Bitcoin has been buying and selling in a good vary over latest weeks, reflecting the everyday habits seen in September. Traditionally, this month has usually delivered muted or barely bearish actions, with merchants watching from the sidelines fairly than chasing momentum. That sample has been seen once more, as Bitcoin has largely hovered round its present zone with out decisive path.

Nonetheless, sentiment has began to tilt another way. Analysts are actually pointing to a possible sharp transfer towards the $117,000 stage, one that would upend the standard September narrative and catch the market without warning. Expectations are shifting towards an explosive breakout that would alter positioning throughout the board.

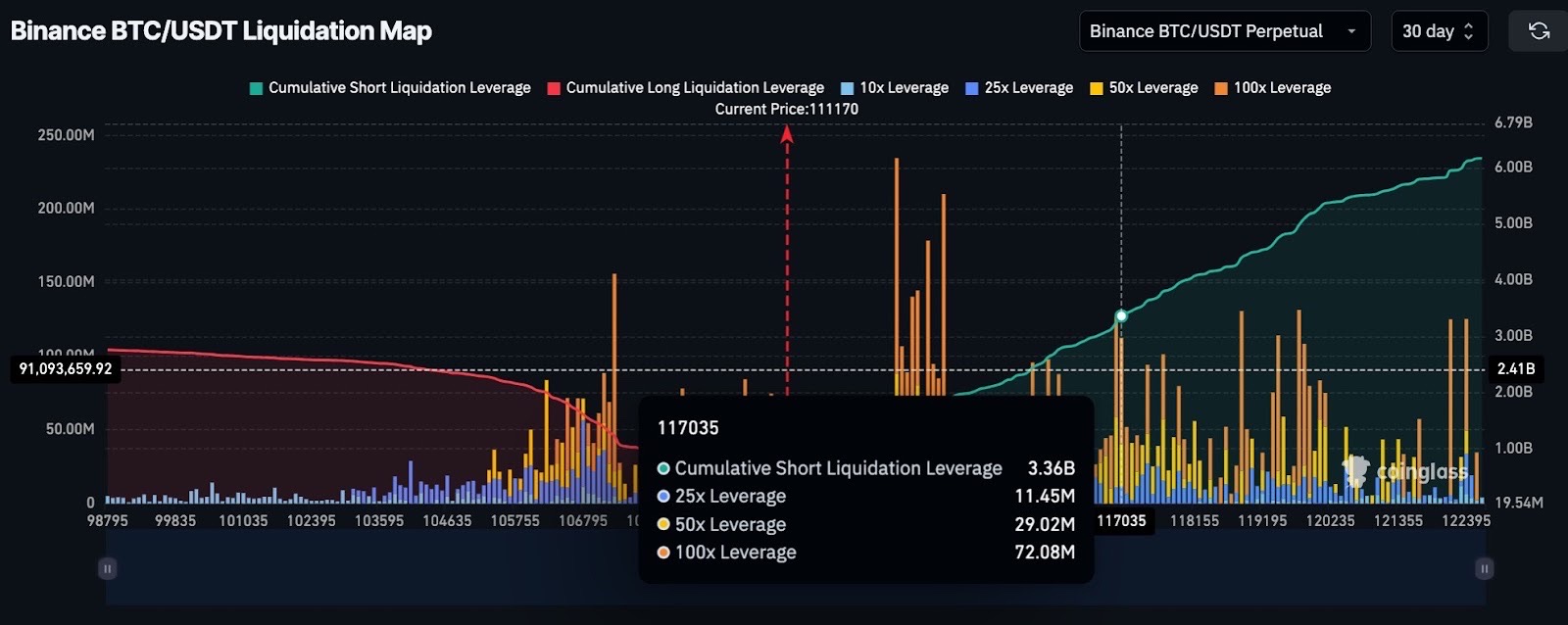

$3B in Shorts Face Danger at $117,000

Derivatives information now exhibits that greater than $3 billion price of brief positions will probably be compelled out of the market if Bitcoin pushes towards the $117,000 mark. Merchants usually see these pockets of leverage as stress factors that may speed up value motion. When shorts are liquidated, their compelled buybacks add gas to upward momentum, making a suggestions loop that may quickly drive costs larger.

