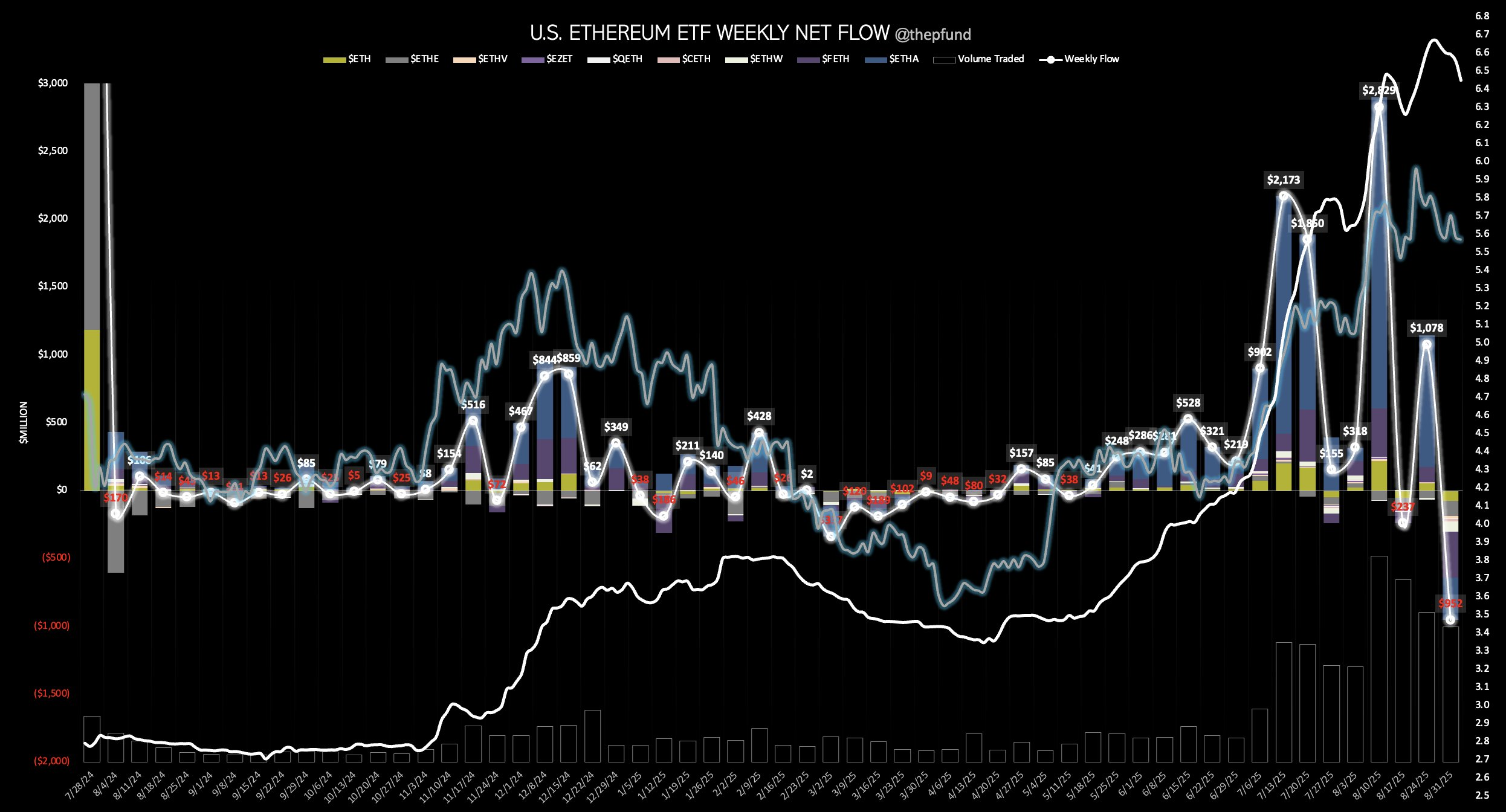

On September 5, Ethereum-linked exchange-traded funds (ETFs) in america noticed a wave of redemptions, with traders pulling greater than $444 million.

The sell-off marked the second-largest outflow for the reason that funds launched in July 2024. It signaled a pointy reversal in investor urge for food for ETH publicity.

Sponsored

Sponsored

ETH Funds Log Sharpest Weekly Decline Since Launch

In keeping with SoSo Worth information, BlackRock’s ETHA led the withdrawals, shedding $307.68 million, which represents practically 70% of the day’s complete.

Grayscale’s two funds adopted with cumulative outflows of over $80 million, whereas Constancy’s FETH shed $37.77 million. 21Shares’ CETH additionally posted $14.68 million in withdrawals.

Consequently, the September 5 redemptions prolonged a five-day run of capital exits that started on August 29.

Sponsored

Sponsored

Over that interval, Ethereum ETFs collectively misplaced greater than $952 million, marking the 9 funds’ largest weekly outflow since their launch.

Market analysts identified that the outflows are a mixture of profit-taking and warning in response to heightened value swings throughout crypto markets.

In the meantime, Ethereum’s derivatives market can also be exhibiting indicators of stress, extending the strain past ETFs.

CryptoQuant analyst JA Maarturn mentioned sellers in ETH futures outweighed patrons by $570 million, pushing internet taker quantity sharply towards the promote aspect.

Traditionally, such heavy promoting usually emerges close to native market tops, reinforcing the view that merchants are hedging in opposition to additional draw back.

Sponsored

Sponsored

Nonetheless, Ethereum’s long-term narrative stays intact amongst its strongest advocates regardless of the short-term turbulence.

Ethereum co-founder Joseph Lubin not too long ago reiterated that ETH’s potential extends far past present valuations. He predicted that the asset may multiply by 100 occasions and finally flip “the Bitcoin/BTC financial base.”

Lubin mentioned Wall Avenue establishments will finally combine Ethereum into core operations, staking, and operating validators to switch legacy programs.

In keeping with him, JPMorgan’s early experimentation with Ethereum know-how reveals that giant banks have already got publicity to blockchain infrastructure. This background positions them to adapt extra simply as soon as decentralized rails turn into the business normal.