The U.S. greenback has lengthy been the spine of world finance, however within the period of digital belongings, Bitcoin is rising as its challenger.

Each function mediums of change and shops of worth, but their basic buildings couldn’t be extra completely different. Understanding these contrasts is essential for anybody exploring the way forward for cash.

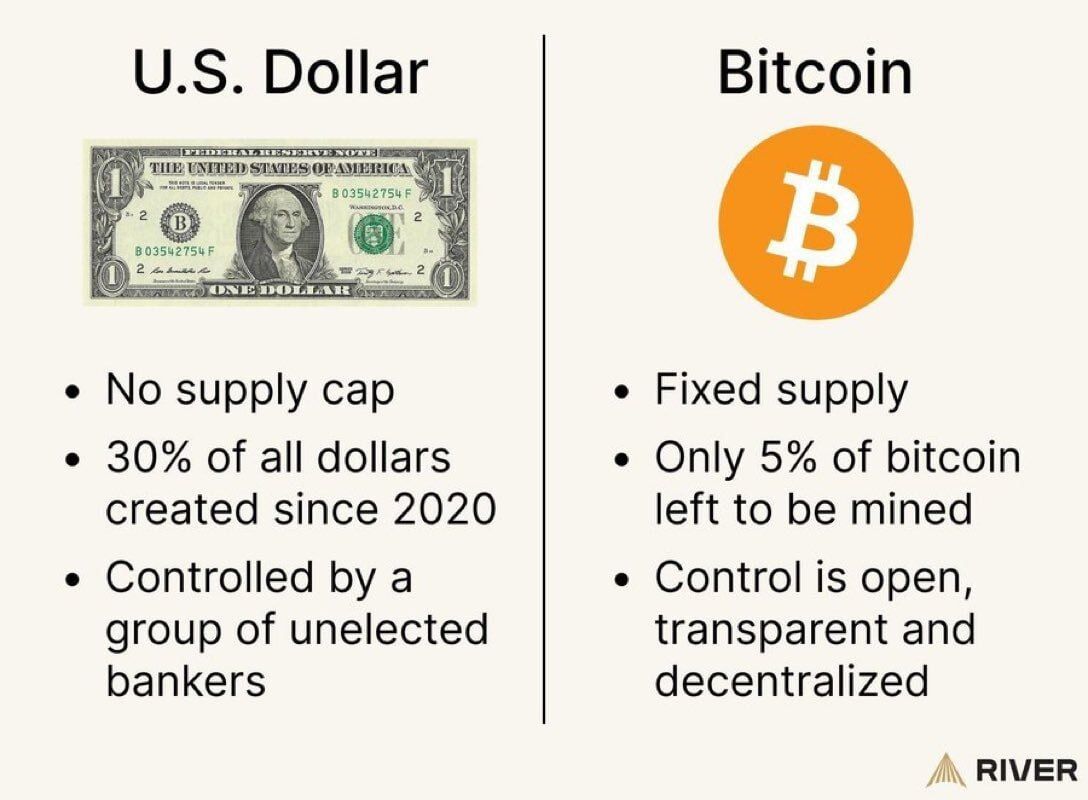

Provide: Limitless vs. Fastened

The U.S. greenback has no provide cap, which means the Federal Reserve can situation new {dollars} at will. In reality, almost 30% of all {dollars} in circulation have been created since 2020, fueling considerations about inflation and forex debasement. In contrast, Bitcoin is ruled by code: it has a hard and fast provide of 21 million cash, with lower than 5% left to be mined. This shortage offers Bitcoin qualities extra just like gold than fiat cash.

Management: Centralized vs. Decentralized

{Dollars} are managed by the U.S. Federal Reserve, a physique of unelected bankers that controls financial coverage. Choices equivalent to rate of interest adjustments or stimulus injections can dramatically impression the greenback’s buying energy. Bitcoin, then again, is decentralized and clear. Its issuance, mining, and transaction guidelines are open-source, with no single authority capable of manipulate its provide or guidelines.

Transparency and Belief

The U.S. greenback depends on centralized belief – confidence in governments and banks. Bitcoin depends on arithmetic and blockchain transparency, the place each transaction is verifiable on a public ledger. This design removes the necessity for intermediaries and shifts belief to expertise moderately than establishments.

The Greater Image

The greenback dominates at this time’s financial system, however Bitcoin provides another monetary mannequin constructed on shortage, decentralization, and transparency. For buyers, savers, and policymakers, the talk isn’t nearly forex – it’s about whether or not the way forward for cash ought to stay below central management or transfer towards open, digital networks.