- Ethereum ETF inflows and rising CME futures open curiosity present establishments are treating ETH like a mature asset, not only a speculative wager.

- On-chain exercise stays regular, proving Ethereum’s demand base isn’t simply speculation-driven.

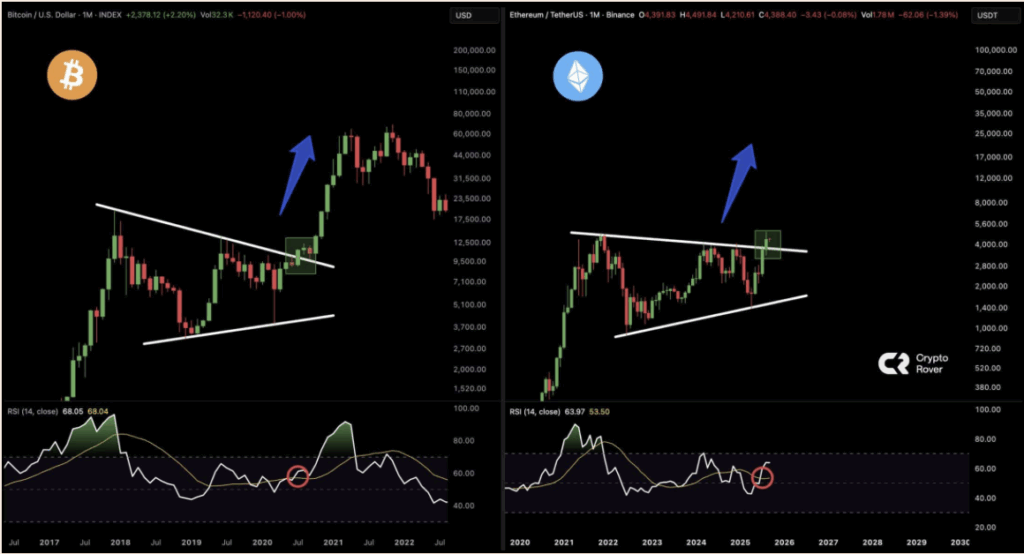

- A breakout from a multi-year wedge, mixed with ETF urge for food, might set ETH on a path much like Bitcoin’s 2021 rally.

Ethereum is slowly shaking off that “second place” label and beginning to act like a real heavyweight out there. A mixture of ETF inflows, rising CME futures exercise, and regular on-chain utilization is organising a story that feels eerily much like Bitcoin’s breakout again in 2021. Nonetheless, ETH has its personal quirks, dangers, and wildcards to contemplate.

Establishments Are Taking part in Each Sides

Contemporary information from Glassnode exhibits that over half of current Ethereum ETF inflows are being mirrored by open curiosity on CME futures. That’s a elaborate means of claiming establishments aren’t simply shopping for ETH to carry — they’re hedging, arbitraging, and constructing structured positions. It appears so much like what occurred when Bitcoin ETFs first exploded, with TradFi gamers stacking each spot and derivatives. The distinction right here? ETH hasn’t even reclaimed its native highs but, which makes this setup look extra like a market maturing than a FOMO-driven spike.

Community Exercise Refuses to Sluggish Down

Whereas merchants zoom in on candles, Ethereum’s community is simply… doing its factor. Transactions preserve climbing, even throughout messy, risky stretches. This isn’t simply speculative churn — it alerts a base layer of precise demand that doesn’t evaporate when value dips. That form of regular utilization is what retains Ethereum related, whether or not it’s at $2,000 or $5,000.

ETH at a Crossroads

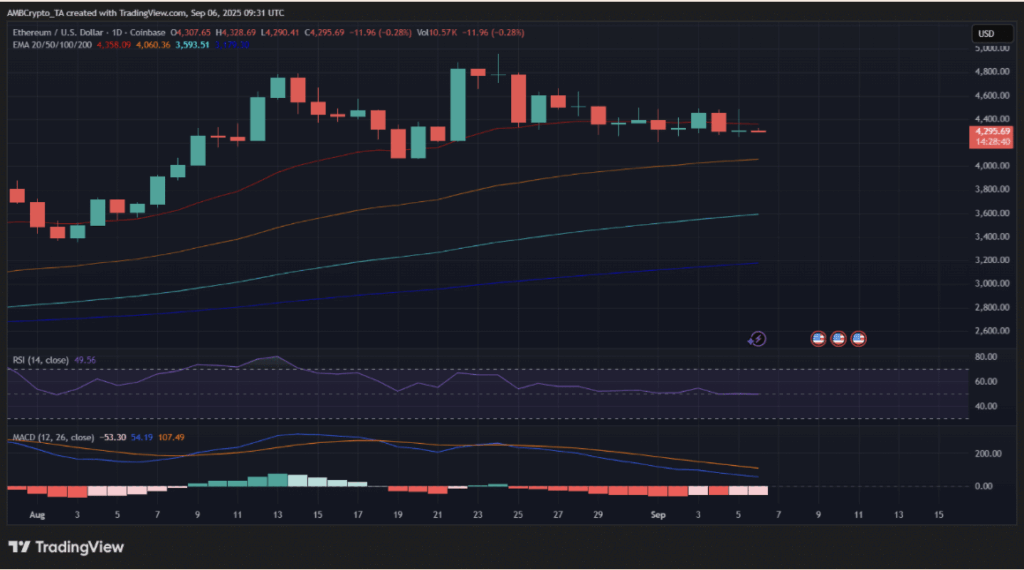

On the time of writing, ETH is hovering round $4,300, with RSI flat and MACD fading. On the floor, that screams hesitation. However zoom out, and also you’ll see Ethereum breaking out of a multi-year wedge sample, not not like the one Bitcoin broke earlier than its 2021 fireworks. The wildcard? ETF demand. There’ve been a number of outflows currently, however web belongings are nonetheless over $27 billion. If that urge for food comes roaring again, ETH might simply catch the identical wave that despatched BTC into uncharted highs.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.