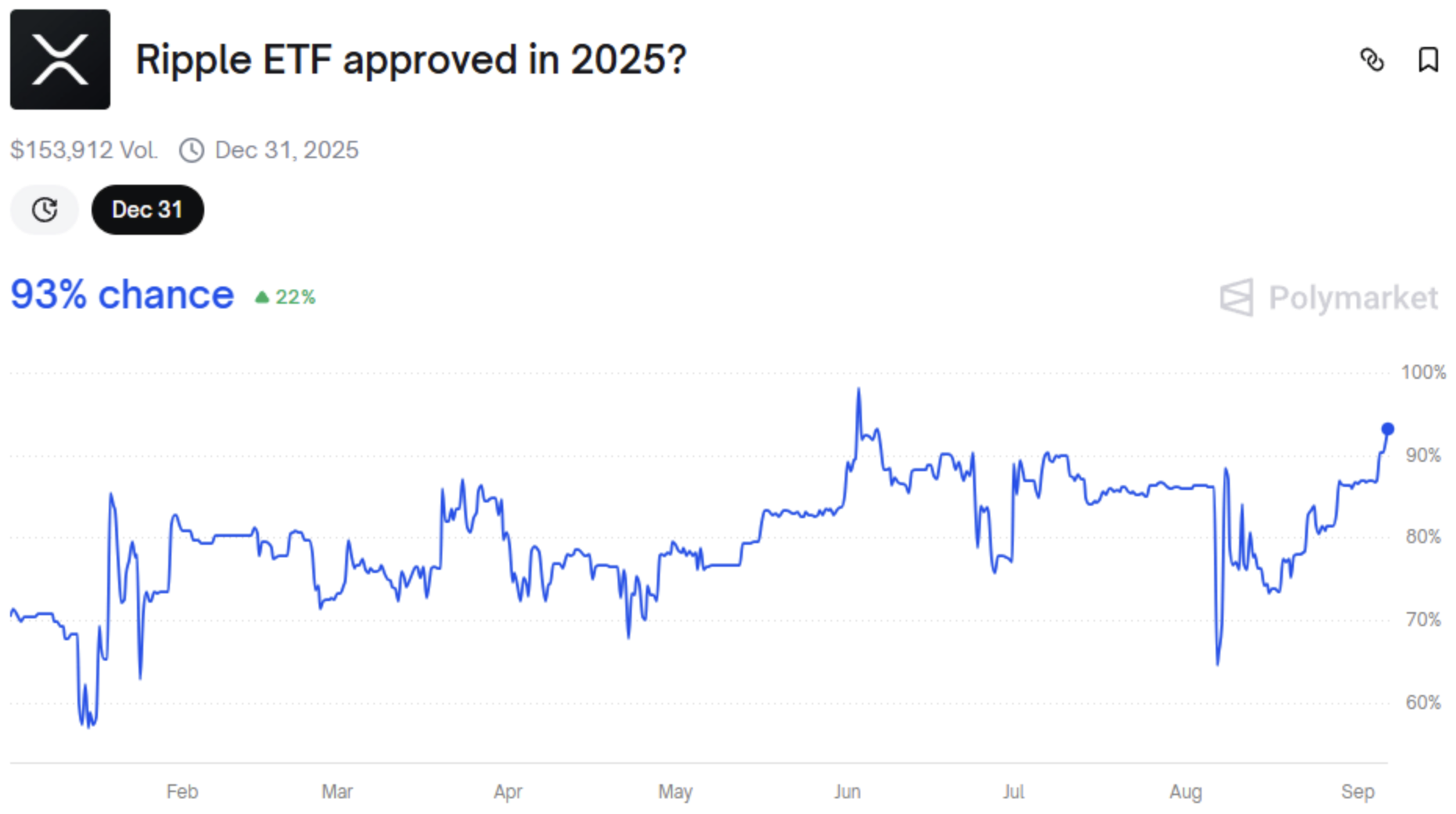

Betting platforms are pricing in close to certainty, 95% odds—that U.S. regulators will quickly approve Solana and XRP exchange-traded funds.

The surge in confidence comes as massive asset managers, together with Grayscale, Franklin Templeton, Bitwise, and VanEck, proceed refining filings. Analysts level to the flood of amended S-1 kinds as an indication that negotiations are within the remaining phases. For a lot of, the query is now not “if,” however “when.”

Diverging Paths: Solana vs. XRP

Although Solana and XRP are sometimes talked about collectively, their regulatory realities are worlds aside.

Solana boasts a number of the quickest throughput in crypto, reportedly dealing with 65,000 transactions per second, and dominates decentralized buying and selling quantity. Nonetheless, a cloud lingers from the SEC’s earlier declare that SOL may qualify as an unregistered safety. A Might 2025 ruling clarified guidelines round custodial staking, however full certainty stays elusive.

XRP, in distinction, already has authorized readability. A federal choose dominated that secondary market gross sales of XRP aren’t securities, giving establishments stable floor. Regulated XRP futures have exploded on the CME, hitting $1 billion in open curiosity sooner than another crypto product—a transparent signal Wall Road is engaged.

What’s at Stake With Approval

Analysts estimate ETF approval may unlock $5–8 billion in inflows for XRP alone in 12 months one, whereas Solana bulls eye a climb towards $335. Fixed ETF-driven shopping for would stabilize liquidity, tighten buying and selling spreads, and deepen by-product markets like choices and futures, giving skilled merchants higher worth discovery.

But historical past gives warning. XRP has repeatedly spiked on authorized victories, solely to fade as early buyers took earnings. A “promote the information” dip may comply with ETF approval for each tokens, even when the long-term trajectory is optimistic.

Past Solana and XRP, approval could be symbolic. It could present Washington’s willingness to carry a number of blockchains below regulated monetary buildings. That precedent may encourage different altcoins to hunt their very own ETFs, intensifying competitors for transparency and institutional buy-in.