writers and reporters contributed to this text.