Analysts word that this setup has been forming for a number of weeks, and it could take solely a reasonable surge in demand to set off the chain response. Importantly, such a transfer may play out earlier than the Federal Reserve makes its subsequent coverage announcement, exhibiting that market dynamics themselves could dictate the tempo.

For the time being, Bitcoin trades round $110,500 and continues to carry above the $108,000 zone, which has acted as a dependable basis all through latest swings. The broader help area between $108,000 and $102,000 has beforehand attracted robust bids, suggesting that patrons stay assured at these ranges.

If this space had been to interrupt, the $98,000 base may come again into play, although many view it as a distant danger fairly than a near-term likelihood. On the upper aspect, reclaiming $114,000 would relieve promoting stress and clear the trail towards $117,000, a stage now seen as pivotal. A profitable push above that time may open targets within the $120,000 to $124,000 hall, the place momentum merchants are already putting expectations.

This sort of setting not solely creates alternative for Bitcoin but additionally tends to ignite stronger participation throughout the market. If the $117,000 set off unleashes recent liquidity, altcoins may very well be among the many largest beneficiaries, with capital rotating into tasks that thrive on larger quantity and bettering sentiment.

Finest Crypto to Purchase Now – Excessive Potential Bets For September

Pepenode

Pepenode represents a brand new wave of meme-aligned tokens that aren’t content material to rely solely on imagery or viral moments. The challenge introduces a mine-to-earn mannequin that invitations members to grow to be lively in constructing worth fairly than standing by as passive holders.

Mining inside this context will not be tied to energy-intensive processes however to an interactive platform the place customers have interaction, contribute, and obtain token rewards in return. This creates a system of participation that resembles the early power of Bitcoin’s grassroots period, but it’s designed with a contemporary viewers in thoughts.

The mascot, Pepe, has lengthy been related to digital communities, and Pepenode’s use of the character is deliberate. By connecting a widely known determine with a system of structured rewards, Pepenode manages to mix id and performance in a manner that resonates with traders. This isn’t a fleeting reference however a sign of belonging that strengthens group cohesion whereas sustaining a sensible base.

Analysts following the challenge counsel that Pepenode is properly positioned to profit from a market setting formed by Bitcoin’s subsequent transfer. Ought to Bitcoin advance towards the $117,000 vary and set off mass liquidations, liquidity is not going to stay remoted inside the prime asset.

Merchants traditionally search out tokens that mix visibility with exercise, and Pepenode affords each. In an setting the place sentiment can change inside hours, tasks which might be capable of retain customers by means of structured engagement stand out.

Pepenode subsequently positions itself as a token with greater than surface-level id, aligning humor, tradition, and a functioning reward construction.

Finest Pockets Token

Finest Pockets Token distinguishes itself by serving because the spine of an increasing multi-chain pockets that has already attracted vital utilization. The pockets integrates main blockchains together with Ethereum and Solana whereas offering a safe setting that prioritizes accessibility.

The token will not be merely a speculative instrument however a key that unlocks options inside the pockets itself. Holders can take part in reward packages, achieve benefits inside staking mechanisms, and obtain advantages from platform progress. This creates a closed loop the place token worth is tied on to adoption of the pockets.

The timing of this improvement is essential. With Bitcoin consolidating above $108,000 and analysts anticipating a decisive push larger, merchants are making ready for elevated exercise throughout a number of ecosystems.

A dependable pockets that unifies entry to totally different networks turns into important in such circumstances. Finest Pockets has made strides by providing simplicity with out sacrificing depth, enabling customers to handle belongings, work together with decentralized functions, and discover new tasks from a single base.

🔥 Over $15M Raised! 🔥

Finest Pockets is setting a brand new commonplace for pace, entry, and management:

✅ Commerce new tokens early, straight in-app

✅ Swap throughout chains seamlessly

✅ Glossy design paired with full management📲 Obtain Finest Pockets immediately: https://t.co/Ykt3PTrPG0 pic.twitter.com/qIZ8kY96L1

— Finest Pockets (@BestWalletHQ) August 21, 2025

Finest Pockets Token captures this progress. Its integration ensures that platform success straight interprets into demand for the token. Having raised greater than $15 million, the pockets has established a point-based system that incentivizes exercise, rewarding loyal customers whereas encouraging ongoing engagement.

