In short

- Bitcoin dipped 1.3% under $110,000 however recorded sturdy ETF inflows of $633 million over two consecutive days—the perfect efficiency since early August.

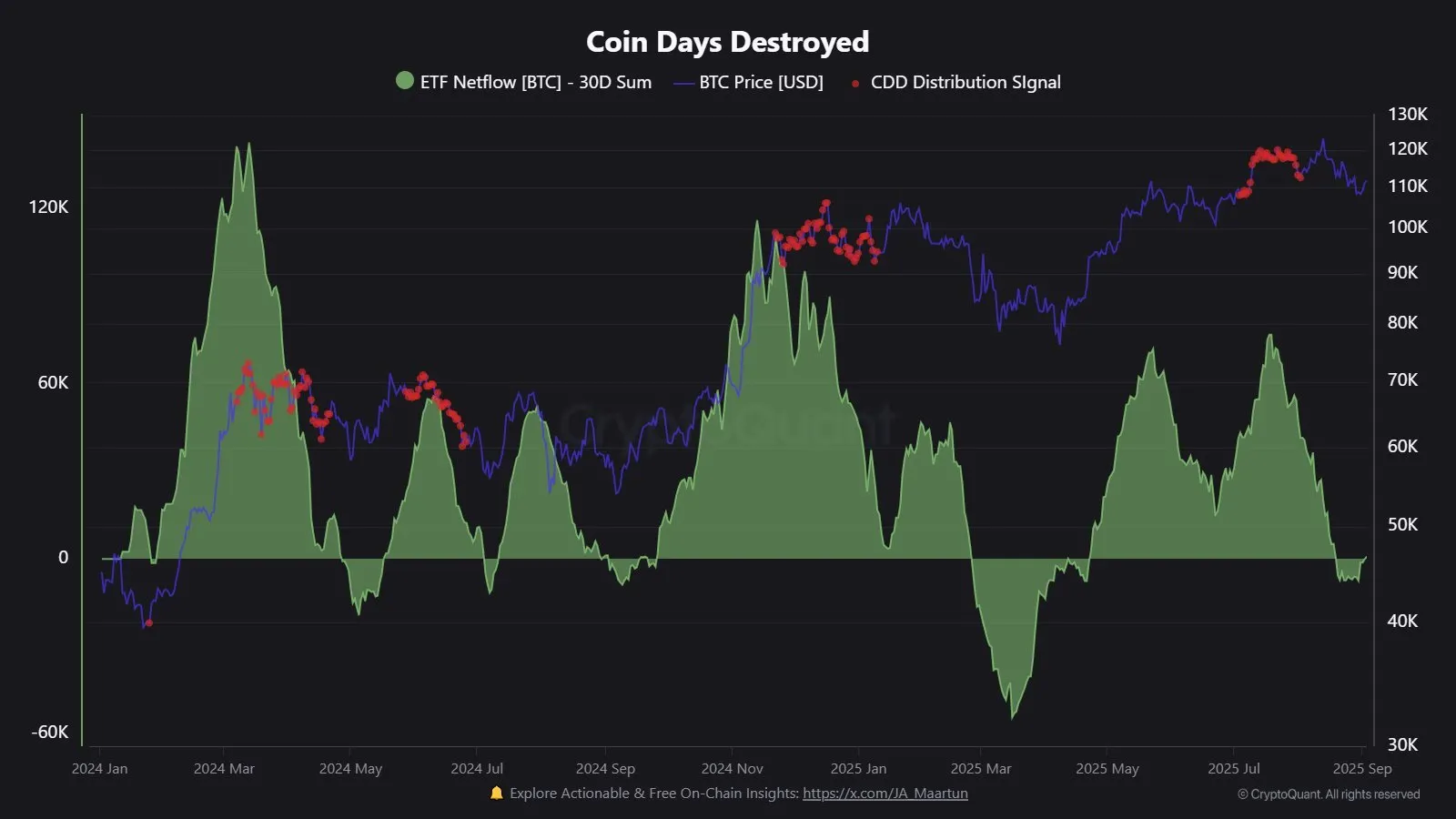

- Lengthy-term Bitcoin holders are shifting their cash into ETFs in what an analyst calls an uncommon redistribution sample.

- Market sentiment stays cautious with 65% of prediction market customers anticipating Bitcoin to fall to $105,000 earlier than reaching $125,000.

