Stripe and Paradigm have launched Tempo, a “payments-first” blockchain designed to optimize stablecoin transactions. This has sparked heated debates about its impression on Ethereum, Solana, and different present payment-focused chains.

Whereas many specialists view this as a chance to increase consumer adoption and strengthen cross-chain infrastructure, others stay skeptical about its claimed “neutrality” and Stripe’s true motives. Tempo might change into a big catalyst for the stablecoin market, however it additionally dangers reshaping the aggressive panorama of crypto.

Tempo as Libra v2?

Stripe and Paradigm drew vital market consideration by saying the idea of a payments-first blockchain known as Tempo. This announcement instantly triggered discussions across the “payments-first” mannequin — a design that prioritizes stablecoin transfers and fee experiences somewhat than specializing in multipurpose sensible contracts like Ethereum.

On a macro stage, a payments-first blockchain gives a direct path for brand spanking new customers (retailers and Stripe’s buyer base) to entry stablecoins and on-chain funds with out essentially going by way of a number of bridges or complicated Layer-2 (L2) options. This might clarify why fintech giants typically favor Layer-1 (L1) over L2.

Apparently, many have in contrast Tempo to Libra, the ill-fated venture as soon as spearheaded by Meta (previously Fb). Nonetheless, Tempo might need higher odds, as crypto now enjoys higher political and institutional assist.

Sponsored

Sponsored

“Tempo chain by Stripe is Libra v2 however with a political local weather that gained’t strangle it within the crib,” famous Ryan Adams from Bankless.

That stated, Tempo’s actual worth is dependent upon whether or not it will possibly appeal to significant fee quantity or change into simply “one other chain” within the ecosystem.

Many Doubts

Though Tempo has been labeled “Libra v2,” some argue its technical foundations might not align with the present state of the market, provided that different platforms already ship rather more than what Tempo proposes.

“There could be enterprise causes for a Stripe L1, however IMO the cited technical motives are a bit sus in 2025,” commented the CEO/CTO of Mysten Labs.

Different specialists have raised considerations concerning the venture’s claims of “neutrality” relating to stablecoins and gasoline tokens inside the Tempo ecosystem. Regulatory dangers stay, as stablecoin issuers might face conflicts of curiosity or lack confidence within the chain’s framework.

“There’s a cause why profitable L1s solely settle for their very own native token for gasoline. The counterparty danger of doing it some other method is excessive and solely grows if the chain succeeds…” one X consumer shared.

Tempo’s Impression on the Crypto Market

Some views spotlight that “fragmentation of chains” may gain advantage cross-chain interoperability protocols, as demand for bridges and /or oracles will increase. Consequently, infrastructure gamers resembling bridges, oracle suppliers like Chainlink (LINK), and on-chain fee service suppliers might achieve essentially the most, as their providers change into important for worth switch throughout ecosystems.

Nonetheless, whereas the expansion of stablecoins is mostly a constructive sign for crypto, and new Stripe customers can nonetheless faucet into Ethereum DeFi, analyst Ignas cautioned that it’s tough to interpret this as a bullish sign for ETH.

