- Avalanche’s RWA market cap surged practically 58% in days, whereas stablecoin transfers jumped 6x in 3 months, fueling institutional consideration.

- AVAX worth is consolidating between $22–$26, holding bullish construction above the SuperTrend however dealing with weak momentum alerts.

- Futures quantity crossed $1B, with funding charges regular — hinting at whale exercise and a possible push again above $25.

Avalanche (AVAX) may lastly be catching that huge break it’s been ready on. The Layer 1 has been pulling extra eyes recently, not simply due to its worth strikes but in addition due to a pointy pickup in on-chain exercise. Two issues stand out because the gasoline right here: stablecoins and real-world belongings (RWAs).

RWA and Stablecoins Take Middle Stage

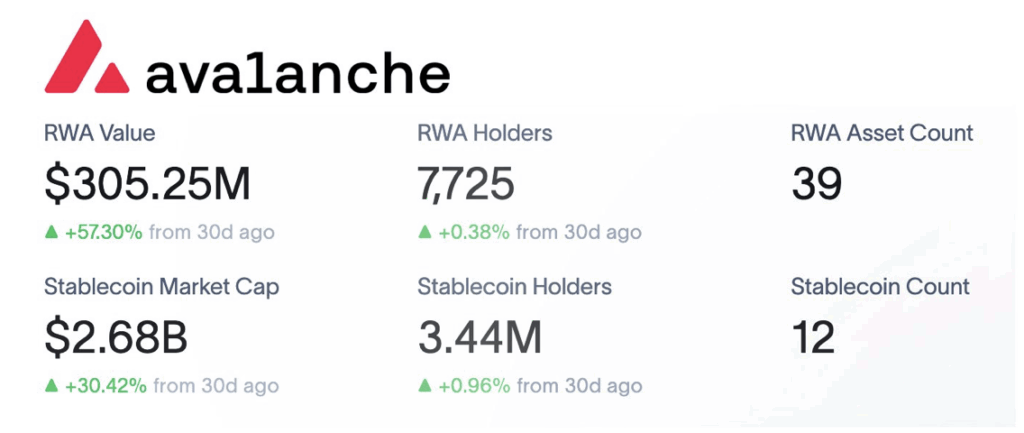

Contemporary knowledge on X confirmed that Avalanche’s RWA market cap ballooned practically 58% in just some days, now sitting round $305.25 million unfold throughout 39 devices. Holders additionally crept greater, climbing to about 7,725. That’s not mind-blowing progress, however it’s regular sufficient to point out traction.

Stablecoins advised an excellent louder story. Switch quantity shot up 6x over the previous three months, whereas their mixed market cap rose 30% in only a month. Holder depend hit 3.44 million — a severe base of exercise. Massive establishments like Franklin Templeton, Grove Finance, and Centrifuge are already circling the ecosystem, hinting that DeFi and TradFi is likely to be stitching nearer collectively on Avalanche than most anticipated.

Value Motion Stalls, However Construction Holds

AVAX itself has been making an attempt to maintain tempo. During the last 30 days, it’s up slightly below 10%. That mentioned, momentum feels prefer it’s cooling a bit. After rallying to $27 on July 28, the token has been caught in a sideways shuffle between $22 and $26.

Nonetheless, it’s not all gloomy. AVAX trades above the SuperTrend indicator, which normally alerts a bullish construction is undamaged. However right here’s the catch — momentum readings dipped into the unfavourable, sitting at –0.66. If patrons can defend the SuperTrend and push by resistance, AVAX might bounce above $25, a modest 5% acquire. On the flip aspect, failure at this degree dangers a slide underneath $23, possibly even testing $21 once more.

Futures Market Flashes Rising Curiosity

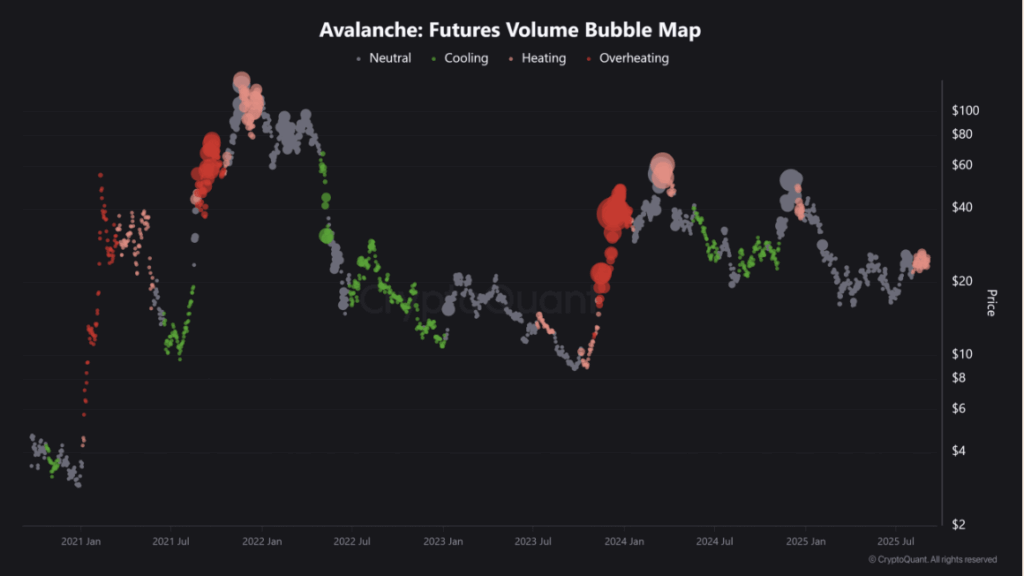

The place issues get extra fascinating is the Futures knowledge. Quantity has surged to round $1.018 billion, and Bubble Map visuals present that huge positions are forming. This usually hints at whales stirring or institutional cash quietly stepping in.

Funding charges and open curiosity additionally line up with the story. CoinGlass confirmed the OI-weighted funding fee ticking barely greater at 0.0058%, although nonetheless down from latest peaks of 0.01%. That drop suggests merchants are cautious, however the gradual return of exercise for the reason that RWA and stablecoin progress stories factors towards constructing momentum underneath the floor.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.