Bitcoin has misplaced steam, falling 1.3% and slightly below $110,000 Thursday morning, however ETF flows have been sturdy, and which may be the important thing to BTC escaping one other Pink September, an analyst advised Decrypt.

CryptoQuant blockchain analyst JA_Maartun mentioned market knowledge exhibits that Bitcoin in longterm holder wallets has been steadily shifting into ETFs.

“Visually, the chart makes it clear that there’s a main redistribution happening: Bitcoin is shifting from long-term holders into new addresses managed by ETFs,” he advised Decrypt. “As ETFs create demand, provide is being offered by previous holders.”

Bitcoin ETFs, first accepted by the SEC in January 2024 after greater than a decade of denials, enable traders to realize publicity to BTC with out the necessity to purchase, maintain, and retailer Bitcoin immediately, avoiding the complexity of crypto exchanges and wallets. BlackRock’s Bitcoin ETF alone now holds over $83 billion in property beneath administration.

Not too long ago, although, Bitcoin ETFs have been rebounding after lagging in comparison with Etheruem ETFs. BTC funds have simply recorded two consecutive days of inflows exceeding $300 million, totaling $633.3 million throughout each classes—the strongest two-day efficiency since early August.

And if quite a lot of that’s being fueled by longtime HODLers changing their stacks into ETF shares, as Maartunn hypothesizes, it’s fairly uncommon.

“This redistribution is sort of distinctive,” he mentioned. “We’ve already seen three such durations—summer season 2024, fall 2024, and summer season 2025. In earlier cycles, this often occurred solely as soon as.”

He added that ETF flows may very well be a powerful predictor of whether or not Bitcoin manages to flee a Pink September—even when it did simply see a Pink August. A month (or every other interval time) is taken into account purple if an asset ends at a cheaper price than it began.

Over the previous 12 years, September has been a down month for Bitcoin eight instances. However the previous three years, the crimson shifted to August, and September was inexperienced.

“ETF flows will probably be decisive,” Maartunn mentioned. “So long as sturdy new inflows are missing, I don’t anticipate something spectacular. Demand wants to choose up, in any other case there’s a danger that new holders might add promoting stress—both if their common buy worth comes beneath pressure, or just because too little is occurring.”

However there’s different large market gamers to think about, like Bitcoin treasury corporations, in keeping with Rick Maeda, a analysis analyst at Presto Analysis. He’s particularly all for ones like Japan’s Metaplanet, which has sworn off ever promoting its BTC stash.

“If we do get a Pink September I might anticipate Metaplanet to lean into it, not step again,” he advised Decrypt. “They’ve mentioned they may by no means promote, and CEO Simon Gerovich has repeated that time. Their acquisition cadence is programmatic. Even after the 25–30% drawdown in Q1, their buys didn’t sluggish.”

Previously week, although, Metaplanet has confronted headwinds. On Monday, the corporate’s shareholders accepted an $884 million capital elevating proposal, though the agency’s inventory dropped 60% since mid-June.

Throughout the identical assembly, the corporate introduced it had acquired 1,009 BTC for about $112.2 million, bringing its treasury to precisely 20,000 Bitcoin. At present costs, the BTC stockpile is price roughly $2.2 billion.

On Myriad, a prediction market created by Decrypt’s guardian firm Dastan, customers are nonetheless skewing pessimistic about which worth milestone Bitcoin hits subsequent: $125,000 or $105,000. The chances flipped a number of instances in August, however now present that 65% of customers suppose Bitcoin will drop to$105,000 earlier than it rallies above its all-time excessive.

And final month, just one in 4 of the 1,900 traders polled by Binance Australia estimated that Bitcoin will prime $150,000 within the subsequent six months.

Half of these polled mentioned that BTC will preserve between $100,000 and $150,000 over the identical time interval. Half the customers—who have been polled between the top of July and August 10—advised the change they intend to extend their Bitcoin holdings.

However there may very well be a shift in sentiment in two weeks’ time, Gadi Chait, head of funding at Xapo Financial institution, advised Decrypt.

“The Federal Reserve’s September assembly is a dominant macro catalyst,” he mentioned, alluding to the September 16 and 17 Federal Open Markets Committee assembly. “With a possible US price reduce on the horizon, liquidity circumstances may ease, growing demand for danger property and doubtlessly boosting Bitcoin by 5-10%.”

Every day Debrief E-newsletter

Begin every single day with the highest information tales proper now, plus authentic options, a podcast, movies and extra.