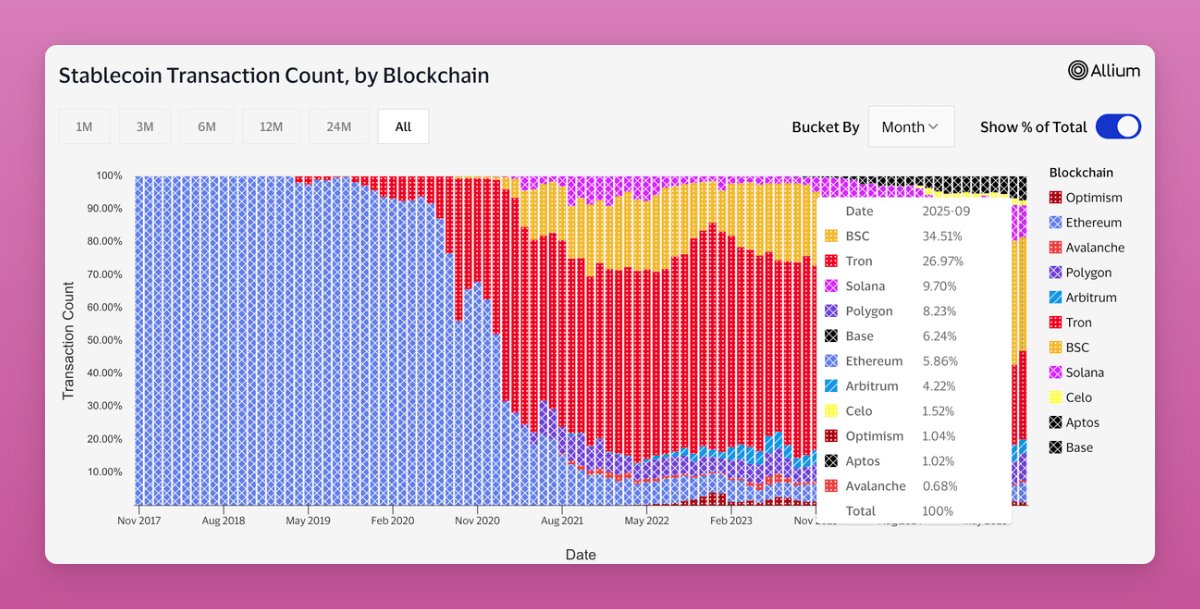

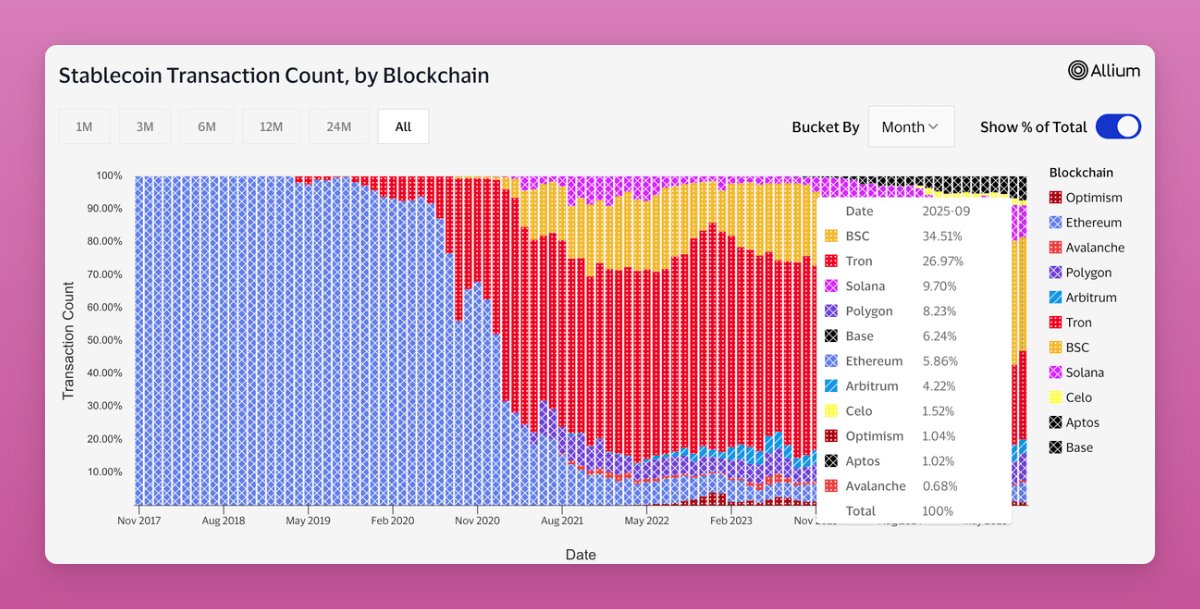

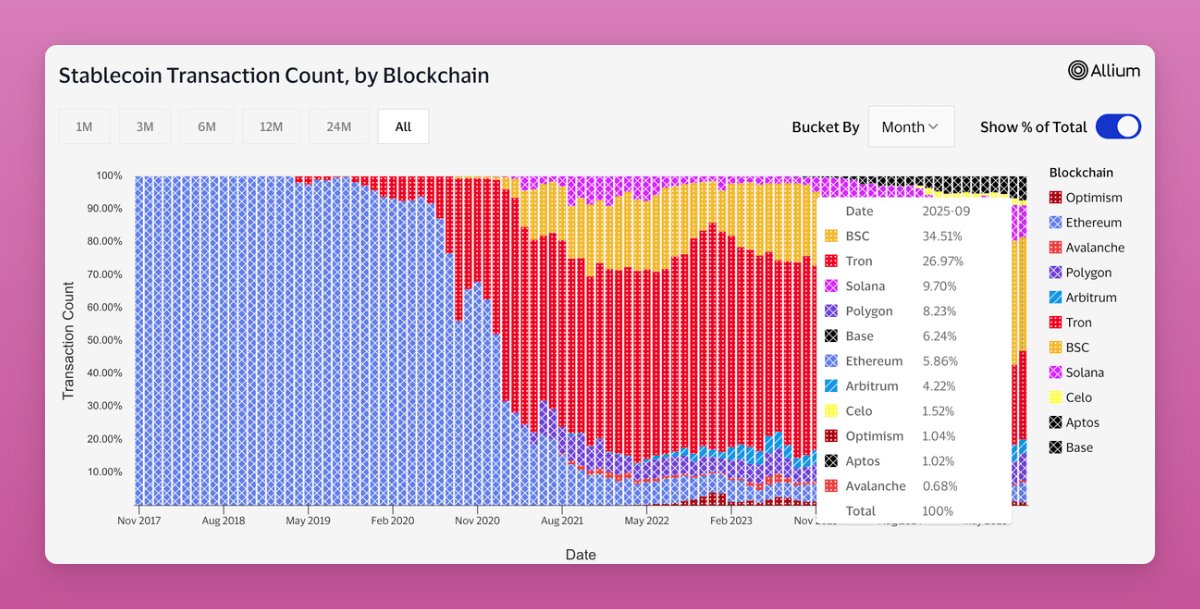

Most stablecoin transactions happen on Tron, Solana, Polygon, and L2 networks. Tempo’s entry might immediately compete with these ecosystems. Nonetheless, specialists predict Ethereum can be a giant winner within the new stablecoin financial system.

Sharing this view, Blockworks CEO Jason Yanowitz argued that Tempo might change into a critical competitor to Tether, Circle, Ethereum, and Solana within the funds area of interest. If Tempo efficiently captures liquidity and service provider adoption, stablecoin flows could possibly be considerably redirected.

Stripe and Paradigm have launched Tempo, a “payments-first” blockchain designed to optimize stablecoin transactions. This has sparked heated debates about its impression on Ethereum, Solana, and different present payment-focused chains.

Sponsored

Sponsored

Whereas many specialists view this as a chance to increase consumer adoption and strengthen cross-chain infrastructure, others stay skeptical about its claimed “neutrality” and Stripe’s true motives. Tempo might change into a big catalyst for the stablecoin market, however it additionally dangers reshaping the aggressive panorama of crypto.

Tempo as Libra v2?

Stripe and Paradigm drew vital market consideration by saying the idea of a payments-first blockchain known as Tempo. This announcement instantly triggered discussions across the “payments-first” mannequin — a design that prioritizes stablecoin transfers and fee experiences somewhat than specializing in multipurpose sensible contracts like Ethereum.

On a macro stage, a payments-first blockchain gives a direct path for brand spanking new customers (retailers and Stripe’s buyer base) to entry stablecoins and on-chain funds with out essentially going by way of a number of bridges or complicated Layer-2 (L2) options. This might clarify why fintech giants typically favor Layer-1 (L1) over L2.

