- Cardano [ADA] is buying and selling inside a falling wedge sample, with analysts eyeing a breakout goal close to $0.94 if resistance ranges give means.

- Binance information reveals 75% of merchants are lengthy on ADA, signaling robust bullish conviction that might gas an upside push.

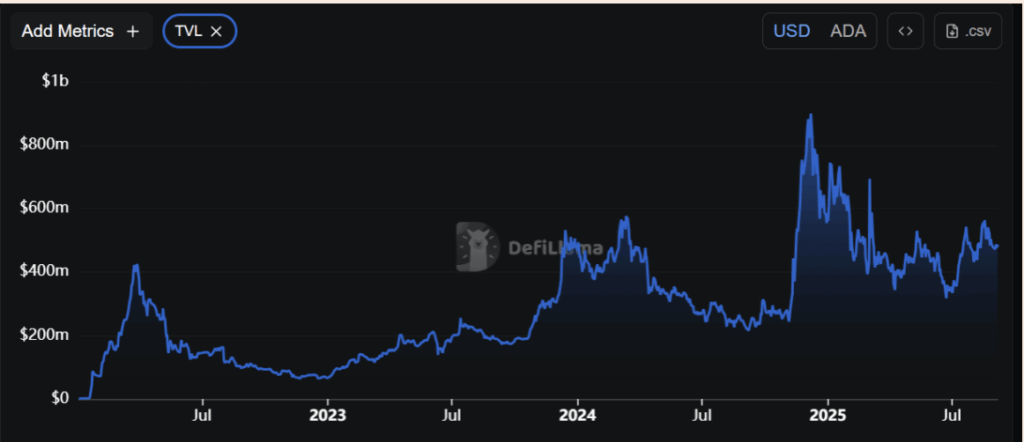

- On-chain progress continues, with TVL climbing to $487M and DEX volumes surging almost 20% in per week, reinforcing ADA’s bullish setup.

Cardano [ADA] has been drifting inside a narrowing falling wedge since early September, a setup that merchants often learn as a touch for bullish reversals. Market analyst Ali Martinez even sketched out a potential breakout goal round $0.94—assuming ADA can muscle by its close by resistance. For now, the coin sits close to $0.83 after weeks of sideways chop, leaving everybody questioning if that is simply extra noise… or the calm earlier than a surge.

Merchants Lean Heavy on the Lengthy Facet

Contemporary Binance information paints a transparent image of optimism. Practically 75% of accounts are lengthy on ADA, with shorts making up solely a few quarter of positions. That’s roughly a 3:1 ratio leaning bullish, which reveals merchants aren’t precisely shy about betting on a breakout. If resistance offers means, these leveraged longs may find yourself fueling the very rally they’re hoping for, turning cautious optimism right into a full-blown rush.

Change Outflows Level to Accumulation

At the same time as ADA’s worth cooled off, cash wasn’t precisely flooding again to exchanges. As a substitute, September sixth noticed web outflows of almost $840K, a transfer that often indicators traders favor tucking their tokens away in non-public wallets. It’s not the kind of circulate you see when holders are itching to promote. If something, it appears to be like like quiet accumulation, trimming the provision obtainable on centralized platforms and establishing for a squeeze if demand kicks in.

DeFi and DEX Numbers Again the Case

Cardano’s DeFi ecosystem has saved regular regardless of the market’s wider hesitation. TVL has climbed to $487.18 million, up simply over 2% within the final 24 hours, hinting at stronger person participation within the community’s decentralized protocols. On the identical time, decentralized trade exercise is ticking up too—day by day quantity hit $4.68 million, whereas weekly totals jumped almost 20% to $25.56 million. That form of regular on-chain exercise usually precedes stronger worth recoveries, and in ADA’s case, it stacks properly with the wedge breakout narrative.

Remaining Takeaway

All advised, ADA’s falling wedge, robust lengthy positioning, regular trade outflows, and rising DeFi footprint level to a market that’s quietly constructing power. The $0.94 goal may sound formidable, but when momentum builds the way in which these indicators counsel, Cardano may lastly be establishing for a transfer that snaps it out of months of consolidation.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.