Welcome to Commerce Secrets and techniques — Bitcoin and Ether worth predictions from prime analysts, together with choices information, sentiment evaluation and prediction markets to find out what they’ll inform us concerning the months and years forward.

Tick, tock, Bitcoin… the $150,000 window is closing: Peter Brandt

After hovering to new highs in August, Bitcoin is now going through a important take a look at for its subsequent main transfer, in response to veteran dealer Peter Brandt.

“I believe there may be nonetheless room for another massive thrust, maybe to $125,000 to $150,000, however it’s working out of time,” Brandt tells Journal.

“The market feels toppy,” Brandt says, explaining that the asset is getting into the interval the place he initially thought it could hit a worth ceiling. Bitcoin is buying and selling at $109,087 on the time of publication, and Brandt says he’ll “stay constructive” as long as the worth holds above $107,000.

If it falls beneath that, he’ll “undertake the angle {that a} 50% decline from the highs may happen.”

With Bitcoin reaching new highs of $124,128 on Aug. 14, a 50% drop would drag it again to round $60,000 — a stage final seen in October 2024. That form of transfer would depart Technique’s Michael Saylor red-faced after declaring in June that “winter shouldn’t be coming again.”

However different analysts are nonetheless holding out for costs above $150,000 by the top of this yr.

Galaxy Digital’s head of analysis, Alex Thorn, tipped Bitcoin would attain $150,000 to $180,000 this yr again in December 2024, whereas BitMEX co-founder Arthur Hayes, Unchained’s Joe Burnett and Fundstrat’s Tom Lee have all tipped $250,000 by the top of the yr.

Ether is quiet for now, however fireworks coming

After topping its 2021 highs not too long ago, Ether is quietly constructing stress once more, with market alerts pointing to a possible surge by November, says Polymath co-founder Trevor Koverko.

“Seemingly, we’re in a consolidation section in the meanwhile, however I see a breakout coming,” Koverko tells Journal, after Ether reclaimed its 2021 all-time excessive of $4,870 on August 22.

“Ethereum seems poised for a grind larger over the following one to 2 months,” he provides, particularly if ETF inflows keep sturdy and L2 exercise retains ramping up.

US-based spot Ether ETFs noticed an enormous $3.87 billion in web inflows in August. Whole inflows since their July 2024 launch are as much as $13.53 billion, in response to Farside information.

In the meantime, treasury corporations now maintain 3.3 million ETH, or 2.75% of the provision, price $14.3 billion at publication, in response to StrategicETHReserve.

Koverko says key catalysts for an upward transfer within the coming months embody accelerating real-world asset tokenization and potential rate of interest cuts from the US Federal Reserve.

CME’s FedWatch Device reveals market individuals see an 86.4% likelihood of the US Federal Reserve slicing rates of interest for the primary time this yr in September, which is often seen as a bullish sign for crypto as buyers search for larger returns in riskier property.

Ether bullishness has been rising exponentially recently amongst treasury firm chairs.

Declaring BitMine’s Tom Lee wasn’t bullish sufficient, Ethereum co-founder Joseph Lubin not too long ago mentioned in an X submit that Ether “will seemingly 100x from right here.” “Most likely rather more,” Lubin mentioned, claiming that the asset “will flippen” the Bitcoin financial base.