Apparently, many have in contrast Tempo to Libra, the ill-fated venture as soon as spearheaded by Meta (previously Fb). Nonetheless, Tempo might need higher odds, as crypto now enjoys higher political and institutional assist.

“Tempo chain by Stripe is Libra v2 however with a political local weather that gained’t strangle it within the crib,” famous Ryan Adams from Bankless.

That stated, Tempo’s actual worth is dependent upon whether or not it will possibly appeal to significant fee quantity or change into simply “one other chain” within the ecosystem.

Many Doubts

Though Tempo has been labeled “Libra v2,” some argue its technical foundations might not align with the present state of the market, provided that different platforms already ship rather more than what Tempo proposes.

“There could be enterprise causes for a Stripe L1, however IMO the cited technical motives are a bit sus in 2025,” commented the CEO/CTO of Mysten Labs.

Different specialists have raised considerations concerning the venture’s claims of “neutrality” relating to stablecoins and gasoline tokens inside the Tempo ecosystem. Regulatory dangers stay, as stablecoin issuers might face conflicts of curiosity or lack confidence within the chain’s framework.

“There’s a cause why profitable L1s solely settle for their very own native token for gasoline. The counterparty danger of doing it some other method is excessive and solely grows if the chain succeeds…” one X consumer shared.

Sponsored

Sponsored

Tempo’s Impression on the Crypto Market

Some views spotlight that “fragmentation of chains” may gain advantage cross-chain interoperability protocols, as demand for bridges and /or oracles will increase. Consequently, infrastructure gamers resembling bridges, oracle suppliers like Chainlink (LINK), and on-chain fee service suppliers might achieve essentially the most, as their providers change into important for worth switch throughout ecosystems.

