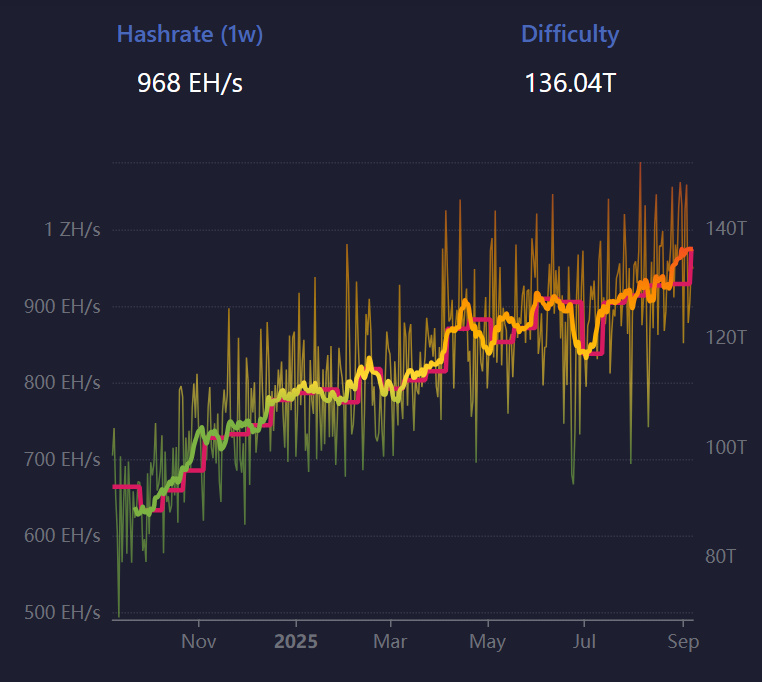

Bitcoin’s community issue has surged to a file excessive above 136 trillion, creating more durable situations for miners already coping with shrinking revenues.

The adjustment, logged at block peak 913,248, marked a 4% rise from 129.6 trillion and prolonged a run of 5 consecutive will increase since June, in accordance with figures from Mempool.

Bitcoin Miners Face Tight Margins With Document Problem And Weakening Earnings

This mechanism is central to Bitcoin’s design. Problem ranges are recalibrated each 2,016 blocks—roughly as soon as each two weeks—to maintain block manufacturing near the ten-minute goal.

Sponsored

Sponsored

An increase indicators that extra computing energy has joined the community, whereas a drop displays miner exits. In each instances, the adjustment ensures stability within the tempo of recent block creation.

In the meantime, the rising threshold comes at a difficult time for Bitcoin miners.

Knowledge from Hashrate Index exhibits that hashprice—the benchmark for miner income per unit of computing energy—has slipped to round $51.

That degree is the weakest since June, underscoring how income strain is constructing at the same time as competitors intensifies.

Based on Hashrate Index, August’s numbers highlighted this squeeze. In the course of the month, Bitcoin’s hashprice common throughout the interval settled at $56.44, about 5% decrease than July.

On the identical time, the agency famous that BTC’s transaction charges supplied little to no assist throughout the interval.

Hashrate Index identified that BTC miners collected simply 0.025 BTC per block on common—a 19.6% slide from July and the weakest efficiency since late 2011. In greenback phrases, that translated to $2,904 in common each day payment earnings, down practically 20% month-on-month and the bottom since early 2013.

Contemplating the above, Bitcoin miners are in a bind as the mix of file issue ranges and weaker income streams leaves their operations on tight margins.

This implies miners could face mounting strain to take care of profitability by means of the rest of the 12 months until Bitcoin’s value climbs meaningfully or on-chain exercise generates greater charges.