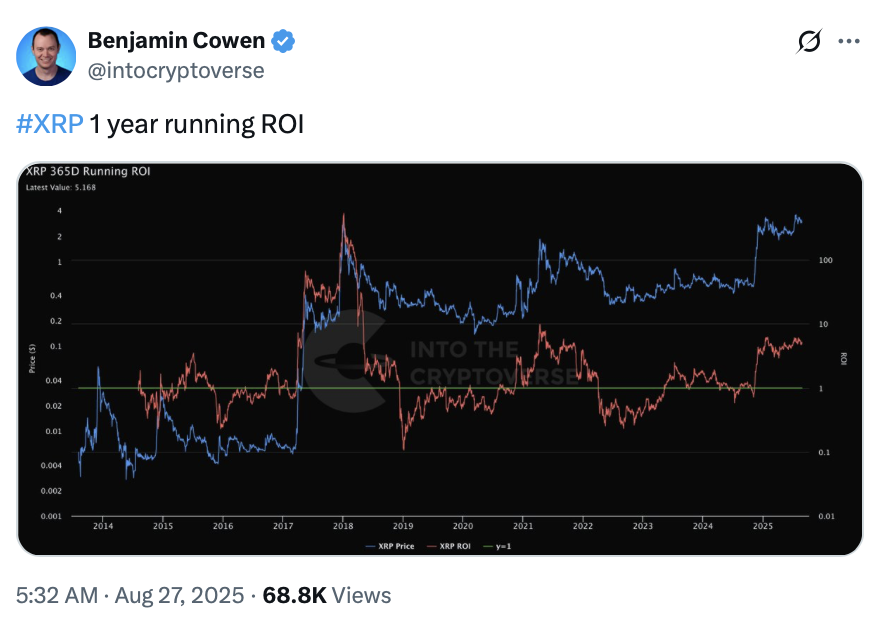

XRP’s subsequent goal could also be a 78% surge. Shopping for alternative first?

XRP is now at a crossroads after tapping new yearly highs in July, says Swyftx lead analyst Pav Hundal.

“It’s make-or-break time for XRP,” Hundal tells Journal.

“Traditionally, September is a purple month throughout markets, and usually, that will have me involved for XRP’s near-term worth, however the tariff wars have thrown seasonal patterns out of the window this yr,” he explains.

“The technicals are stable, and for those who use a easy Fibonacci extension, you may make a case for XRP’s subsequent goal being inside the $4.90 vary,” he says.

A transfer as much as right here would symbolize a 78% surge from its present worth of $2.76 and a 34% spike above its present all-time excessive of $3.88.

XRP fell wanting reclaiming its all-time excessive in July when it reached a yearly excessive of $3.66.

Hundal cautions that the transfer might not be straight upward and that “we may see decrease first.”

“The specter of XRP’s month-to-month token unlock makes me a bit of cautious about among the $10 targets I’m seeing proper now. We don’t know for a incontrovertible fact that Ripple received’t promote these unlocks right into a constructive worth transfer,” he says. Ripple releases 1 billion XRP on the primary day of every month from a collection of escrows it created in 2017, when it locked up 55 billion XRP.

In the meantime, pseudonymous analyst XForceGlobal not too long ago mentioned XRP could also be getting ready one other bullish impulse and that “$20 stays the first cycle goal.”

$1,000 SOL is “pure hopium,” says one dealer; others see it as conservative

Solana received’t hit a four-figure price ticket this cycle, in response to crypto dealer The Bitcoin Specific, although others are much more optimistic.

“SOL is rarely hitting $1,000 this cycle,” the dealer mentioned in an X submit, arguing that whereas Solana’s market cap is at file highs, token inflation is conserving the worth suppressed. “SOL can hold climbing, however inflationary provide retains the per-token worth down,” he mentioned.

“I like SOL long-term, however $1K this cycle is pure hopium,” he added. Solana’s present inflation charge is 4.318% and continues to lower yearly, in response to Solana Compass information.

Solana is buying and selling at $197 on the time of publication, up practically 20% over the previous month however nonetheless 49% beneath its January all-time excessive of $293.

Not everybody shares that skepticism. Crypto dealer Curb.sol mentioned that “no one’s targets are excessive sufficient” as eight US-based Solana ETFs await SEC approval.

“$1,000 is conservative,” he mentioned. The US Securities and Change Fee not too long ago delayed rulings on 21Shares’ and Bitwise’s Solana ETFs, pushing again the choice to October 16.

What the derivatives markets are saying about Bitcoin and Ether

Onchain choices protocol Derive founder Nick Forster tells Journal that futures merchants have change into extra bearish over the previous seven days concerning the probabilities of Bitcoin and Ether tapping ranges that merchants have been hoping for.

Future merchants are pricing in a 7% likelihood of Bitcoin reaching $150,000 by the top of October, down 14% from final week.

Learn additionally

Options

What it’s like when the banks collapse: Iceland 2008 firsthand

Options

Assist! My mother and father are hooked on Pi Community crypto tapper

The chances of Bitcoin reaching $150,000 by the top of this yr stand at 22%.

For Ether, futures merchants are pricing in a 30% likelihood of ETH hitting $6,000 by the top of October, down 15% from final week. By yr’s finish, the percentages rise to 44%.