If Bitcoin’s climb to $117,000 units off wider strikes into altcoins, instruments that simplify buying and selling throughout chains will see heavy utilization. Finest Pockets Token is subsequently greater than a aspect instrument to hypothesis. It’s an infrastructure asset with clear performance, constructed to develop alongside the very exercise that defines every market cycle.

Snorter

Snorter approaches the market from a unique angle by offering utility inside the area the place most communities already collect. Constructed as a Telegram bot, Snorter equips customers with direct entry to market information, contract info, and buying and selling instruments inside the identical platform the place dialogue and coordination happen.

This positioning removes limitations and locations performance straight in entrance of members in the intervening time they want it. The mascot chosen for Snorter, an aardvark, reinforces this idea. Identified for digging beneath the floor to uncover what others overlook, the aardvark symbolizes the challenge’s intention to assist merchants determine alternatives earlier than they grow to be seen to the broader market.

What units Snorter aside is the best way it ties id to utilization. The design is easy, but the features are extremely sensible. Customers can monitor stay trades, monitor new token deployments, and analyze contract security with out leaving their communication hub.

This reduces delay and helps stage the enjoying subject for many who would not have entry to specialised techniques. In a market setting the place Bitcoin could take a look at $117,000 and set off risky rotations, the necessity for well timed info is extra necessary than ever.

Creators like ClayBro have already highlighted the potential of the challenge as an undervalued gem able to pump quickly.

Traditionally, liquidity launched by Bitcoin rallies spreads shortly into smaller tokens, usually rewarding those that act with pace and precision. Snorter’s instruments are tailor-made for such circumstances, permitting customers to place themselves successfully throughout speedy shifts in sentiment.

By combining ease of entry with helpful analytics, Snorter has positioned itself as greater than a themed challenge. It’s a practical useful resource designed to thrive during times of heightened exercise.

Bitcoin Hyper

Bitcoin Hyper has been gaining consideration as one of many few tasks that makes an attempt to mix the load of Bitcoin’s model with the flexibleness of a brand new framework. Constructed as a devoted Layer 2 answer, its objective is to increase Bitcoin’s capability past easy worth switch and permit for quicker, cheaper, and extra scalable exercise.

The purpose is to not compete with Bitcoin however to increase its attain, making it potential for builders and customers to construct functions and execute transactions with out the delays or prices related to the bottom chain. By doing so, Bitcoin Hyper introduces a manner for the unique cryptocurrency to step nearer to the kind of performance that has lengthy been the area of Ethereum and different programmable networks.

This improvement carries significance within the current market context. As Bitcoin holds above $108,000 and eyes a possible surge to $117,000, confidence in its long-term trajectory is as soon as once more shaping sentiment.

A Layer 2 straight tied to Bitcoin stands to profit from this momentum, because it channels renewed curiosity into infrastructure that enhances the utility of essentially the most established digital asset. Merchants usually search for secondary tasks linked to main strikes in Bitcoin, and Bitcoin Hyper affords precisely that connection.

The challenge additionally advantages from its twin character. On one hand, it faucets into meme-driven power with branding that resonates throughout social media. On the opposite, it builds actual expertise that addresses scaling limitations which have constrained Bitcoin for years.

This mix of id and utility strengthens its profile. If Bitcoin triggers the anticipated liquidations and clears resistance towards $120,000 or larger, tasks like Bitcoin Hyper may entice vital inflows from traders seeking to take part in each narrative energy and sensible adoption.

Conclusion

If Bitcoin drives by means of $117,000 and forces billions in liquidations, the whole market may enter a brand new section of momentum. In such circumstances, traders normally search for tasks with each endurance and actual objective fairly than chasing noise. The tokens highlighted right here carry outlined roles, with clear constructions that join group, utility, and progress potential.

Their foundations are already seen, and in a market the place timing is essential, that makes them robust choices to contemplate now. With liquidity poised to increase, constructing positions in these tasks affords an opportunity to get forward of the subsequent rotation.