- Hyperliquid has proposed USDH, a local stablecoin pegged to the greenback, pending validator approval by on-chain voting.

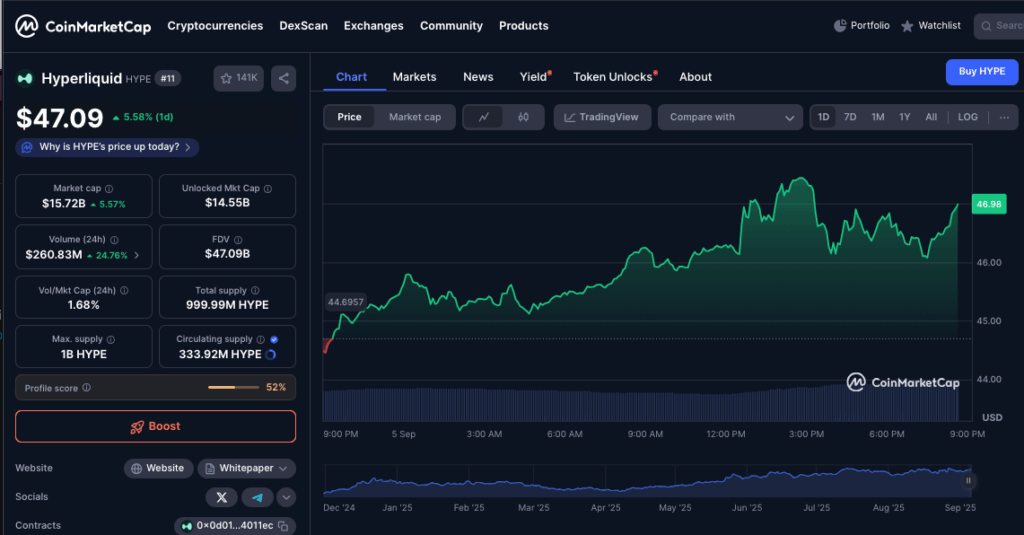

- HYPE token jumped 3.4% to $47 after the announcement, displaying robust market optimism regardless of no official itemizing but.

- The plan makes use of a dual-token stablecoin mannequin for transparency and comes alongside an 80% reduce in spot market charges plus new public spot quotes.

Hyperliquid is making waves once more—this time with plans to roll out USDH, its personal native dollar-pegged stablecoin. The catch? It’s not reside but. The proposal nonetheless wants validator approval by an on-chain vote, however the very point out of it was sufficient to ship the HYPE token up 3.4% in a single day, hitting $47. Merchants are clearly paying consideration, even when the stablecoin itself hasn’t formally landed on the positioning.

Governance First, Buying and selling Later

The change confirmed in Discord that the USDH rollout will solely transfer ahead if validators green-light the design and choose the event workforce. It’s the identical course of Hyperliquid makes use of for asset delistings, conserving selections anchored in neighborhood governance. For now, USDH hasn’t proven up on Hyperliquid’s homepage, however the market appears to be pricing in optimism anyway. Worth motion on September 5 reveals that HYPE bulls rapidly seized the narrative, pushing the token greater regardless of the dearth of concrete launch particulars.

Stablecoin Wars Warmth Up

The timing isn’t any coincidence. For the reason that Genius Act was signed into legislation again in July 2025, stablecoins have been on fireplace. USDC and USDT are hitting new provide data, Trump-backed WLFI rolled out USD1, and even JPMorgan jumped in with its personal JPMD token. Hyperliquid’s pitch? Give customers a decentralized stablecoin that’s extra clear than the massive guys.

They’re eyeing the dual-token mannequin pioneered by Tether co-founder Reeve Collins with STBL. That setup separates peg upkeep from yield era, with one token making certain stability whereas one other distributes yield on to customers. It’s a approach of creating reserve administration much less murky whereas giving holders extra management over returns. For traders nonetheless burned by algorithmic disasters of the previous, transparency is the true promoting level.

Charges Slashed, Transparency Boosted

Alongside the USDH proposal, Hyperliquid dropped a hefty protocol replace. Charges on dual-currency spot market pairs—maker, taker, and person—are set to fall by 80%. Public spot quotes are additionally going reside, bringing extra visibility to order books. Taken collectively, the updates underline Hyperliquid’s technique: preserve pushing for transparency, reduce prices for merchants, and construct new instruments that make decentralized markets really feel rather less just like the Wild West.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.