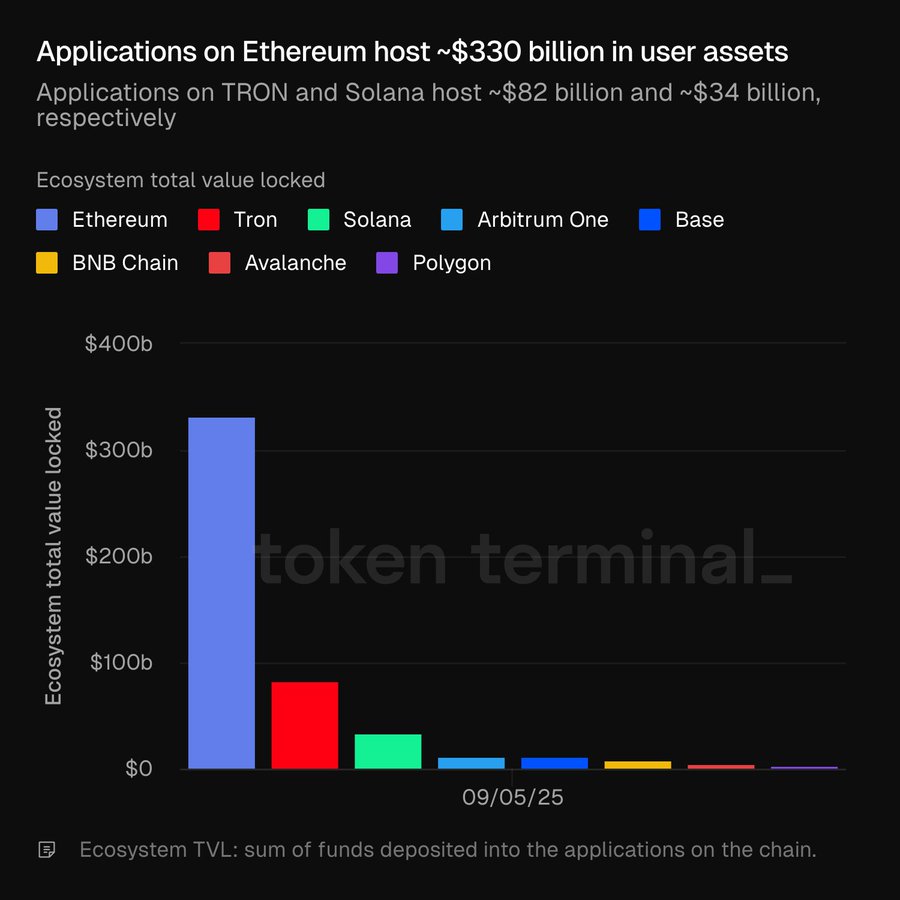

Ethereum continues to claim its dominance in decentralized finance (DeFi), with purposes on the community now internet hosting roughly $330 billion in consumer property, in line with contemporary knowledge from Token Terminal.

This determine dwarfs competing ecosystems and highlights Ethereum’s place because the main blockchain for liquidity and decentralized purposes.

TRON and Solana comply with at a distance

Trailing far behind Ethereum, TRON purposes host round $82 billion, whereas Solana helps about $34 billion. Each chains have made vital progress in attracting liquidity, significantly TRON in stablecoin exercise and Solana in decentralized exchanges. Nonetheless, their mixed totals nonetheless signify lower than half of Ethereum’s locked worth.

Different ecosystems, together with Arbitrum, Base, BNB Chain, Avalanche, and Polygon, contribute to the broader DeFi panorama, however none come near Ethereum’s scale. The chart supplied by Token Terminal exhibits Ethereum towering over rivals, underscoring its entrenched position as the popular blockchain for institutional and retail capital alike.

Why TVL issues

Complete Worth Locked (TVL) measures the quantity of property deposited into decentralized purposes (dApps) throughout blockchains. A better TVL not solely indicators better consumer belief but in addition deeper liquidity, which reinforces buying and selling, lending, and yield alternatives.

Ethereum’s $330 billion dominance suggests builders and buyers proceed to view it as probably the most safe and versatile platform for DeFi.

The larger image

Whereas Ethereum maintains a commanding lead, the rise of TRON and Solana demonstrates rising competitors within the multi-chain world. Improvements in scalability and decrease transaction prices are serving to various chains carve out niches. Nonetheless, Ethereum’s liquidity moat supplies a robust basis, making it the ecosystem to beat as DeFi adoption expands globally.