Forster says the extremely anticipated US Federal Reserve charge reduce choice on September 17, together with establishments persevering with to stockpile ETH, signifies that “markets are establishing for explosive potential heading into This fall.”

“Institutional adoption of ETH is constructing severe momentum,” Forster says.

Sentiment is hovering for Solana: Santiment

Increasingly retail merchants are turning their consideration to Solana at the same time as broader sentiment throughout the crypto market stays risky, sentiment platform Santiment says.

“Solana has lastly loved a mini breakthrough of its personal,” Santiment mentioned on August 28, pointing to its current soar above $210.

“Retail is making 5.8 bullish feedback for each 1 bearish remark, which is at an 11-week excessive,” Santiment mentioned.

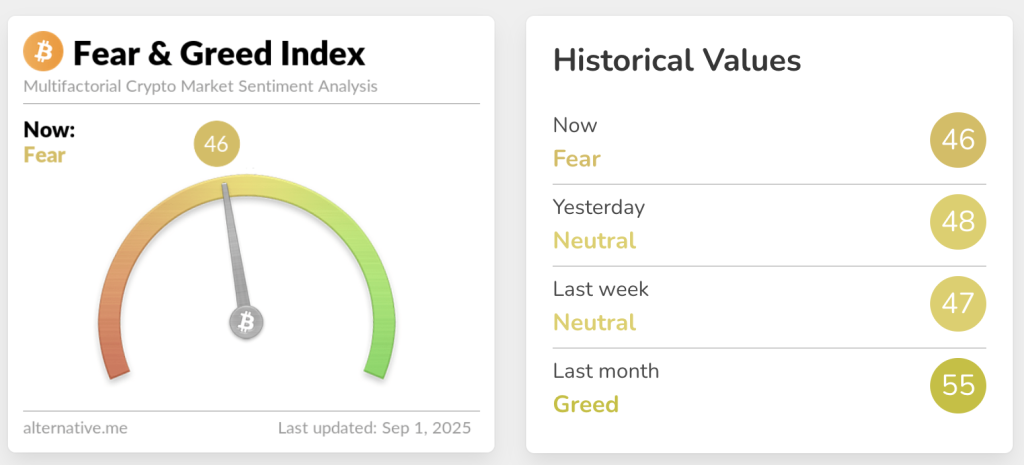

It comes as sentiment throughout the broader crypto market has been everywhere recently.

The Crypto Concern & Greed Index, which measures total crypto market sentiment, slipped into the “concern” zone on Saturday, recovered to “impartial” after which dropped again into “concern” by Monday.

In the meantime, indicators of altcoin season might already be fading.

Learn additionally

Options

Bitcoin inheritances: A information for heirs and the not-yet-dead

Columns

We tracked down the unique Bitcoin Lambo man

CoinMarketCap’s Altcoin Season Index, which tracks how the highest 100 altcoins have carried out in opposition to Bitcoin over the previous 90 days, has dropped again to “Bitcoin Season” with a rating of 48 out of 100 — after briefly signaling “Altcoin Season” on August 28 for simply 4 days.

What prediction markets say about Bitcoin and Ether

Prediction markets have change into extra bearish for Bitcoin because it reached new all-time highs of $124,128 on August 14.

Bitcoin has a 68% likelihood of dipping beneath $100,000 once more earlier than 2026, in response to crypto prediction platform Polymarket.

The chance of Bitcoin dropping beneath the six-figure mark is now 17% larger than it was 30 days in the past, because the cryptocurrency continues to commerce below $110,000.

Because the July Commerce Secrets and techniques column, Polymarket’s odds of Solana hitting new all-time highs by year-end have elevated.

Pundits consider Solana now has a forty five% likelihood of surpassing its earlier peak of $293 by the top of 2025, up 19% from its odds final month, as its worth spiked 22.50% over the identical interval.

In the meantime, Dogecoin has a 14% likelihood of surpassing its Might 2021 all-time excessive of $0.73 by 2026.

Subscribe

Essentially the most participating reads in blockchain. Delivered as soon as a

week.

Ciaran Lyons

Ciaran Lyons is an Australian crypto journalist. He is additionally a standup comic and has been a radio and TV presenter on Triple J, SBS and The Venture.