Nonetheless, whereas the expansion of stablecoins is mostly a constructive sign for crypto, and new Stripe customers can nonetheless faucet into Ethereum DeFi, analyst Ignas cautioned that it’s tough to interpret this as a bullish sign for ETH.

Most stablecoin transactions happen on Tron, Solana, Polygon, and L2 networks. Tempo’s entry might immediately compete with these ecosystems. Nonetheless, specialists predict Ethereum can be a giant winner within the new stablecoin financial system.

Sharing this view, Blockworks CEO Jason Yanowitz argued that Tempo might change into a critical competitor to Tether, Circle, Ethereum, and Solana within the funds area of interest. If Tempo efficiently captures liquidity and service provider adoption, stablecoin flows could possibly be considerably redirected.

Stripe and Paradigm have launched Tempo, a “payments-first” blockchain designed to optimize stablecoin transactions. This has sparked heated debates about its impression on Ethereum, Solana, and different present payment-focused chains.

Whereas many specialists view this as a chance to increase consumer adoption and strengthen cross-chain infrastructure, others stay skeptical about its claimed “neutrality” and Stripe’s true motives. Tempo might change into a big catalyst for the stablecoin market, however it additionally dangers reshaping the aggressive panorama of crypto.

Tempo as Libra v2?

Stripe and Paradigm drew vital market consideration by saying the idea of a payments-first blockchain known as Tempo. This announcement instantly triggered discussions across the “payments-first” mannequin — a design that prioritizes stablecoin transfers and fee experiences somewhat than specializing in multipurpose sensible contracts like Ethereum.

On a macro stage, a payments-first blockchain gives a direct path for brand spanking new customers (retailers and Stripe’s buyer base) to entry stablecoins and on-chain funds with out essentially going by way of a number of bridges or complicated Layer-2 (L2) options. This might clarify why fintech giants typically favor Layer-1 (L1) over L2.

Sponsored

Sponsored

Apparently, many have in contrast Tempo to Libra, the ill-fated venture as soon as spearheaded by Meta (previously Fb). Nonetheless, Tempo might need higher odds, as crypto now enjoys higher political and institutional assist.

“Tempo chain by Stripe is Libra v2 however with a political local weather that gained’t strangle it within the crib,” famous Ryan Adams from Bankless.

That stated, Tempo’s actual worth is dependent upon whether or not it will possibly appeal to significant fee quantity or change into simply “one other chain” within the ecosystem.

Many Doubts

Though Tempo has been labeled “Libra v2,” some argue its technical foundations might not align with the present state of the market, provided that different platforms already ship rather more than what Tempo proposes.

“There could be enterprise causes for a Stripe L1, however IMO the cited technical motives are a bit sus in 2025,” commented the CEO/CTO of Mysten Labs.

Sponsored

Sponsored

Different specialists have raised considerations concerning the venture’s claims of “neutrality” relating to stablecoins and gasoline tokens inside the Tempo ecosystem. Regulatory dangers stay, as stablecoin issuers might face conflicts of curiosity or lack confidence within the chain’s framework.

“There’s a cause why profitable L1s solely settle for their very own native token for gasoline. The counterparty danger of doing it some other method is excessive and solely grows if the chain succeeds…” one X consumer shared.

Tempo’s Impression on the Crypto Market

Some views spotlight that “fragmentation of chains” may gain advantage cross-chain interoperability protocols, as demand for bridges and /or oracles will increase. Consequently, infrastructure gamers resembling bridges, oracle suppliers like Chainlink (LINK), and on-chain fee service suppliers might achieve essentially the most, as their providers change into important for worth switch throughout ecosystems.

Nonetheless, whereas the expansion of stablecoins is mostly a constructive sign for crypto, and new Stripe customers can nonetheless faucet into Ethereum DeFi, analyst Ignas cautioned that it’s tough to interpret this as a bullish sign for ETH.

Most stablecoin transactions happen on Tron, Solana, Polygon, and L2 networks. Tempo’s entry might immediately compete with these ecosystems. Nonetheless, specialists predict Ethereum can be a giant winner within the new stablecoin financial system.

Sharing this view, Blockworks CEO Jason Yanowitz argued that Tempo might change into a critical competitor to Tether, Circle, Ethereum, and Solana within the funds area of interest. If Tempo efficiently captures liquidity and service provider adoption, stablecoin flows could possibly be considerably redirected.